Health care services provider Encompass Health (NYSE: EHC) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 10.6% year on year to $1.46 billion. The company’s full-year revenue guidance of $5.89 billion at the midpoint came in 0.6% above analysts’ estimates. Its non-GAAP profit of $1.37 per share was 14.9% above analysts’ consensus estimates.

Is now the time to buy Encompass Health? Find out by accessing our full research report, it’s free.

Encompass Health (EHC) Q1 CY2025 Highlights:

- Revenue: $1.46 billion vs analyst estimates of $1.43 billion (10.6% year-on-year growth, 1.6% beat)

- Adjusted EPS: $1.37 vs analyst estimates of $1.19 (14.9% beat)

- Adjusted EBITDA: $313.6 million vs analyst estimates of $290.8 million (21.5% margin, 7.8% beat)

- The company slightly lifted its revenue guidance for the full year to $5.89 billion at the midpoint from $5.85 billion

- Management raised its full-year Adjusted EPS guidance to $4.98 at the midpoint, a 3.3% increase

- EBITDA guidance for the full year is $1.2 billion at the midpoint, above analyst estimates of $1.19 billion

- Operating Margin: 18.3%, up from 17% in the same quarter last year

- Free Cash Flow Margin: 15.3%, up from 12.7% in the same quarter last year

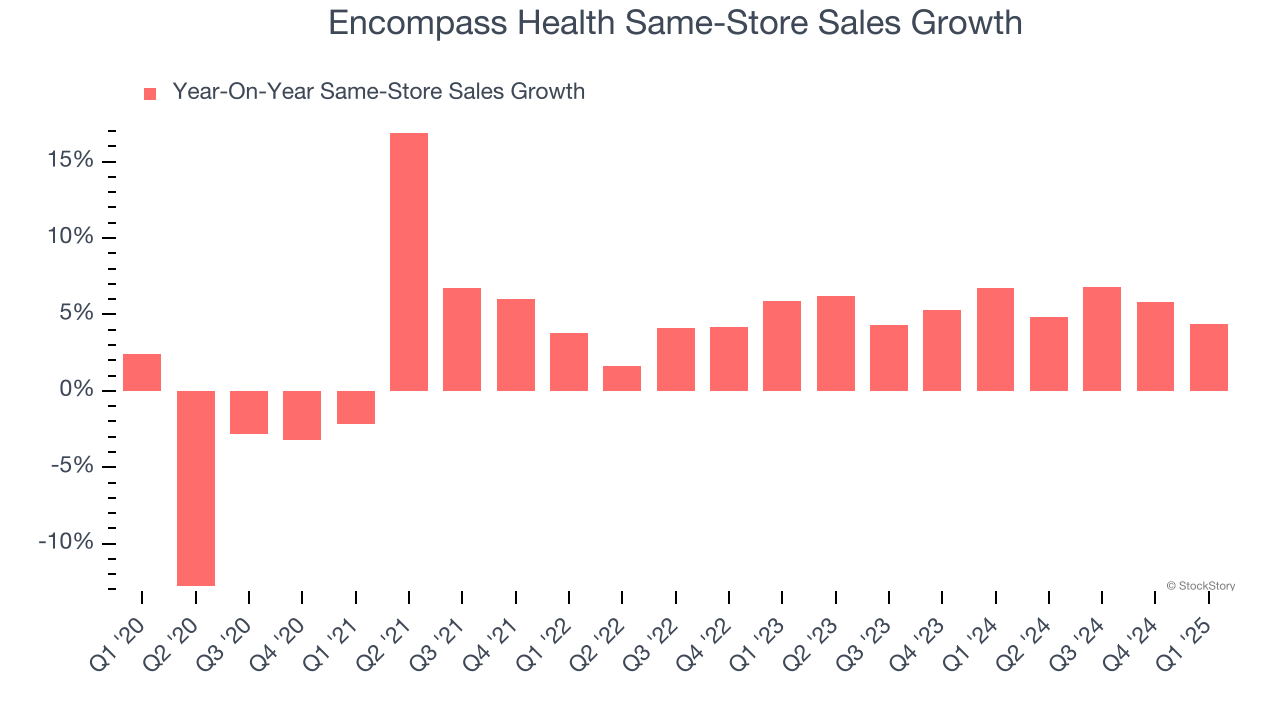

- Same-Store Sales rose 4.4% year on year (6.7% in the same quarter last year)

- Market Capitalization: $10.17 billion

"We are very pleased with our first quarter performance, which drove a 10.6% increase in revenue and a 14.9% increase in Adjusted EBITDA," said President and Chief Executive Officer of Encompass Health Mark Tarr.

