Department store chain Macy’s (NYSE: M) announced better-than-expected revenue in Q1 CY2025, but sales fell by 4.1% year on year to $4.79 billion. The company’s full-year revenue guidance of $21.2 billion at the midpoint came in 0.8% above analysts’ estimates. Its non-GAAP profit of $0.16 per share was in line with analysts’ consensus estimates.

Is now the time to buy Macy's? Find out by accessing our full research report, it’s free.

Macy's (M) Q1 CY2025 Highlights:

- Revenue: $4.79 billion vs analyst estimates of $4.63 billion (4.1% year-on-year decline, 3.6% beat)

- Adjusted EPS: $0.16 vs analyst estimates of $0.15 (in line)

- The company reconfirmed its revenue guidance for the full year of $21.2 billion at the midpoint

- Management lowered its full-year Adjusted EPS guidance to $1.80 at the midpoint, a 16.3% decrease

- Operating Margin: 2%, in line with the same quarter last year

- Free Cash Flow was -$241 million compared to -$100 million in the same quarter last year

- Same-Store Sales fell 1.2% year on year, in line with the same quarter last year

- Market Capitalization: $3.35 billion

“We continued to execute against our Bold New Chapter strategy during the quarter, scaling key initiatives that improved our customer experience and contributed to stronger than expected performance across all three of our nameplates,” said Tony Spring, chairman and chief executive officer of Macy’s,

Company Overview

With a storied history that began with its 1858 founding, Macy’s (NYSE: M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $22.8 billion in revenue over the past 12 months, Macy's is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To accelerate sales, Macy's likely needs to optimize its pricing or lean into international expansion.

