Last year, Boston Consulting Group opined that quantum computing will create $450 billion to $850 billion in economic value globally by 2040. This projection implies sustained tailwinds for the industry and ample scope for early movers to create value.

D-Wave (QBTS), which identifies itself as the world’s first commercial supplier of quantum computers, is well positioned to benefit.

Backed by industry tailwinds and positive business developments, QBTS stock has rallied by 222% year-to-date (YTD). However, the stock has corrected by 42% from recent highs of $46.75. This correction seems like a good accumulation opportunity.

Recently, Benchmark reaffirmed its “Buy” rating for the stock with a price target of $35. This view is backed by positive business progress that should translate into continued growth momentum.

About QBTS Stock

D-Wave is in the development and delivery of quantum computing systems, software, and services. The company already has 200 million problems submitted to its quantum systems to date and has exceeded 100 revenue-generating customers.

The company’s established products include the world’s largest quantum computers. While the company is at an early-growth stage, the addressable market is significant, providing headroom for healthy growth.

Backed by a robust growth trajectory, swelling client base, and swelling bookings, QBTS stock has surged by 152% in the last six months.

High Focus on Innovation

D-Wave has been a frontrunner in terms of innovation, and that’s likely to serve as a foundation for robust long-term growth.

Currently, the company has more than 280 granted patents in the United States. Further, there are more than 550 granted or pending patents globally. With a team of 50 PhD scholars, D-Wave seems well positioned to drive meaningful progress in quantum computing.

It’s worth noting that for the first nine months of 2025, D-Wave reported $21.8 million in revenue and spent $37 million in R&D. While this implies cash burn, it’s unlikely to be a concern for an early-stage company.

Further, as of Q3 2025, D-Wave reported a cash balance of $836.2 million. A robust cash buffer also eliminates the risk of equity dilution in the foreseeable future.

Positives from Q3 2025 Results

Recently, D-Wave reported Q3 2025 numbers, and there are multiple positives. For the quarter, revenue growth was at 100% on a year-on-year (YoY) basis to $3.7 million.

For Q3, the company reported bookings of $2.4 million. However, subsequent to the quarter, D-Wave closed $12 million in additional bookings. This sets the stage for sustained growth.

Another important point to note is that the company is engaging with some big customers that can potentially imply strong growth in the order book.

As an example, D-Wave is collaborating with BASF on quantum hybrid applications. Similarly, the company has signed an agreement with one of the largest U.S.-based international airlines. At the same time, D-Wave is going global with engagements in Japan and Turkey during the quarter.

Earlier this month, the company’s Advantage2 quantum computer became operational for government use. The system will address “mission-critical U.S. government problems, particularly in national defense.” This is another potential high-growth area for the company.

What Analysts Say About QBTS Stock

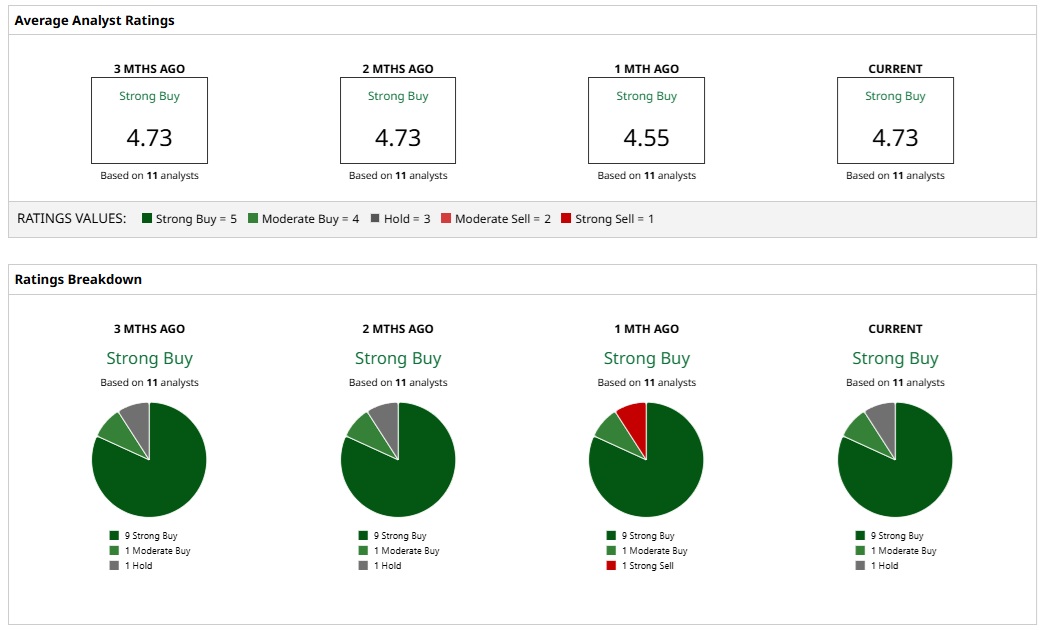

Based on the rating of 11 analysts, QBTS stock is a “Strong Buy.”

While nine analysts have assigned a “Strong Buy” rating, one analyst has assigned a “Moderate Buy” rating, and another has a “Hold” rating.

Further, a mean average price target of $34.40 implies an upside potential of 26%. Considering the most bullish price target of $41, the upside potential is 51%.

Coming back to the “Buy” rating by Benchmark, the thesis is supported by the company’s path towards “broad commercialization and sustainable profitability.”

The Benchmark analyst estimates a full-system sale range between $20 million and $40 million. As the number of customers swells, the revenue potential can therefore be significant with contracts that “could easily be in the millions of dollars.”

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Heavy Put Option Activity in Advanced Micro Devices Implies AMD Stock Is Overvalued - But Is It?

- CoreWeave Has a ‘Tremendous Long-Term Opportunity’ But Is Stuck in Limbo Here. Should You Buy, Sell, or Hold CRWV Stock for 2026?

- As C3.ai Explores a Sale, Should You Buy, Sell, or Hold AI Stock?

- D-Wave’s Contracts Could Be Worth ‘Millions of Dollars.’ Should You Buy QBTS Stock Now?