Company Overview

With a network of 161 specialized facilities across 37 states and Puerto Rico, Encompass Health (NYSE: EHC) operates inpatient rehabilitation hospitals that help patients recover from strokes, hip fractures, and other debilitating conditions.

Outpatient & Specialty Care

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amid competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

Sales Growth

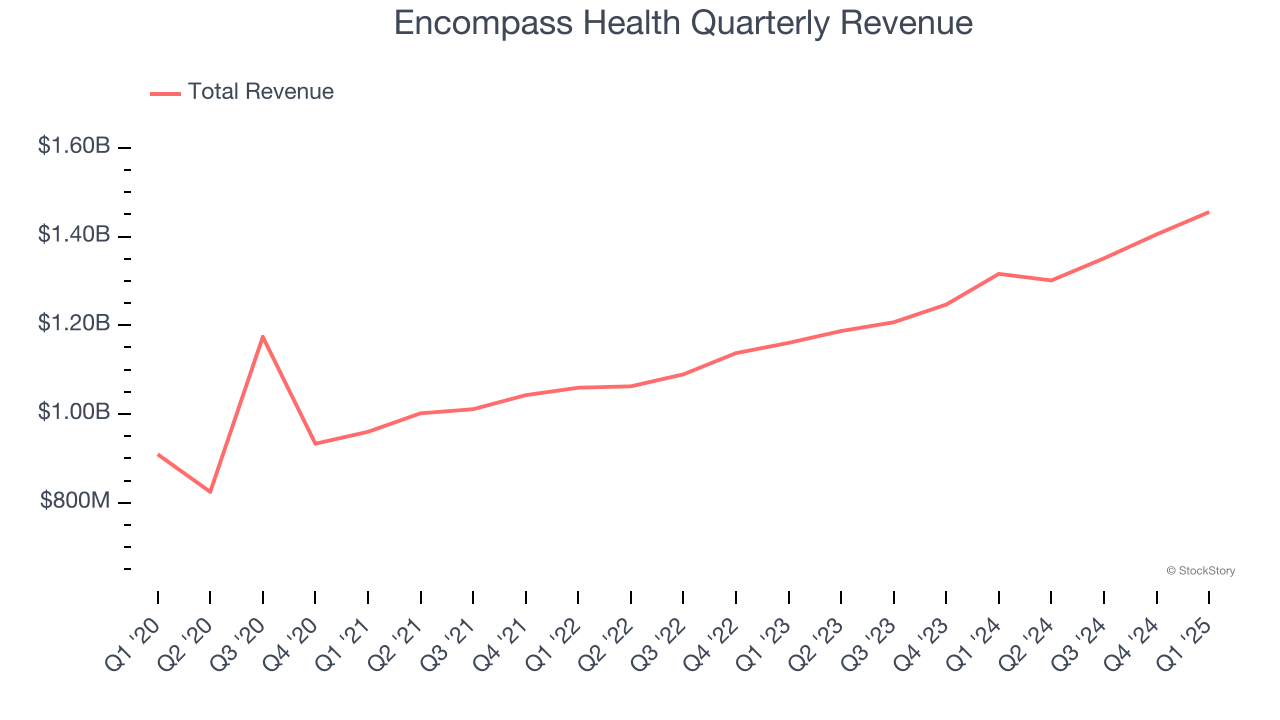

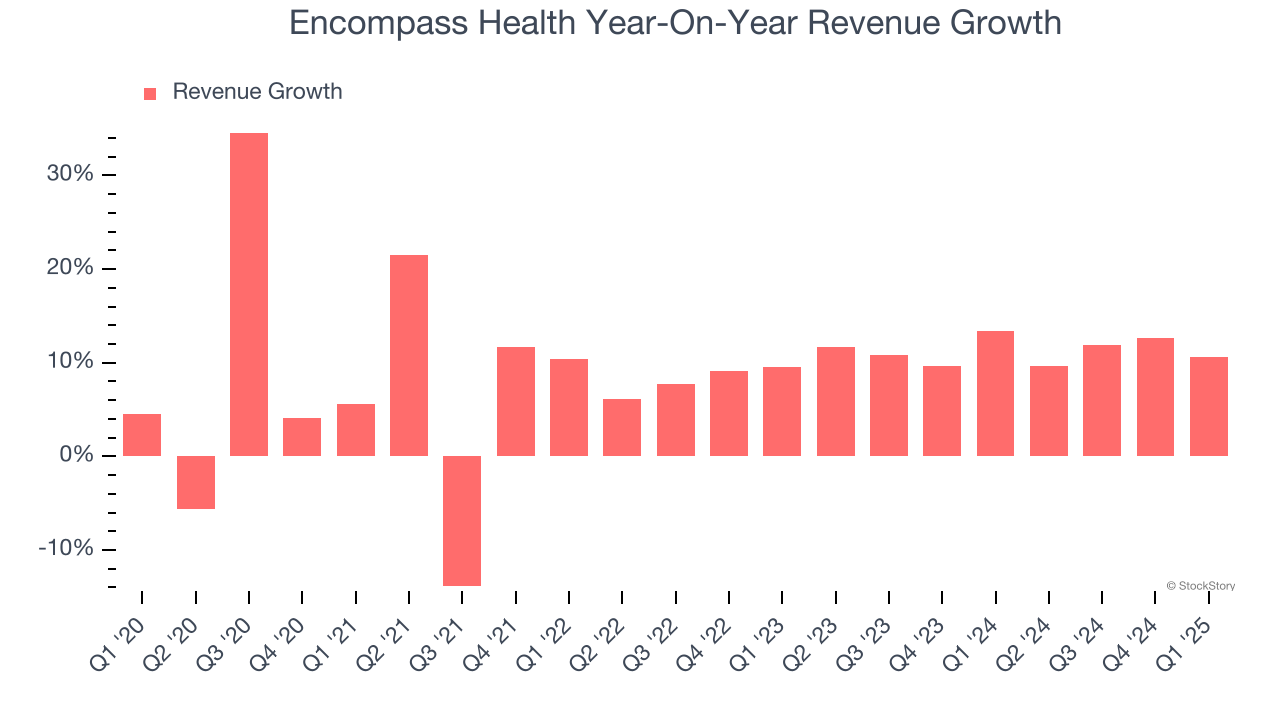

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Encompass Health grew its sales at a decent 9.2% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Encompass Health’s annualized revenue growth of 11.3% over the last two years is above its five-year trend, suggesting some bright spots.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Encompass Health’s same-store sales averaged 5.5% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Encompass Health reported year-on-year revenue growth of 10.6%, and its $1.46 billion of revenue exceeded Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is commendable and suggests the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

