What a brutal six months it’s been for Inspire Medical Systems. The stock has dropped 44.2% and now trades at $83, rattling many shareholders. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is now the time to buy INSP? Find out in our full research report, it’s free for active Edge members.

Why Is INSP a Good Business?

Offering an alternative for the millions who struggle with traditional CPAP machines, Inspire Medical Systems (NYSE: INSP) develops and sells an implantable neurostimulation device that treats obstructive sleep apnea by stimulating nerves to keep airways open during sleep.

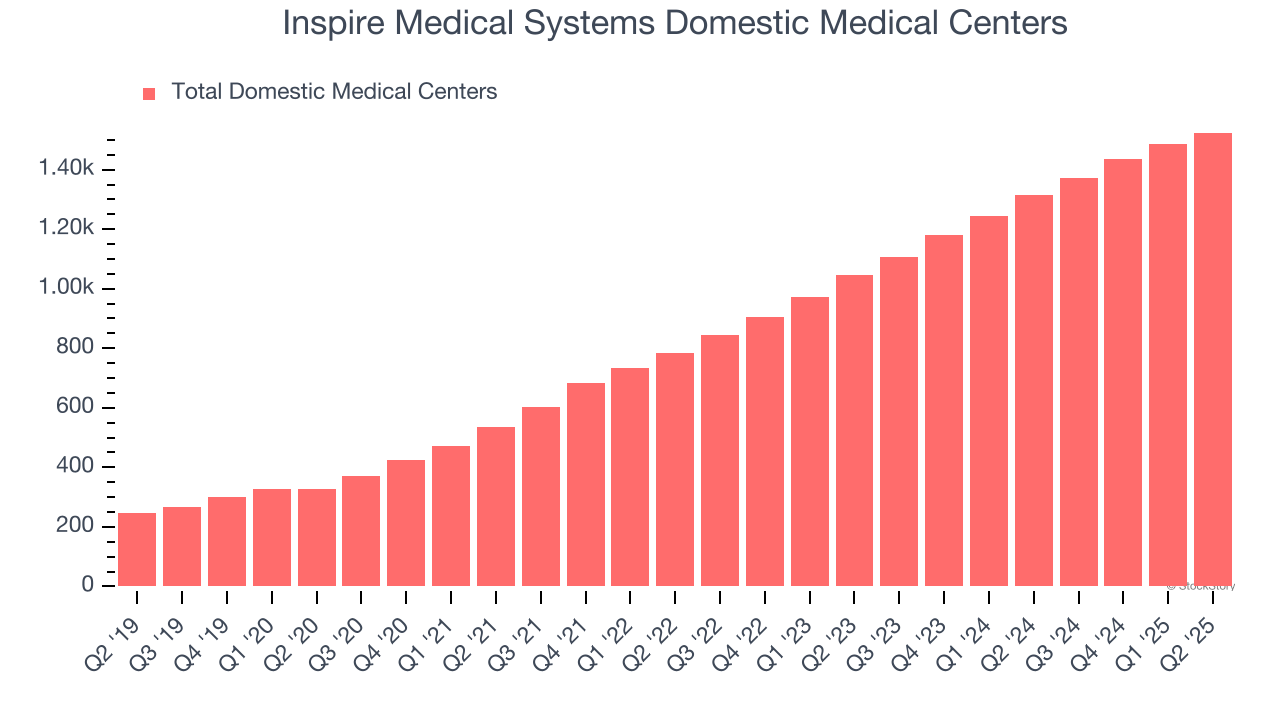

1. Increasing Number of Domestic Medical Centers Leads to More Shots On Goal

Sales growth for companies like Inspire Medical Systems can be broken down into the number of facilities/providers and the revenue for each. While both are important, the latter is the lifeblood of a successful Medical Devices & Supplies - Specialty company because there’s a ceiling to how many facilities and providers one can secure.

Inspire Medical Systems’s number of domestic medical centers punched in at 1,524 in the latest quarter, and over the last two years, averaged 24.5% year-on-year growth. This pace was fast and gives the company more opportunities to increase its revenue.

