It’s been a challenging year for Xerox Holdings (XRX). The company wrapped 2019 with an amicable resolution to its aborted merger with Japan’s Fujifilm Holdings, but then entered 2020 pursuing a bizarre hostile takeover attempt of HP Inc. (HPQ) that abruptly collapsed with the COVID-19 pandemic took root. The company’s high-tech prowess was also called into question this fall with a pair of embarrassing cybersecurity breaches.

In its favor, the Norwalk, Connecticut-based company made efforts to show it was a socially responsible corporation eager to help during the early stages of the COVID-19 pandemic by switching gears to mass produce disposable ventilators and hospital-grade hand sanitizers for healthcare workers. It even responded to the challenges of the remote workforce in June with the debut of an availability app designed to support the new occupational configuration. But those efforts wound up being overshadowed by activist investor Carl Icahn, Xerox’s largest shareholder, who made himself the center of attention by mysteriously increasing his ownership stake in the company by acquiring armfuls of shares.

Does this company have the ability to regain its focus and attract others besides Carl Icahn? Here’s how our proprietary POWR Ratings system evaluates XRX:

Trade Grade: C

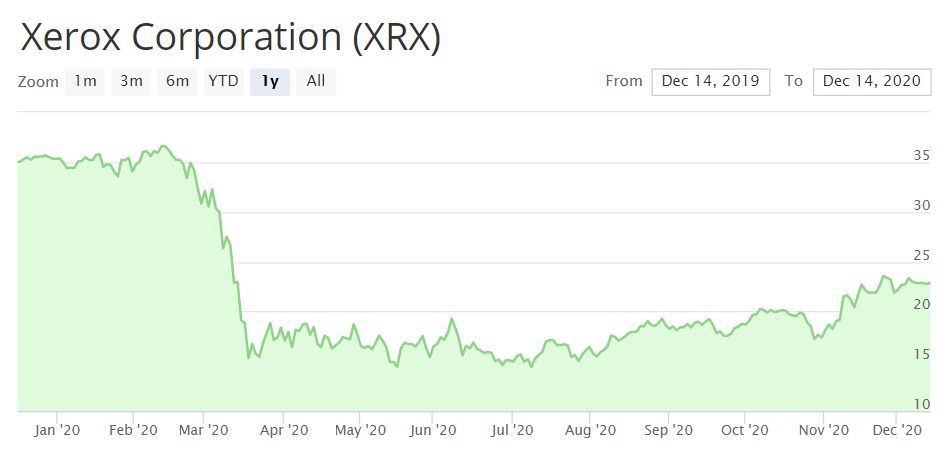

XRX is currently trading at $22.77, which is roughly in between its 52-week high of $38.69 and its 52-week low of $14.22.

XRX’s stock value began to head south in February and March with its ill-fated HP takeover. Over the past three months, the stock has been picking up some steam, recording a 20.5% uptick. The company is clearly eager to gain more upward motion, as witnessed in its Dec. 14 announcement promoting Xavier Heiss to chief financial officer, effective Jan 1, 2021. Heiss held the position on an interim basis since September and was previously president of the company’s Europe, Middle East, and Africa operations. CEO and Vice Chairman John Visentin pegged Heiss as a key to a financial turnaround, praising him for possessing “a deep understanding of the financials with a clear vision for renewing Xerox’s growth.”

Buy & Hold Grade: D

The lethargic stock performance of XRX is not in its favor, and the Q3 earnings report from late October didn’t help matters: $1.77 billion in revenue, down 18.9% year-over-year, with $419 million in equipment sales revenues, down 15.2% year-over-year on a reported basis and 16.1% on a constant-currency basis – this contributed to roughly one-quarter of total revenues.

Admittedly, the pandemic had a chaotic impact on XRX’s space, especially with the massive shift to a remote workforce, but the company seemed to have been impacted more than its rivals: XRX shares fell 53.2% year-to-date while its sector only recorded slightly less than 21% for overall share decline.

Peer Grade: D

XRX is ranked #19 out of 30 in the Technology – Hardware category. Some amusement might be found it locating HPQ, which XRX disastrously attempted to takeover earlier in the year, at #5 in this category – perhaps the hunter should have been the hunted? Not surprisingly in view of the realignment of the white-collar workforce, companies involved in the copier manufacturing sector are faring poorly this year in the category, with Canon Inc. (CAJ) ranked one berth above XRX at #18 and Kyocera Corp. (KYO) unranked.

Industry Rank: A

The Technology – Hardware category ranks #21 out of 123 stock categories, with an average POWR Rating of B. Admittedly, the category is a grab-bag ranging from #1 ranked Dell Technologies (DELL) to bottom-berth Corsair Gaming (CRSR), with major names including Apple Inc. (AAPL), IBM (IBM) and Pitney Bowes (PBW) in the mix. XRX is somewhere in the midst of this group, perhaps treading water but at least not sinking.

Overall POWR Rating: C (Neutral)

At this point in time, XRX is neither a hot stock nor a hot mess. Based on its competition, it has displayed little reason to generate enthusiasm for any investor not named Icahn.

Bottom Line

During the Q3 earnings call, Visentin took on a battle-hardened vibe by declaring, “With all this year has thrown at us, the team has remained steadfast and determined to provide exceptional support to our clients while driving our transformation forward.” He highlighted efforts the company made to expand further into growth areas including 3D printing, cloud computing, robotics process automation and Internet of Things, and scored woke points by promising to do more on reducing corporate-induced greenhouse gas emissions.

However, Visentin also declared that XRX will “continue to evaluate acquisition targets, large and small, using our established M&A playbook that focuses on ROI and IRR amongst other things.” In view of XRX’s disastrous attempts to mate with Fujifilm Holdings and strong-arm HPQ into submission, one has to wonder if XRX can generate a different result if it insists on making what could be the same mistake all over again. Based on that uneven vision of things to come, a wait-and-see attitude is the best approach to this stock.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

XRX shares were trading at $22.82 per share on Monday afternoon, up $0.06 (+0.26%). Year-to-date, XRX has declined -35.38%, versus a 15.63% rise in the benchmark S&P 500 index during the same period.

About the Author: Phil Hall

Phil is an experienced financial journalist responsible for generating original content on the weekly Fairfield County Business Journal and Westchester County Business Journal, plus their respective daily online news sites, podcasts and video interview series. He is the winner of 2018, 2019 and 2020 Connecticut Press Club Awards and 2019 and 2020 Connecticut Society of Professional Journalists Award for editorial output.

The post Can Xerox (XRX) Stock Continue to Rebound? appeared first on StockNews.com