Shareholders of Integra LifeSciences would probably like to forget the past six months even happened. The stock dropped 46.7% and now trades at $13.10. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Integra LifeSciences, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Integra LifeSciences Will Underperform?

Despite the more favorable entry price, we're cautious about Integra LifeSciences. Here are three reasons why you should be careful with IART and a stock we'd rather own.

1. Core Business Falling Behind as Demand Declines

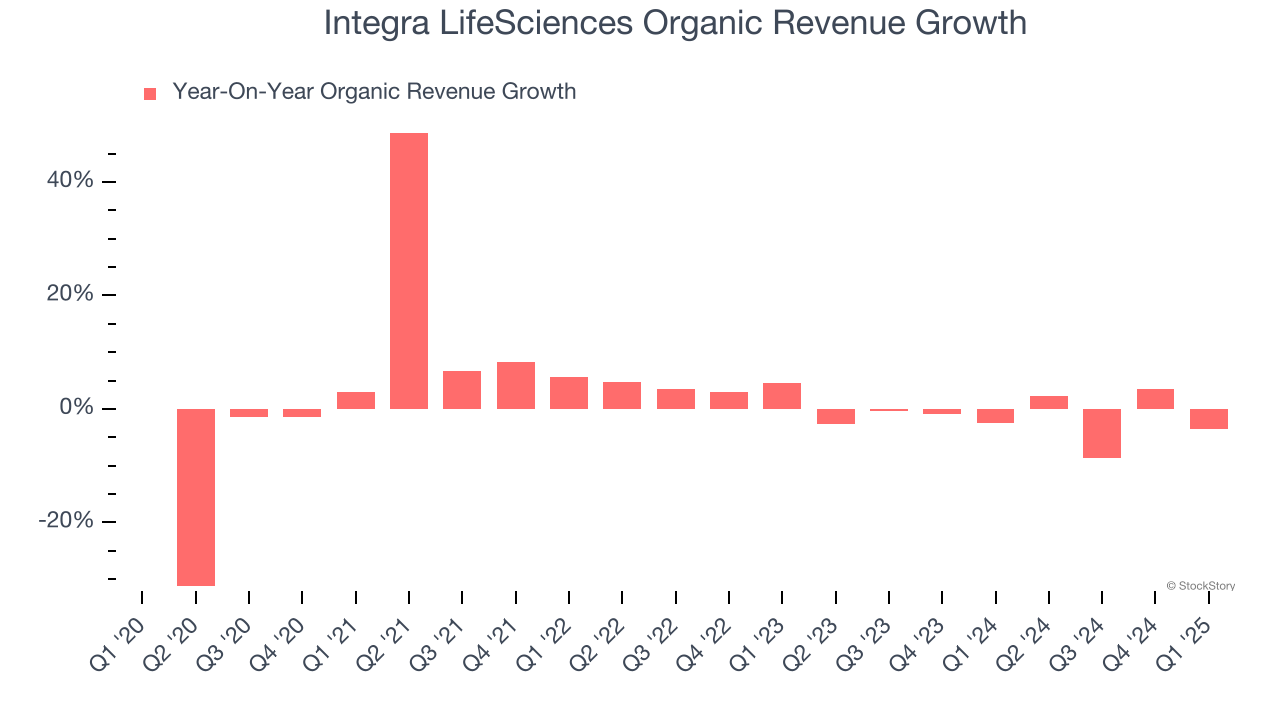

Investors interested in Surgical Equipment & Consumables - Specialty companies should track organic revenue in addition to reported revenue. This metric gives visibility into Integra LifeSciences’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Integra LifeSciences’s organic revenue averaged 1.6% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Integra LifeSciences might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. EPS Trending Down

