Even during a down period for the markets, Levi's has gone against the grain, climbing to $18.39. Its shares have yielded a 5.3% return over the last six months, beating the S&P 500 by 7.2%. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Levi's, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Levi's Will Underperform?

Despite the momentum, we're cautious about Levi's. Here are three reasons why you should be careful with LEVI and a stock we'd rather own.

1. Weak Constant Currency Growth Points to Soft Demand

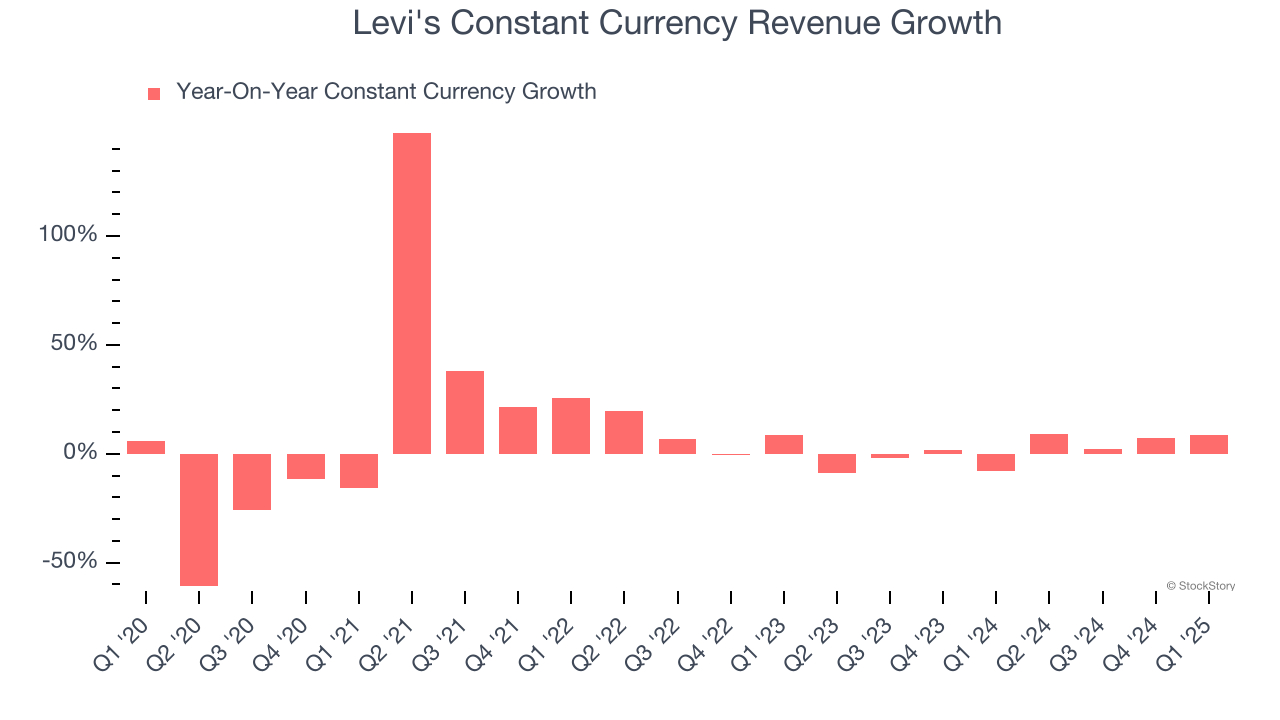

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Apparel and Accessories companies. This metric excludes currency movements, which are outside of Levi’s control and are not indicative of underlying demand.

Over the last two years, Levi’s constant currency revenue averaged 1.3% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Levi’s revenue to stall, close to its 1.5% annualized declines for the past two years. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

3. Previous Growth Initiatives Haven’t Impressed

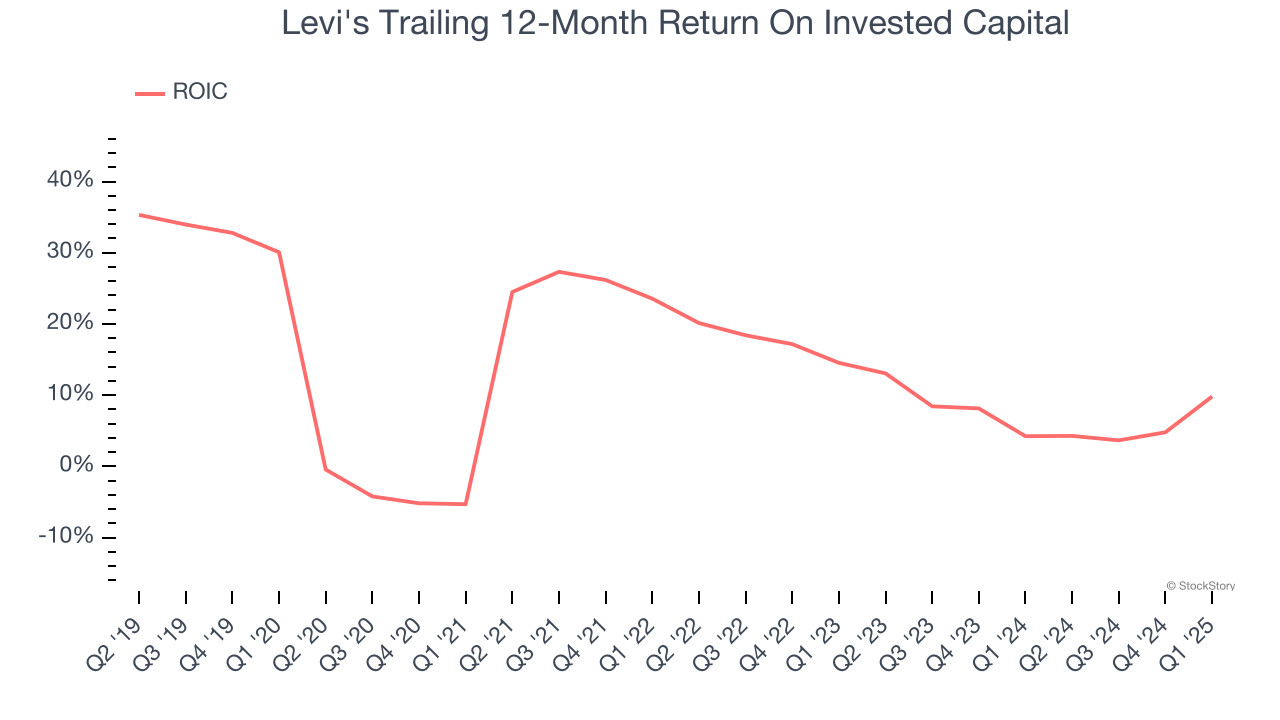

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Levi's historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.4%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

Levi's doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 14.2× forward P/E (or $18.39 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d recommend looking at our favorite semiconductor picks and shovels play.

Stocks We Like More Than Levi's

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.