Over the past six months, BJ's has been a great trade, beating the S&P 500 by 13.6%. Its stock price has climbed to $41.66, representing a healthy 20.7% increase. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy BJ's, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think BJ's Will Underperform?

Despite the momentum, we're swiping left on BJ's for now. Here are three reasons why there are better opportunities than BJRI and a stock we'd rather own.

1. Same-Store Sales Falling Behind Peers

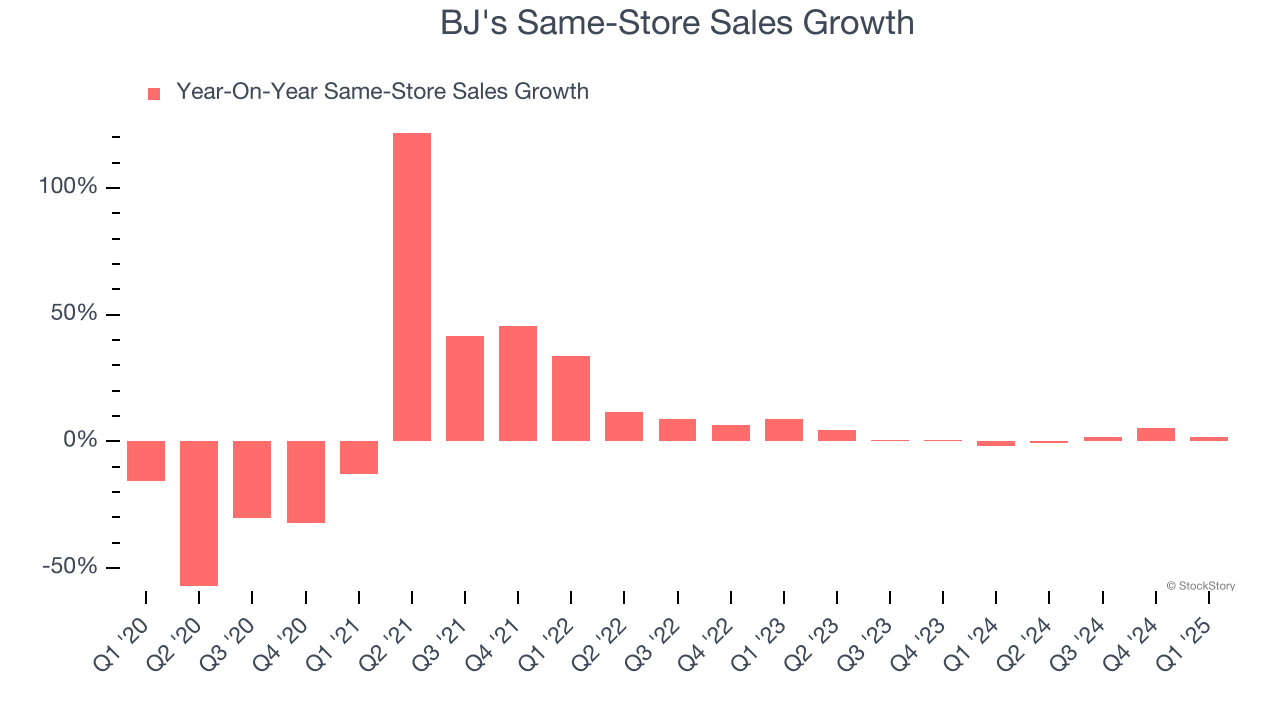

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

BJ’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.5% per year.

2. Low Gross Margin Reveals Weak Structural Profitability

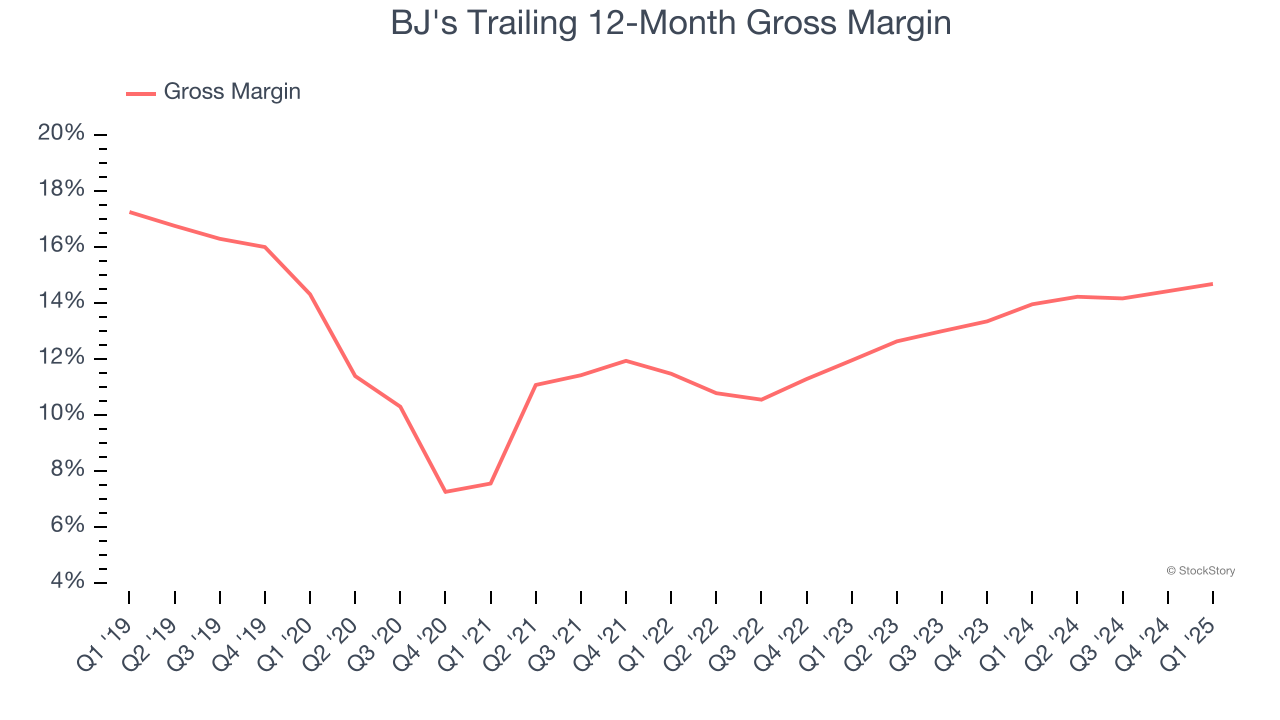

Gross profit margins are an important measure of a restaurant’s pricing power and differentiation, whether it be the dining experience or quality and taste of food.

BJ's has bad unit economics for a restaurant company, signaling it operates in a competitive market and has little room for error if demand unexpectedly falls. As you can see below, it averaged a 14.3% gross margin over the last two years. That means BJ's paid its suppliers a lot of money ($85.69 for every $100 in revenue) to run its business.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

BJ's historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.9%, lower than the typical cost of capital (how much it costs to raise money) for restaurant companies.

Final Judgment

BJ's falls short of our quality standards. With its shares outperforming the market lately, the stock trades at 23.8× forward P/E (or $41.66 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than BJ's

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.