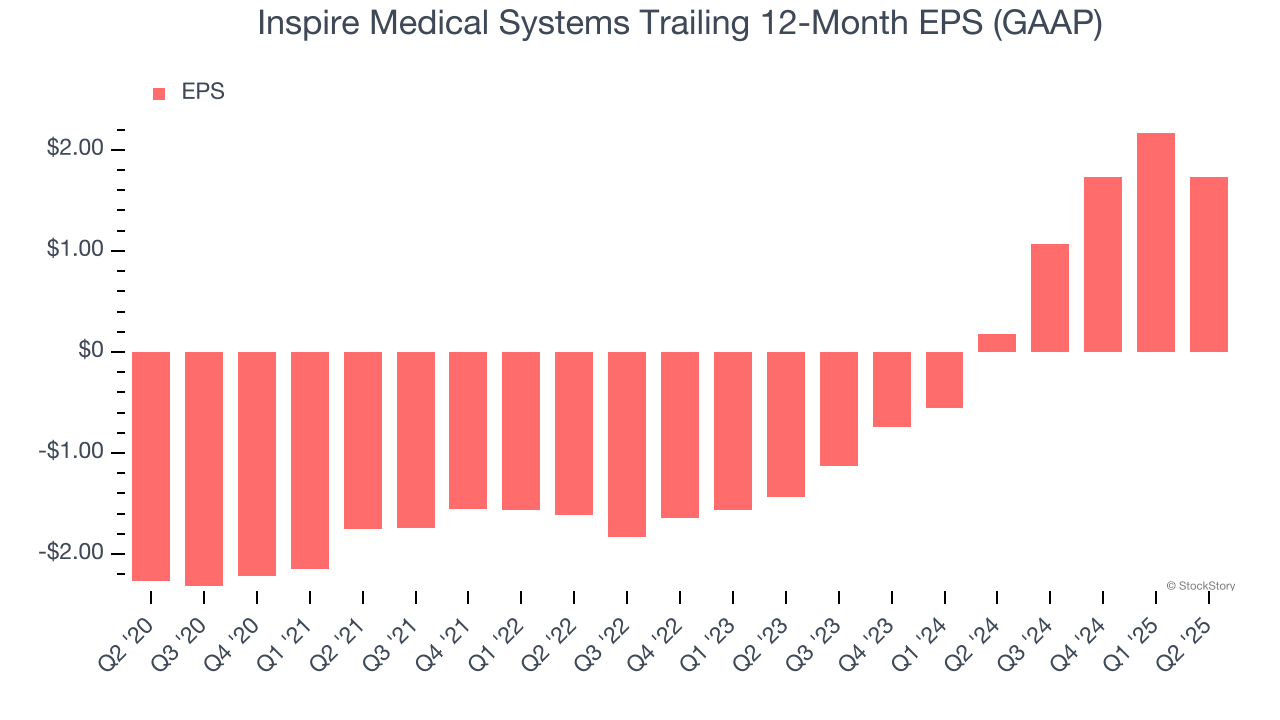

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Inspire Medical Systems’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

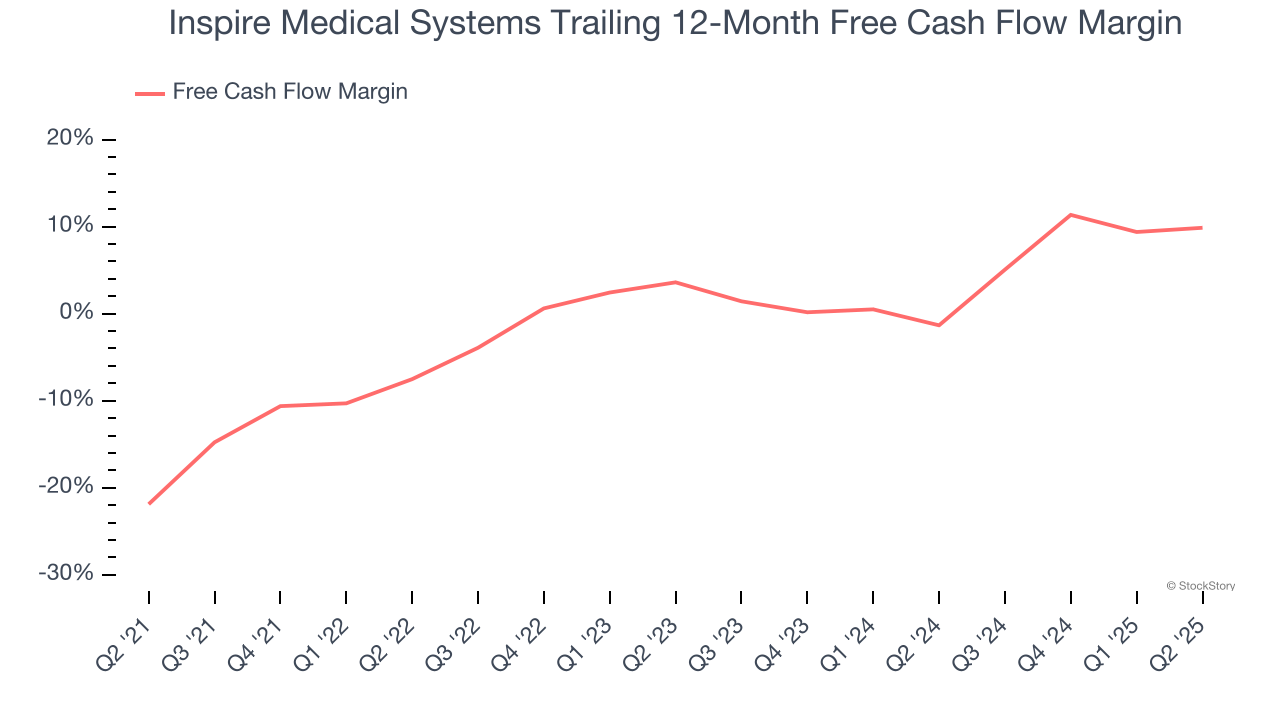

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Inspire Medical Systems’s margin expanded by 31.8 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Inspire Medical Systems’s free cash flow margin for the trailing 12 months was 9.9%.

Final Judgment

These are just a few reasons why we think Inspire Medical Systems is a high-quality business. After the recent drawdown, the stock trades at 102.9× forward P/E (or $83 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.