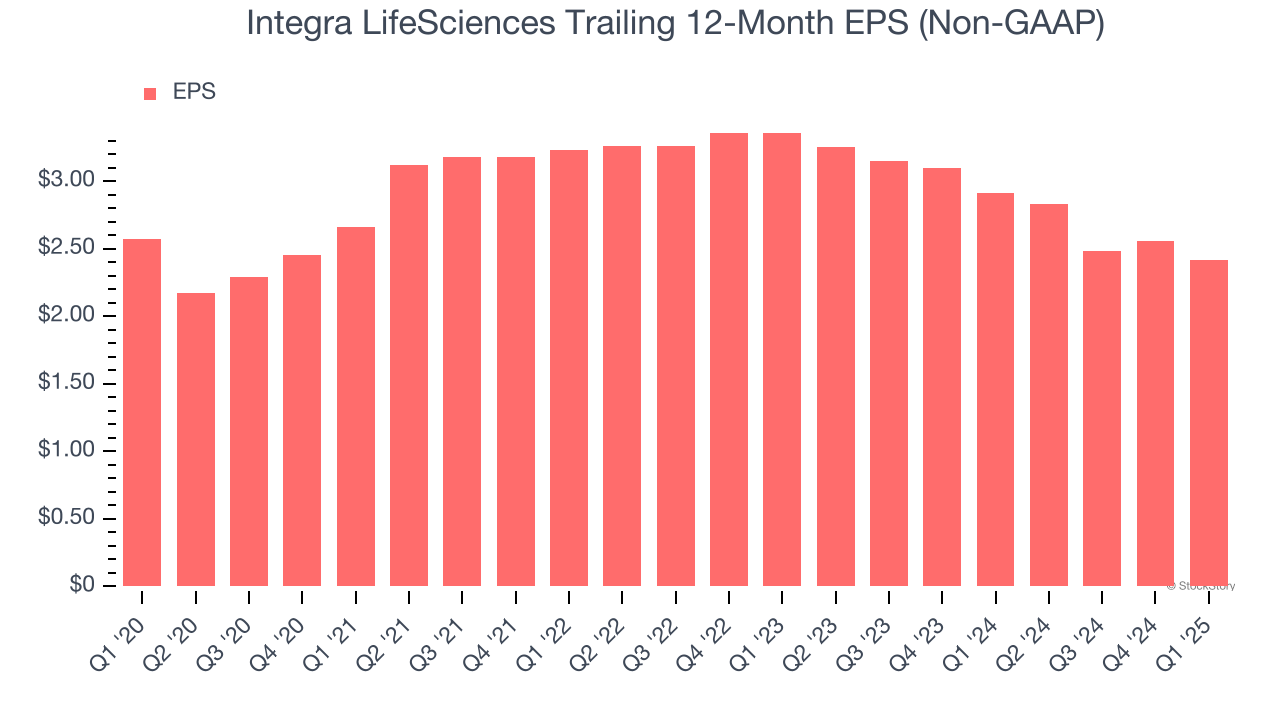

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Integra LifeSciences, its EPS declined by 1.2% annually over the last five years while its revenue grew by 1.4%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

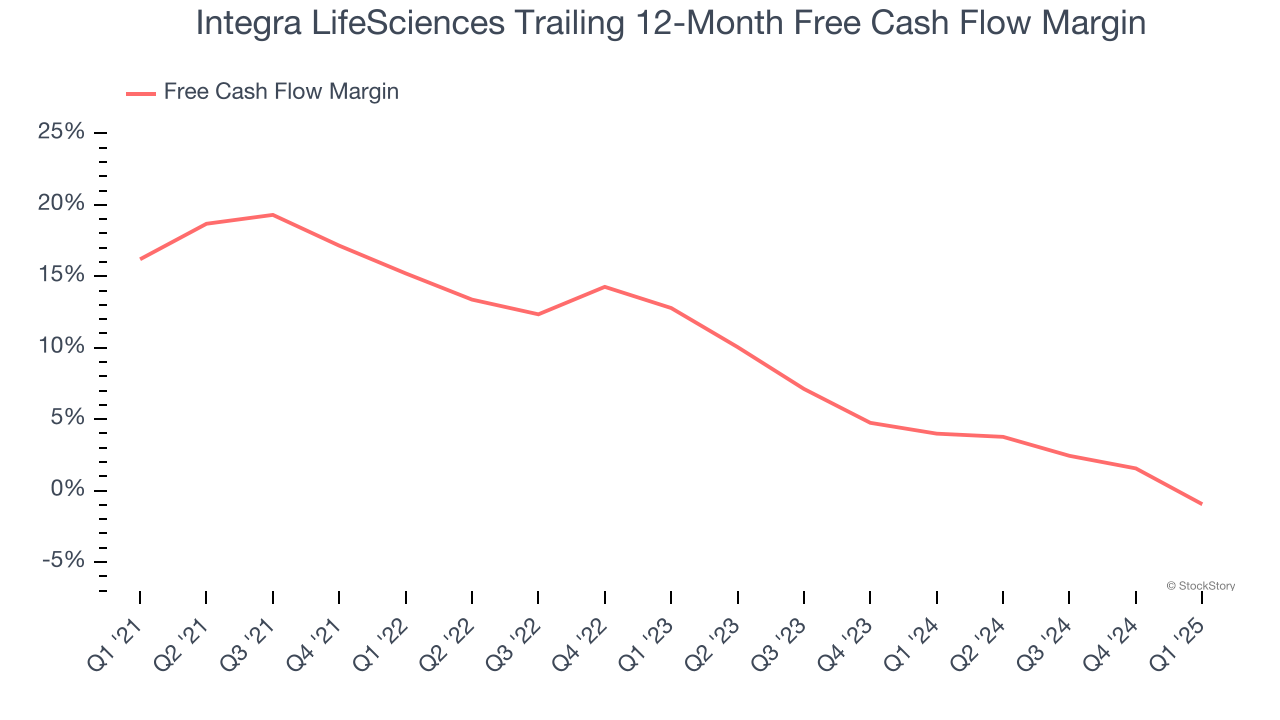

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Integra LifeSciences’s margin dropped by 17.1 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Integra LifeSciences’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

We see the value of companies helping consumers, but in the case of Integra LifeSciences, we’re out. After the recent drawdown, the stock trades at 5.1× forward P/E (or $13.10 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Integra LifeSciences

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.