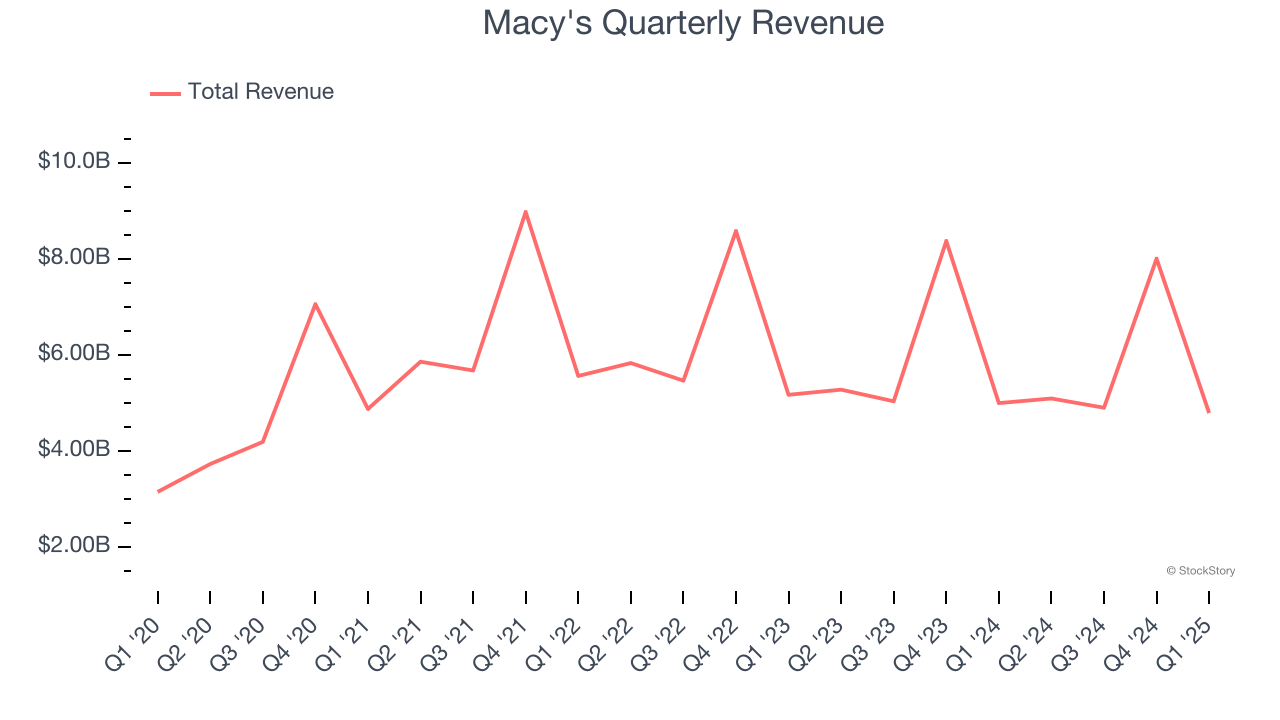

As you can see below, Macy’s revenue declined by 2% per year over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores and observed lower sales at existing, established locations.

This quarter, Macy’s revenue fell by 4.1% year on year to $4.79 billion but beat Wall Street’s estimates by 3.6%.

Looking ahead, sell-side analysts expect revenue to decline by 5.4% over the next 12 months, a deceleration versus the last six years. This projection doesn't excite us and suggests its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

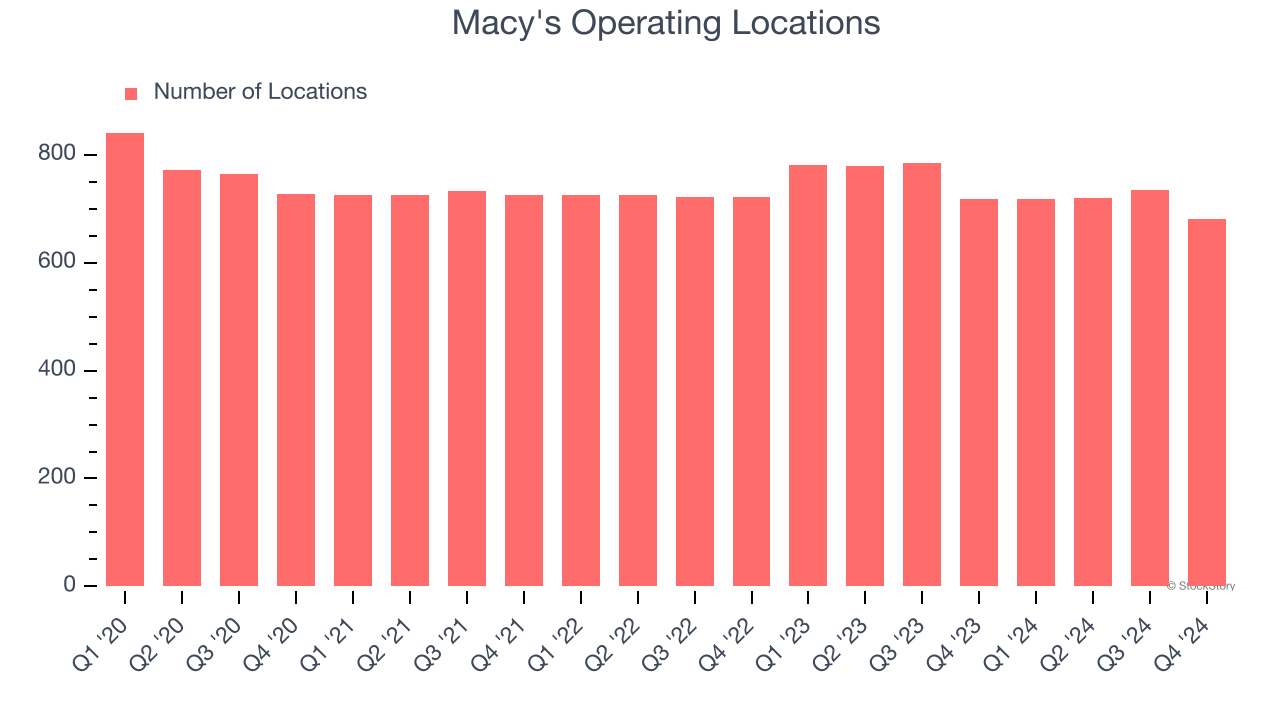

A retailer’s store count often determines how much revenue it can generate.

