Valued at a market cap of $60.5 billion, Seagate Technology Holdings plc (STX) is a global leader in data storage solutions, offering hard disk drives (HDDs), solid-state drives (SSDs), and hybrid storage products for enterprise, cloud, and consumer applications. Based in Singapore, the company serves customers worldwide through its vertically integrated supply chain.

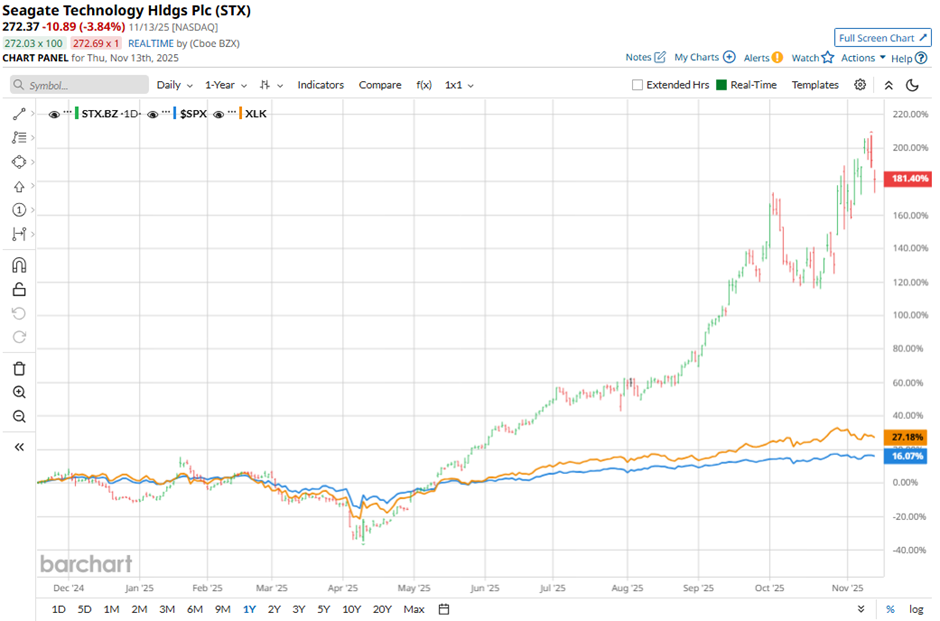

Shares of the electronic storage maker have significantly outpaced the broader market over the past 52 weeks. STX stock has climbed 173.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.8%. Moreover, shares of the company have surged 211.6% on a YTD basis, compared to SPX's 15.8% gain.

In addition, STX stock has outperformed the Technology Select Sector SPDR Fund's (XLK) 23.6% return over the past 52 weeks.

Shares of Seagate Technology soared 19.1% on Oct. 29 after the company reported strong Q1 2026 results, with adjusted EPS of $2.61 and revenue of $2.63 billion, beating estimates. The company also issued a bullish forecast for Q2, expecting revenue of $2.70 billion ± $100 million and adjusted EPS of about $2.75, both above Wall Street projections. Investor optimism was further fueled by Seagate’s outlook for robust demand from cloud providers expanding GenAI-related hardware investments, signaling a strong recovery in storage device demand.

For the fiscal year ending in June 2026, analysts expect STX's EPS to increase nearly 39% year-over-year to $10.09. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

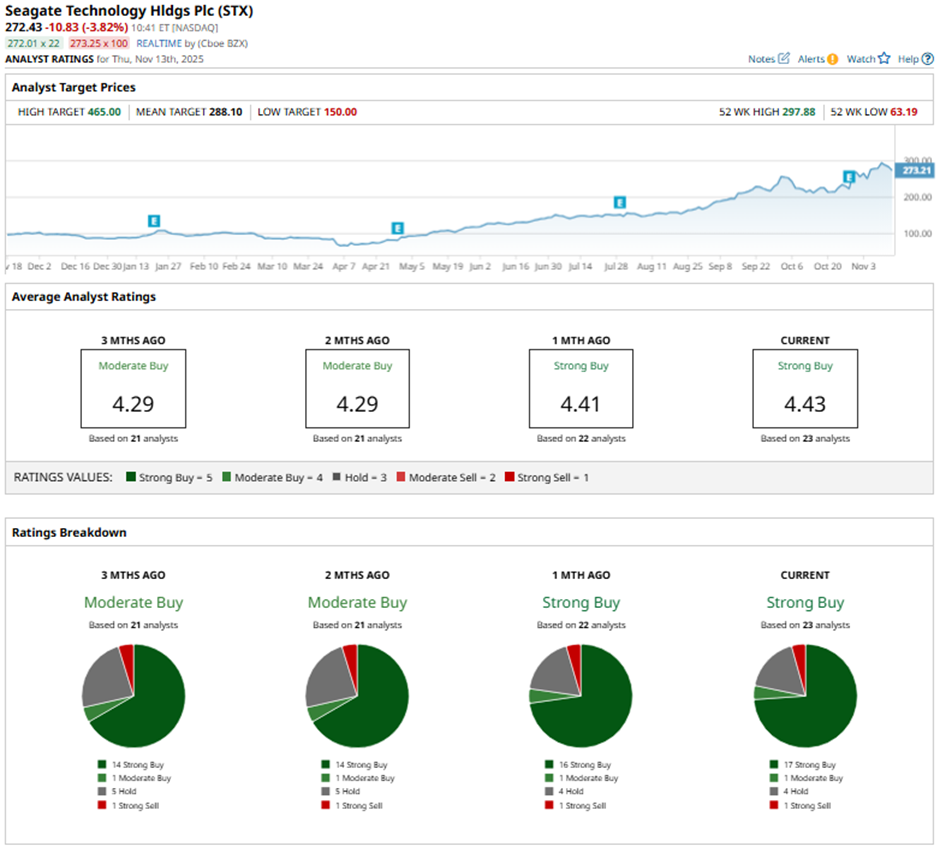

Among the 23 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, one “Moderate Buy,” four “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with 14 “Strong Buy” ratings on the stock.

On Nov. 11, TD Cowen increased its price target on Seagate to $340 and maintained a “Buy” rating.

The mean price target of $288.10 represents a 5.8% premium to STX’s current price levels. The Street-high price target of $465 suggests a 70.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Two Straddles Define Wednesday’s Unusual Options Activity Across Key Stocks

- Find Stocks to Trade Before the Rest of the Market by Adding This Trend Indicator to Your Charts

- IBM Is Staring Down Quantum Advantage. Should You Buy IBM Stock First?

- Michael Burry Shutters Hedge Fund as Trump’s 50-Year Mortgage Threatens an $11 Trillion Housing Collapse – Is Big Short 2.0 Brewing in Housing, Not Tech?