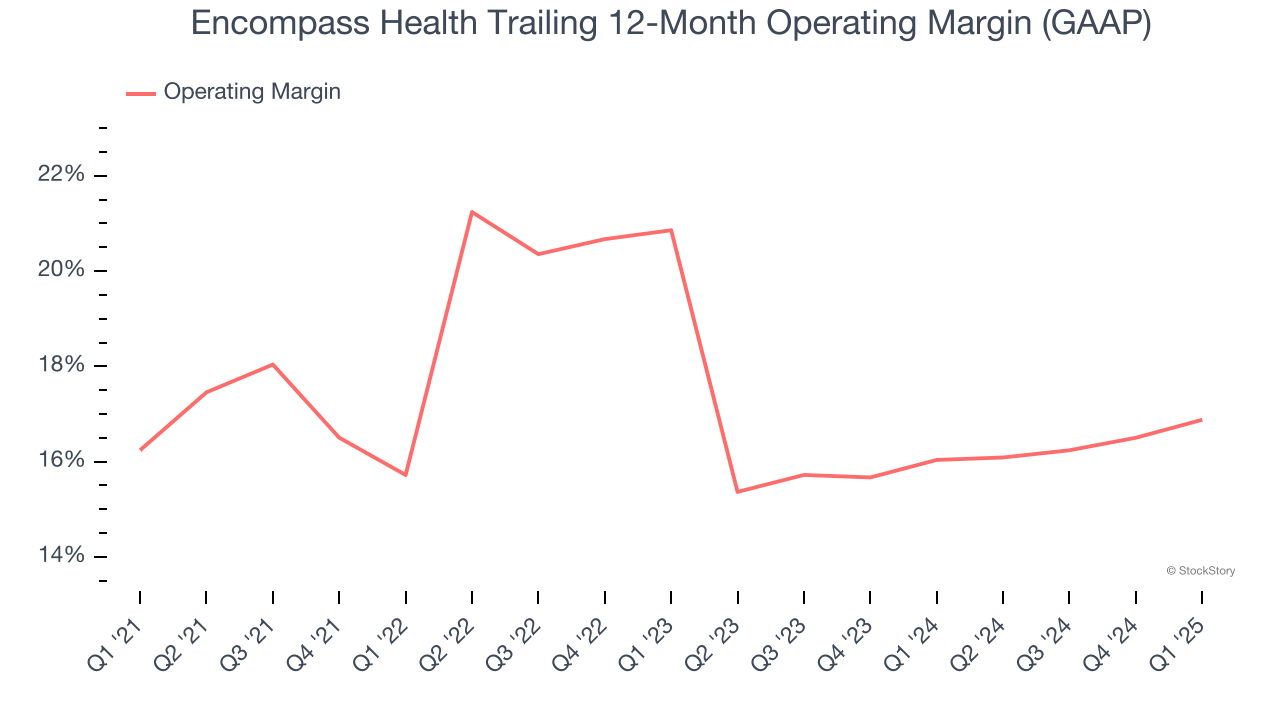

Encompass Health has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 17.2%.

Analyzing the trend in its profitability, Encompass Health’s operating margin of 16.9% for the trailing 12 months may be around the same as five years ago, but it has decreased by 4 percentage points over the last two years.

In Q1, Encompass Health generated an operating profit margin of 18.3%, up 1.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

