Arcade company Dave & Buster’s (NASDAQ: PLAY) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 10.8% year on year to $534.5 million. Its non-GAAP profit of $0.69 per share was in line with analysts’ consensus estimates.

Is now the time to buy Dave & Buster's? Find out by accessing our full research report, it’s free.

Dave & Buster's (PLAY) Q4 CY2024 Highlights:

- Revenue: $534.5 million vs analyst estimates of $545.4 million (10.8% year-on-year decline, 2% miss)

- Adjusted EPS: $0.69 vs analyst estimates of $0.69 (in line)

- Adjusted EBITDA: $127.2 million vs analyst estimates of $128.3 million (23.8% margin, 0.9% miss)

- Operating Margin: 8.3%, down from 15% in the same quarter last year

- Free Cash Flow was $108.9 million, up from -$25.4 million in the same quarter last year

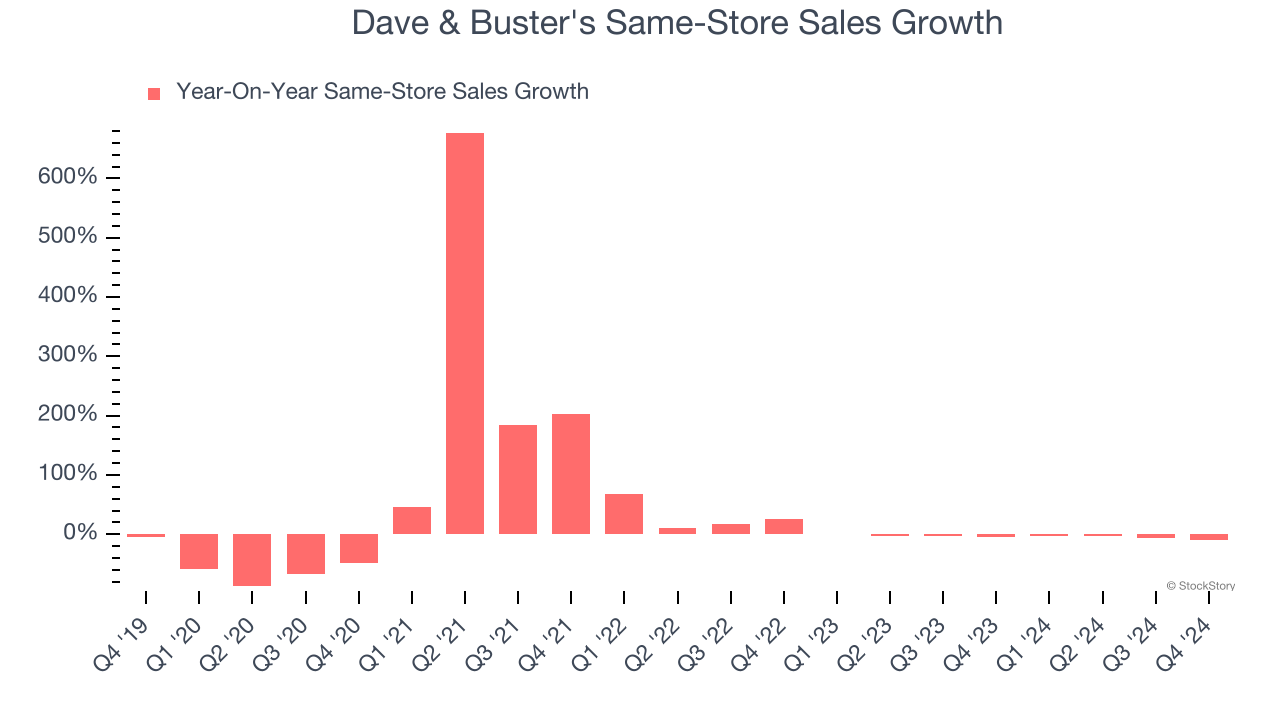

- Same-Store Sales fell 9.4% year on year (-4.4% in the same quarter last year)

- Market Capitalization: $648.2 million

“While we are disappointed by our results in the fourth quarter, we are very encouraged by the clear opportunities we have identified over the past few months and the most recent trends in the business since taking actions to unwind mistakes and make appropriate changes. Previous leadership, while well intentioned, made significant and ill-advised changes to marketing, food and beverage, operations, remodels and games investment that negatively impacted the business. The current leadership team has been systematically unwinding these mistakes and pursuing a “back to basics” strategy while making high confidence improvements to the key areas of the business entirely in line with our previously communicated strategic plan."

Company Overview

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ: PLAY) operates a chain of arcades providing immersive entertainment experiences.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Sales Growth

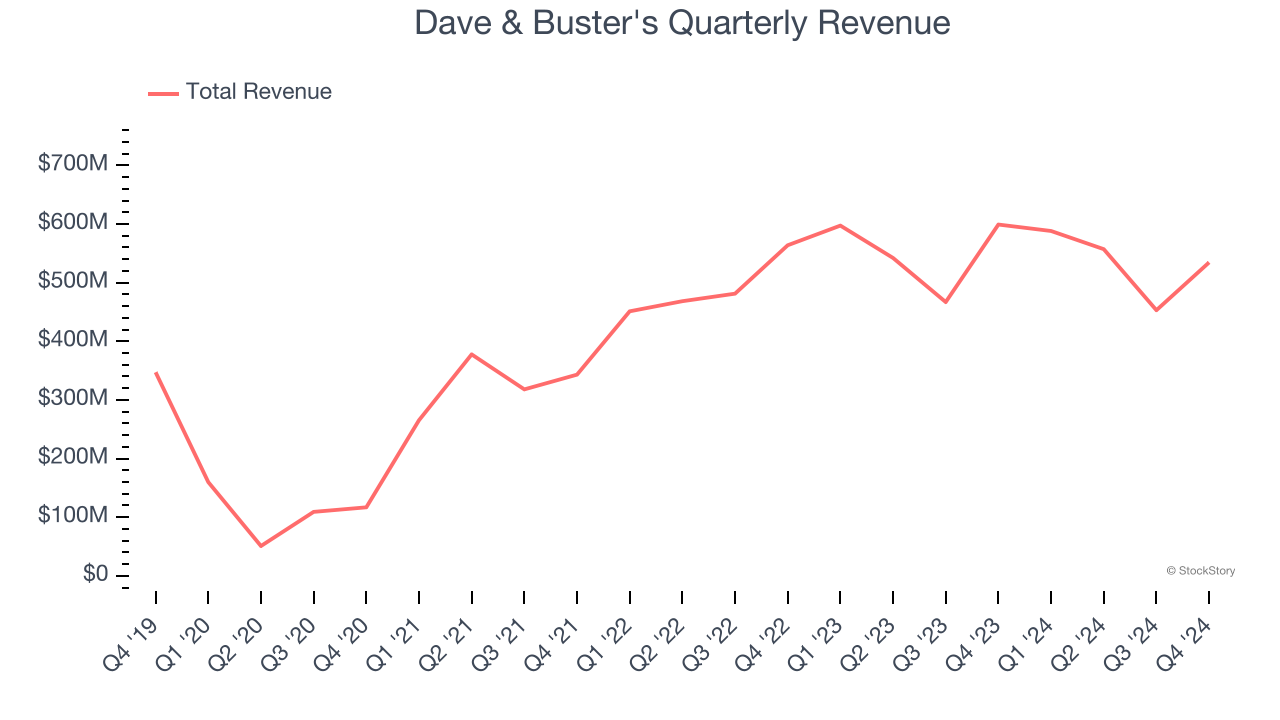

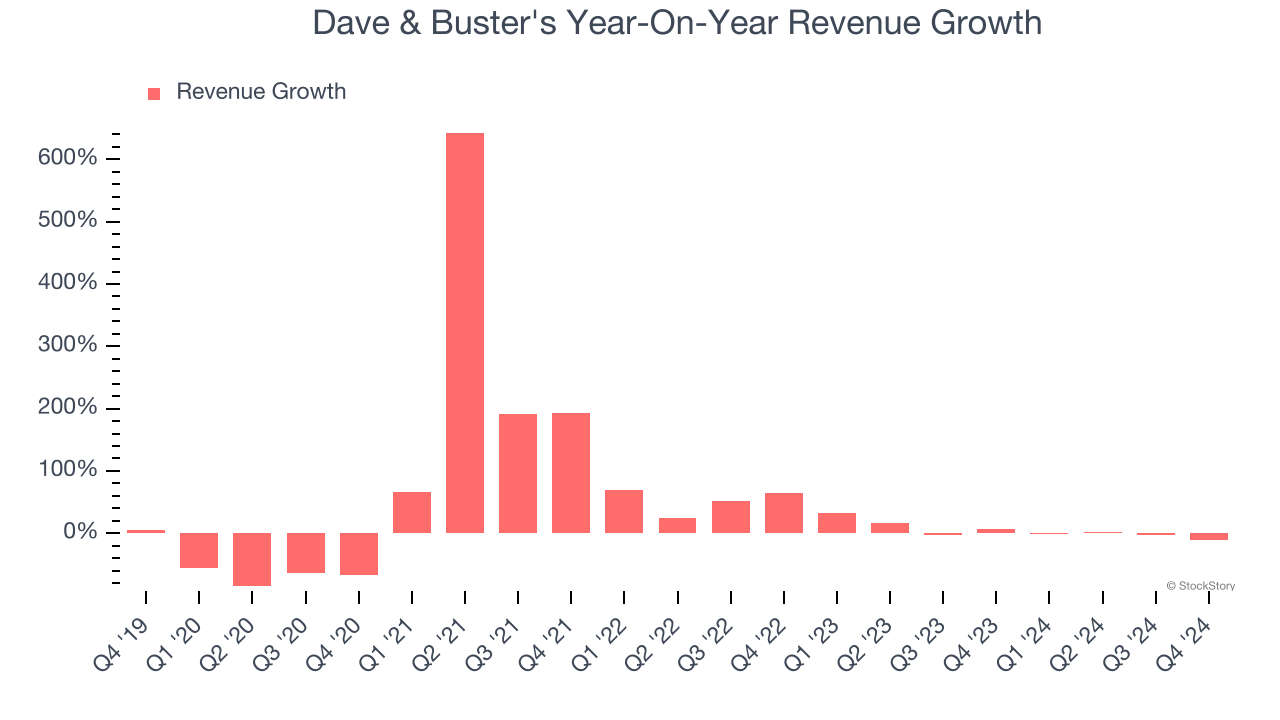

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Dave & Buster’s 9.5% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Dave & Buster’s recent performance shows its demand has slowed as its annualized revenue growth of 4.2% over the last two years was below its five-year trend. Note that COVID hurt Dave & Buster’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Dave & Buster's also reports same-store sales, which show how much revenue its established locations generate. Over the last two years, Dave & Buster’s same-store sales averaged 4% year-on-year declines. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company’s top-line performance.

This quarter, Dave & Buster's missed Wall Street’s estimates and reported a rather uninspiring 10.8% year-on-year revenue decline, generating $534.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

