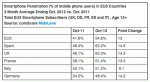

Europe’s mobile market has reached a tipping point: the top-five markets in the region collectively have a majority of consumers using smartphones, according to the latest numbers from comScore, and that proportion only continues to grow. France, Germany, Italy, Spain and the UK are now collectively reporting a 55% smartphone penetration, according to comScore’s MobiLens research — an online survey of “nationally representative” sample of mobile subscribers aged 13 and up.

The numbers cover the last three months ending October 31, 2012. ComScore tells me that the first time European users tipped into a smartphone majority was in July.

But while Apple has continued to hold on to its lead in the biggest market among them, the UK, the tides that have seen Android become the most dominant platform have also put Samsung on to a strong trajectory. It looks like it will soon overtake Apple for pole position in the UK — as it already has across all of Europe.

Looking at individual countries, Spain is at the top of the pile for smartphone usage: 63.2% of all mobile phone users now on smartphones, a rise of nearly 15% percentage points on last year. It was also in the lead a year ago. Historically, Spain has always been a strong market for mobile penetration, with less landlines proportionately than other European markets because of the high degree of fixed-to-mobile substitution.

The UK, another market where many have simply done away with their landlines, has also seen an almost-similar rise, with 62.3% of consumers here now using smartphone. The only market that has yet to break the 50% barrier in the group is German, at 48.4%.

comScore is sending me numbers on how specific handset makers or platforms are performing across all of Europe — for some reason it chose not to include these in today’s data release. What it did do what draw out those numbers for one market in particular: the UK. [Update: it's now provided those numbers; more info below.]

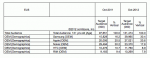

Here, Apple has managed to hold on to its lead as the most popular smartphone brand, but it’s just barely doing it. Whereas a year ago it had a comfortable lead over the competition — Apple was at 26.6% of all smartphones, with RIM and HTC (!) tied for second — today the picture is very different. Apple is at 28% as of October 2012, but that was a rise of only 1.5 percentage points. Meanwhile, Samsung is now at 24%, a more dramatic rise of 12.8 percentage points. All others declined, with Nokia for the first time dipping below 10% of all smartphone usage.

Keep in mind that these numbers cover the three months ending October 31, so there is a chance that the holiday shopping season, where Apple has always seen a bump in sales, could see a flip, or at least a narrowing of some of these margins.

When it comes to platforms, unsurprisingly Android continues to remain in the lead in the UK — and most likely Europe overall. Android now accounts for 46.6% of the 30.9 million smartphones in use in the UK, comScore says. Most of that increase is down to Samsung’s prowess in the market: Android rose by a nearly identical amount to Samsung itself, up 12.4 percentage points over last year.

Apple, now at 28%, remains a strong number-two competitor, underscored by the fact that the next two in the rankings, RIM and Symbian, continue to decline. Glimmer of hope for Nokia, though: Microsoft was up by half a percentage point. It’s now at 3.1% of all smartphones in use in the UK.

ComScore is sending over European numbers, but for now a spokesperson notes that in fact, the UK is not actually all that representative of what’s happening in the region overall. But if you compare the UK market against recent figures from Kantar Worldpanel, which measures smartphone purchases rather than which devices are in use, you get an interesting picture. Kantar places Android at over 60% of all purchases in the EU5, with Apple at just 21%. That implies that we may be seeing further falls for Apple ahead at the expense of Google’s powerhouse mobile platform and how it’s getting implemented specifically by Samsung.

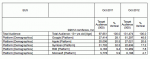

Update: I now have the stats aross the big-five markets in Europe, and while Apple has continued to hold on to the lead in the UK in the last three months, it’s not the case in wider Europe.

There, Apple has around a 20% share of the market, but Samsung is at over 30%. Given that Apple’s share has remained almost equal with its share a year ago — when it was in the lead — Samsung has effectively been the most successful in picking up ex-Nokia users. Although all other major OEMs have declined, Nokia has seen the most drastic drop.

Platform-wise, meanwhile, Google’s Android is dominating, accounting for over 46% of all smartphones in use in the last three months: