Semiconductor testing company Teradyne (NASDAQ: TER) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 4.8% year on year to $737.3 million. Its non-GAAP profit of $0.90 per share was also 14.2% above analysts’ consensus estimates.

Is now the time to buy Teradyne? Find out by accessing our full research report, it’s free.

Teradyne (TER) Q3 CY2024 Highlights:

- Revenue: $737.3 million vs analyst estimates of $715.6 million (3% beat)

- Adjusted EPS: $0.90 vs analyst estimates of $0.79 (14.2% beat)

- Adjusted Operating Income: $165 million vs analyst estimates of $145.8 million (13.2% beat)

- Gross Margin (GAAP): 59.2%, up from 56.6% in the same quarter last year

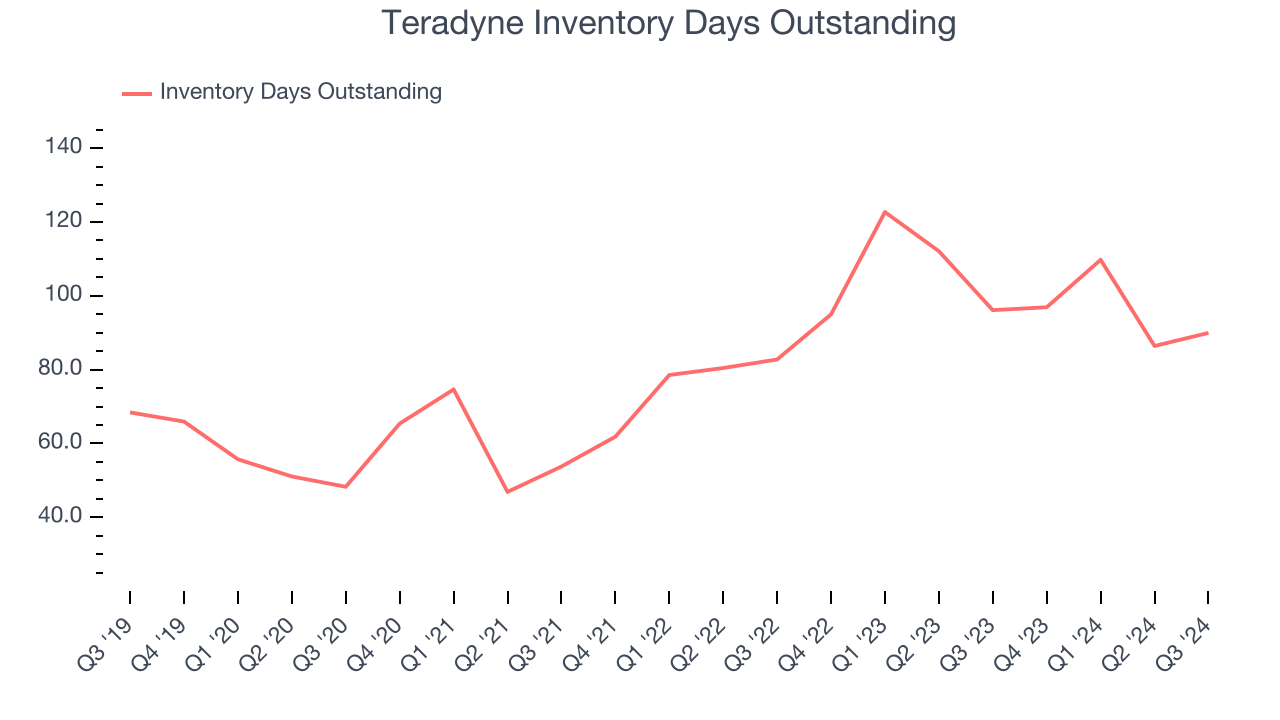

- Inventory Days Outstanding: 90, up from 86 in the previous quarter

- Operating Margin: 20.6%, in line with the same quarter last year

- Free Cash Flow Margin: 15.5%, down from 19.9% in the same quarter last year

- Market Capitalization: $20.46 billion

“Semiconductor Test continues to perform better than planned on record Memory revenue driven by High Bandwidth Memory (HBM) and compute demand for AI applications,” said Teradyne CEO, Greg Smith.

Company Overview

Sporting most major chip manufacturers as its customers, Teradyne (NASDAQ: TER) is a US-based supplier of automated test equipment for semiconductors as well as other technologies and devices.

Semiconductor Manufacturing

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

Sales Growth

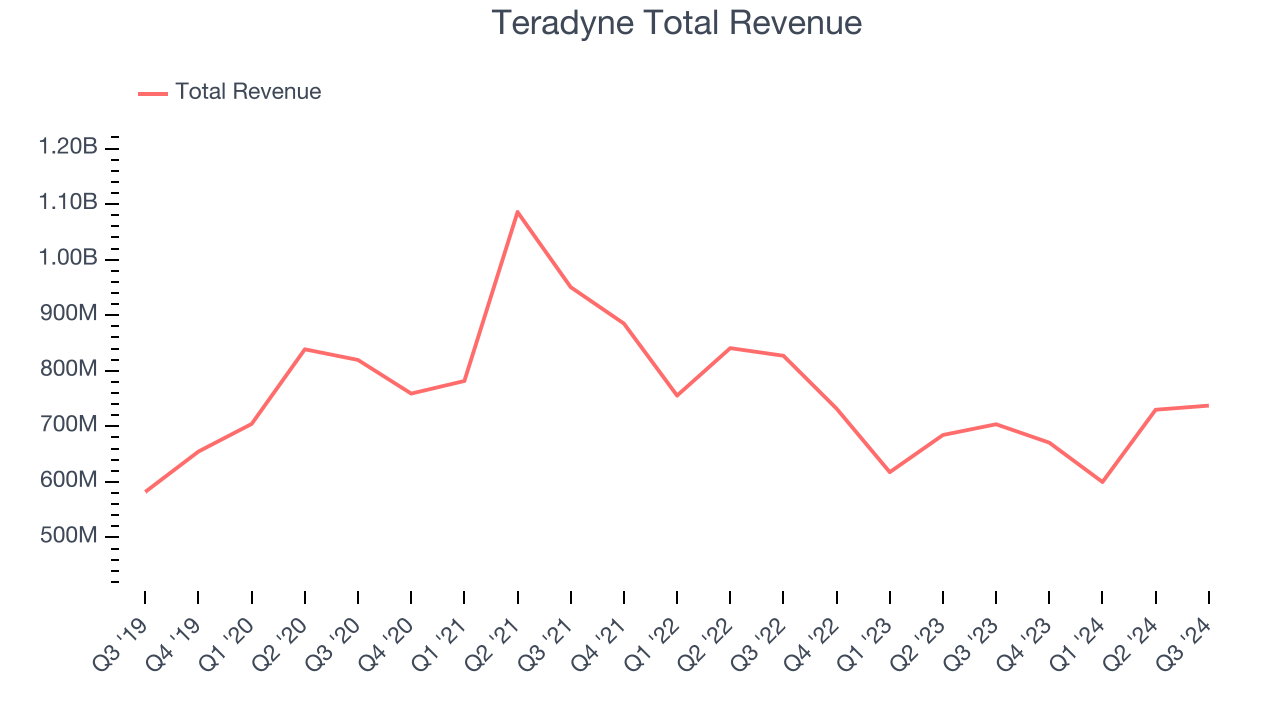

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Teradyne’s sales grew at a tepid 4.9% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but recency is neccessary for semiconductors because of Moore's Law, which suggests the pace of technological innovation is so high that yesterday's hit new product could be obsolete today. Teradyne’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 9% annually.

This quarter, Teradyne reported modest year-on-year revenue growth of 4.8% but beat Wall Street’s estimates by 3%.

Looking ahead, sell-side analysts expect revenue to grow 19.8% over the next 12 months, an acceleration versus the last two years. This projection is noteworthy and indicates the market believes its newer products and services will spur faster growth.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Teradyne’s DIO came in at 90, which is 11 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

Key Takeaways from Teradyne’s Q3 Results

We were impressed by how significantly Teradyne blew past analysts’ EPS expectations this quarter on revenue and operating income that both came in ahead. We were also glad its gross margin improved. On the other hand, its inventory levels increased. Overall, we think this was a solid quarter with some key metrics above expectations. The stock traded up 2.8% to $128 immediately following the results.

Indeed, Teradyne had a rock-solid quarterly earnings result, but is this stock a good investment here?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.