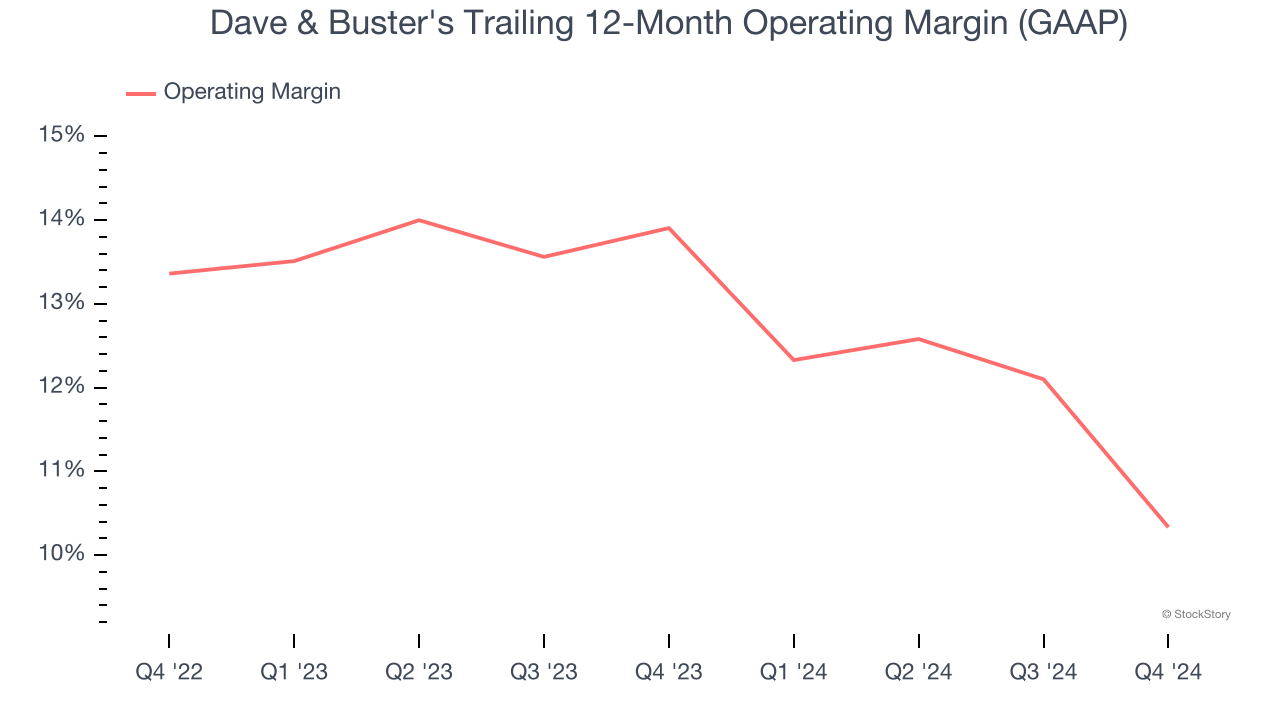

Operating Margin

Dave & Buster’s operating margin has been trending down over the last 12 months, but it still averaged 12.2% over the last two years, decent for a consumer discretionary business. This shows it generally does a decent job managing its expenses.

In Q4, Dave & Buster's generated an operating profit margin of 8.3%, down 6.7 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

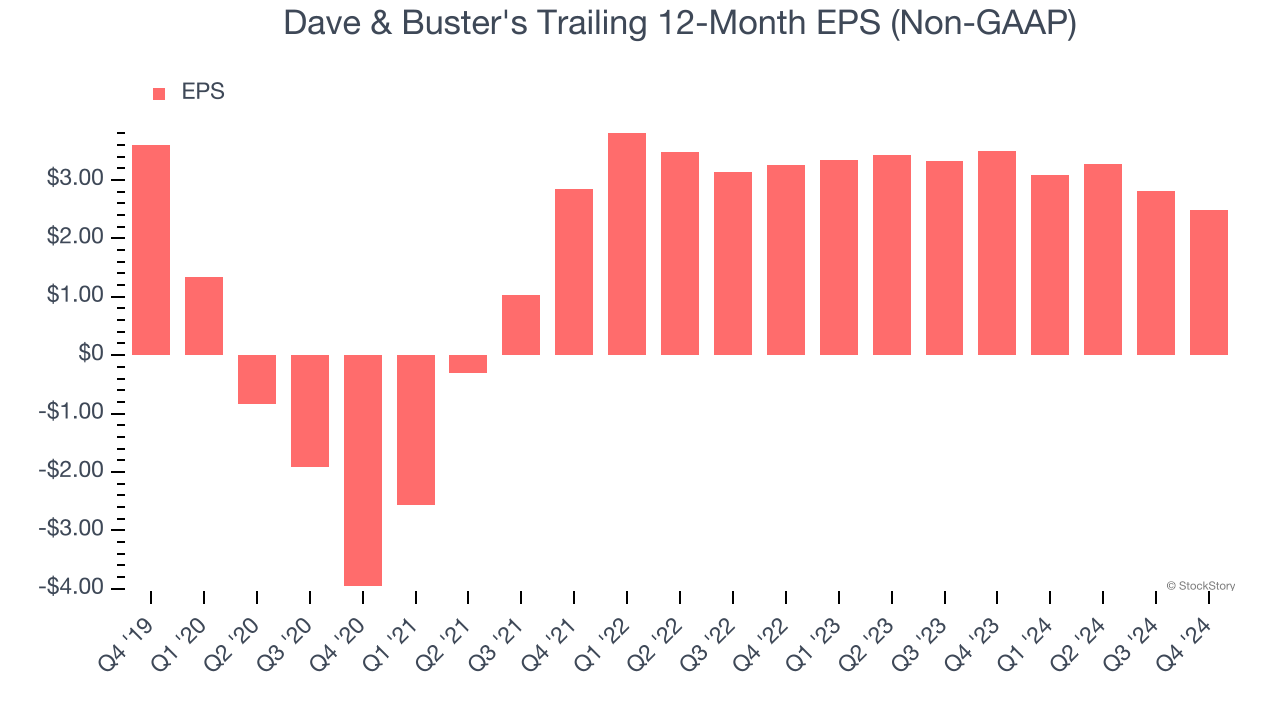

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Dave & Buster's, its EPS declined by 7.2% annually over the last five years while its revenue grew by 9.5%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q4, Dave & Buster's reported EPS at $0.69, down from $1.02 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Dave & Buster’s full-year EPS of $2.48 to grow 9.5%.

Key Takeaways from Dave & Buster’s Q4 Results

We struggled to find many positives in these results as its revenue, same-store sales, and EBITDA missed Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $16.29 immediately following the results.

So should you invest in Dave & Buster's right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.