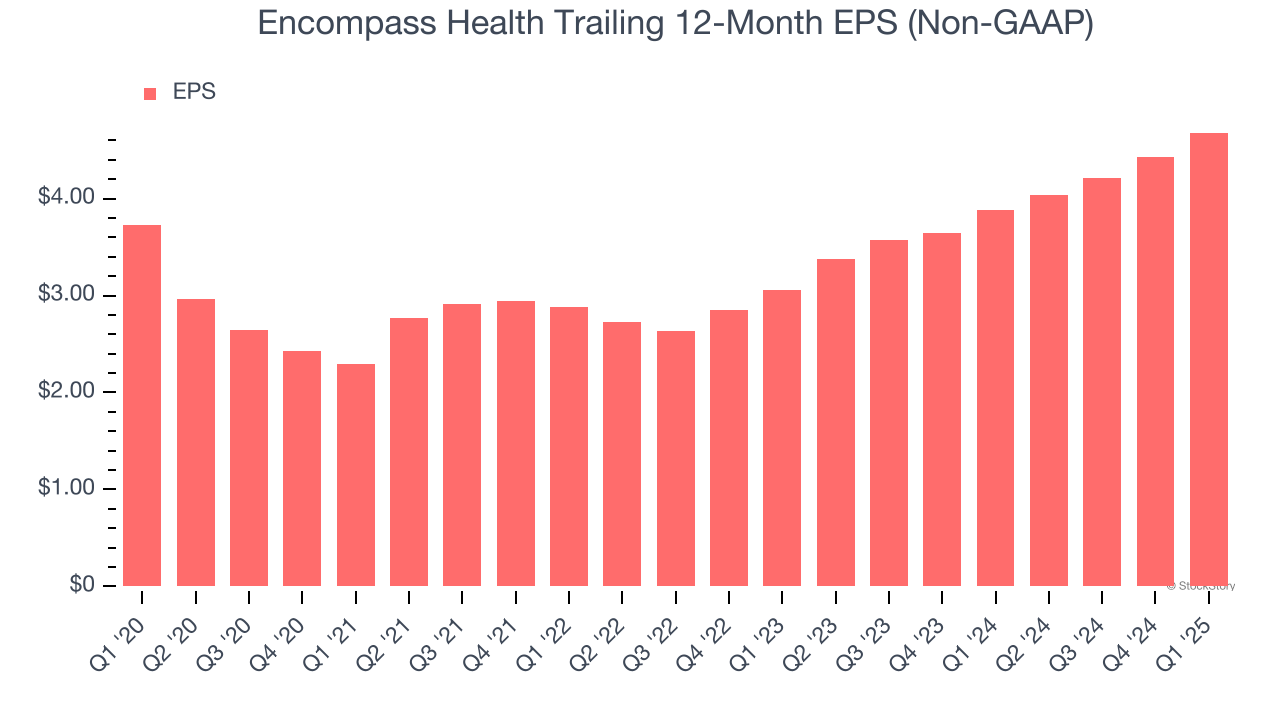

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Encompass Health’s EPS grew at an unimpressive 4.6% compounded annual growth rate over the last five years, lower than its 9.2% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

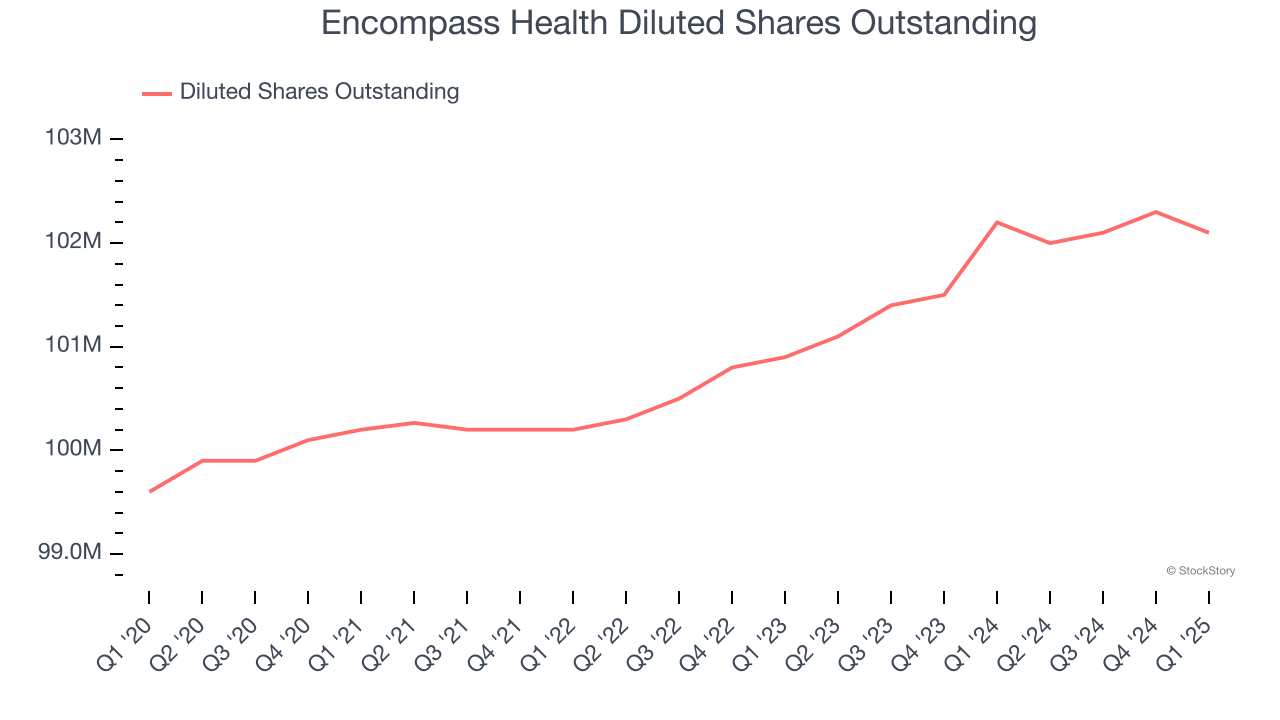

We can take a deeper look into Encompass Health’s earnings to better understand the drivers of its performance. A five-year view shows Encompass Health has diluted its shareholders, growing its share count by 2.5%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Encompass Health reported EPS at $1.37, up from $1.12 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Encompass Health’s full-year EPS of $4.68 to grow 4.9%.

Key Takeaways from Encompass Health’s Q1 Results

We enjoyed seeing Encompass Health beat analysts’ full-year EPS guidance expectations this quarter. We were also glad both its revenue and EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2.5% to $103.95 immediately after reporting.

Encompass Health had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.