Macy's has generally closed its stores over the last two years, averaging 1.7% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Note that Macy's reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

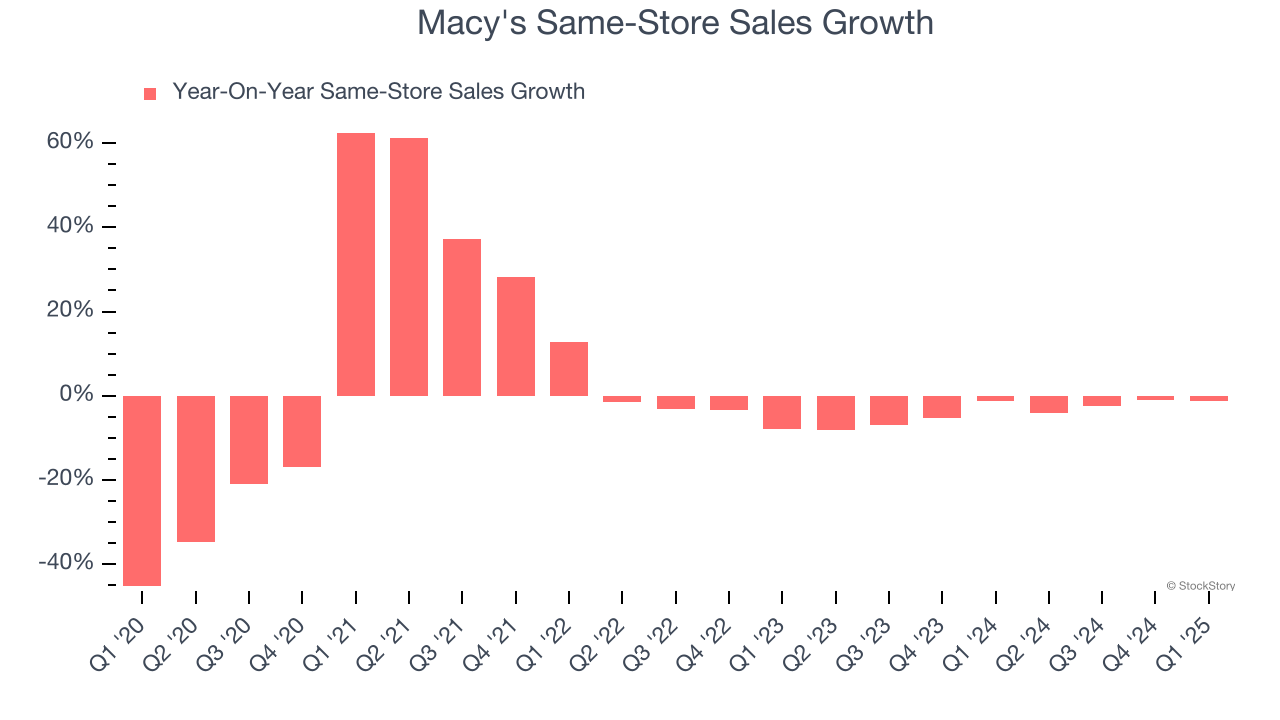

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Macy’s demand has been shrinking over the last two years as its same-store sales have averaged 3.8% annual declines. This performance isn’t ideal, and Macy's is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Macy’s same-store sales fell by 1.2% year on year. This decrease was an improvement from its historical levels. It’s always great to see a business’s demand trends improve.

Key Takeaways from Macy’s Q1 Results

We liked that Macy's beat analysts’ revenue and gross margin expectations this quarter. On the other hand, its full-year EPS guidance was lowered and missed. The company cited "initial and current tariffs; some moderation in consumer discretionary spending; and a heightened competitive promotional landscape" as reasons for the guidance cut. Overall, this was a mixed print. The stock traded up 1.5% to $12.27 immediately after reporting.

Indeed, Macy's had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.