Webster Financial currently trades at $53.68 per share and has shown little upside over the past six months, posting a small loss of 3.8%.

Is there a buying opportunity in Webster Financial, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Webster Financial Not Exciting?

We're swiping left on Webster Financial for now. Here are three reasons why you should be careful with WBS and a stock we'd rather own.

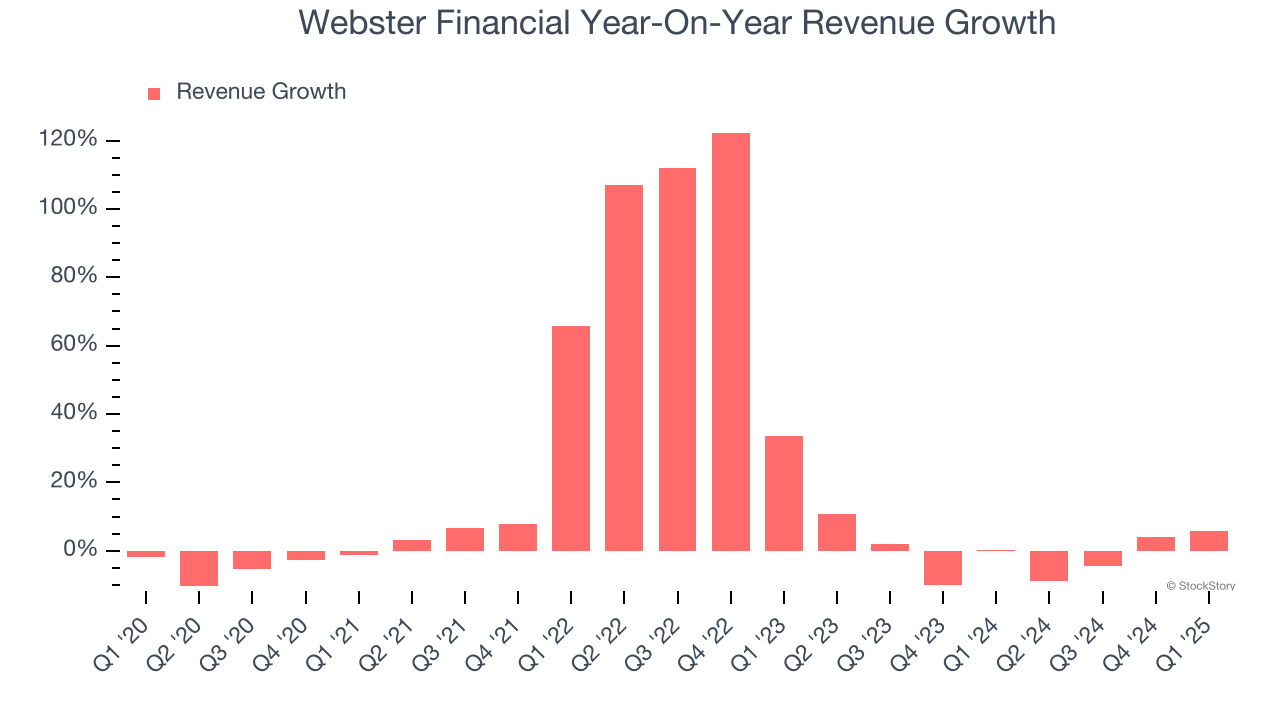

1. Revenue Growth Flatlining

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Webster Financial’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

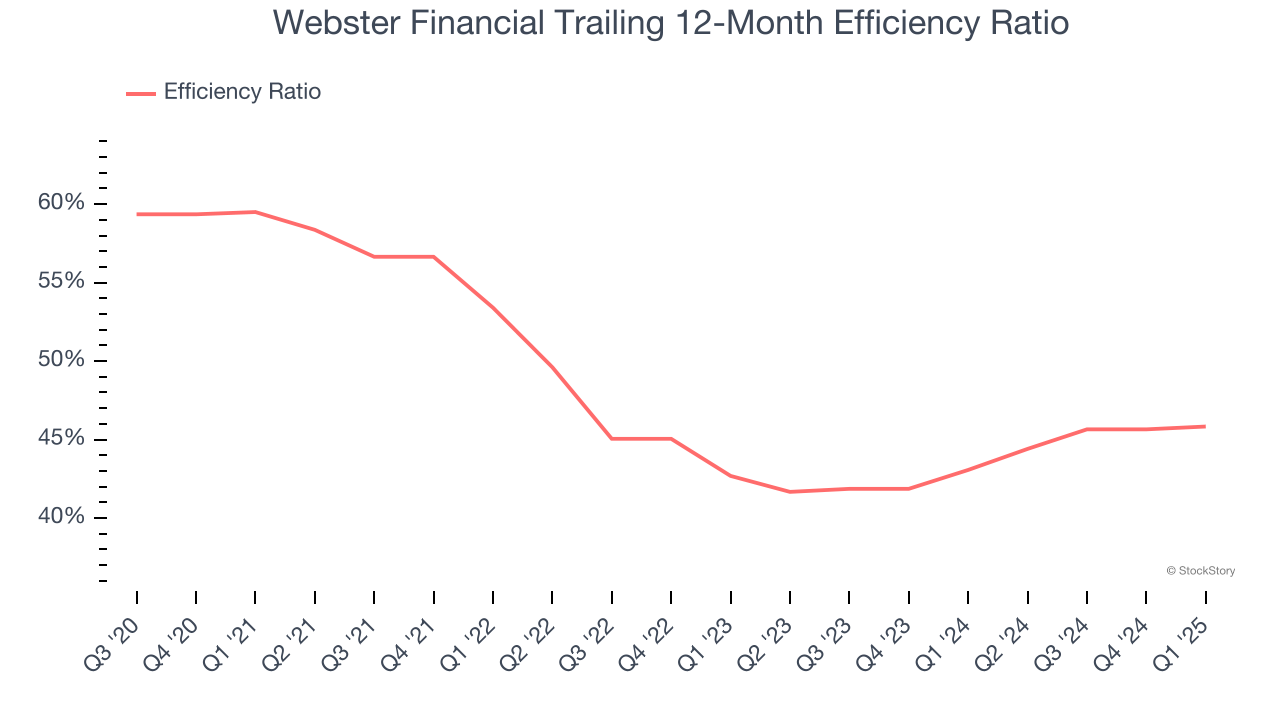

2. Efficiency Ratio Expected to Falter

Topline growth carries importance, but the overall profitability behind this expansion determines true value creation. For banks, the efficiency ratio captures this relationship by measuring non-interest expenses, including salaries, facilities, technology, and marketing, against total revenue.

Investors place greater emphasis on efficiency ratio movements than absolute values, understanding that expense structures reflect revenue mix variations. Lower ratios represent better operational performance since they show banks generating more revenue per dollar of expense.

For the next 12 months, Wall Street expects Webster Financial to become less profitable as it anticipates an efficiency ratio of 48.5% compared to 45.8% over the past year.

3. High Interest Expenses Increase Risk

Leverage is core to the bank’s business model (loans funded by deposits) and to ensure their stability, regulators require certain levels of capital and liquidity, focusing on a bank’s Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a bank holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all banks must maintain a Tier 1 capital ratio greater than 4.5% On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, banks generally must maintain a 7-10% ratio at minimum.

Over the last two years, Webster Financial has averaged a Tier 1 capital ratio of 11.5%, which is considered unsafe in the event of a black swan or if macro or market conditions suddenly deteriorate. For this reason alone, we will be crossing it off our shopping list.

Final Judgment

Webster Financial isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 1× forward P/B (or $53.68 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Webster Financial

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.