Over the past six months, Illinois Tool Works’s shares (currently trading at $246.98) have posted a disappointing 11% loss while the S&P 500 was down 2.5%. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Illinois Tool Works, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Illinois Tool Works Not Exciting?

Even though the stock has become cheaper, we're swiping left on Illinois Tool Works for now. Here are three reasons why you should be careful with ITW and a stock we'd rather own.

1. Core Business Falling Behind as Demand Plateaus

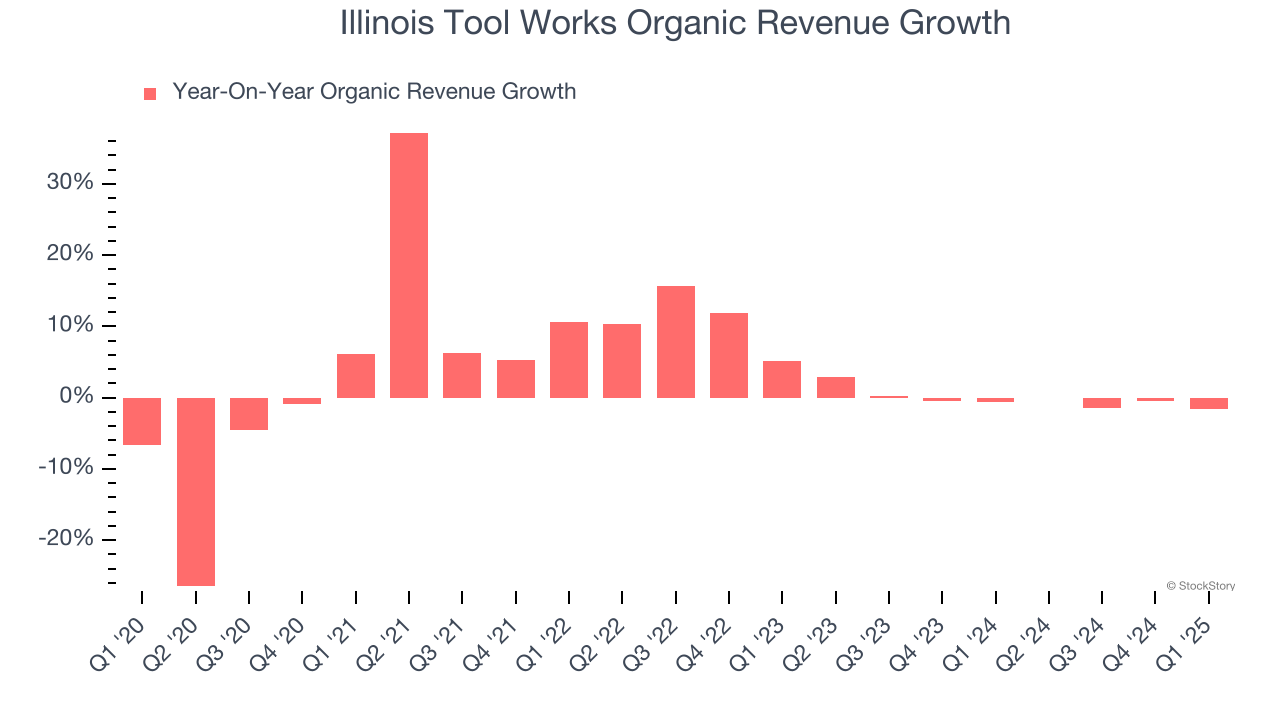

Investors interested in General Industrial Machinery companies should track organic revenue in addition to reported revenue. This metric gives visibility into Illinois Tool Works’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Illinois Tool Works failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Illinois Tool Works might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Illinois Tool Works’s revenue to rise by 1.3%. While this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

3. Free Cash Flow Margin Dropping

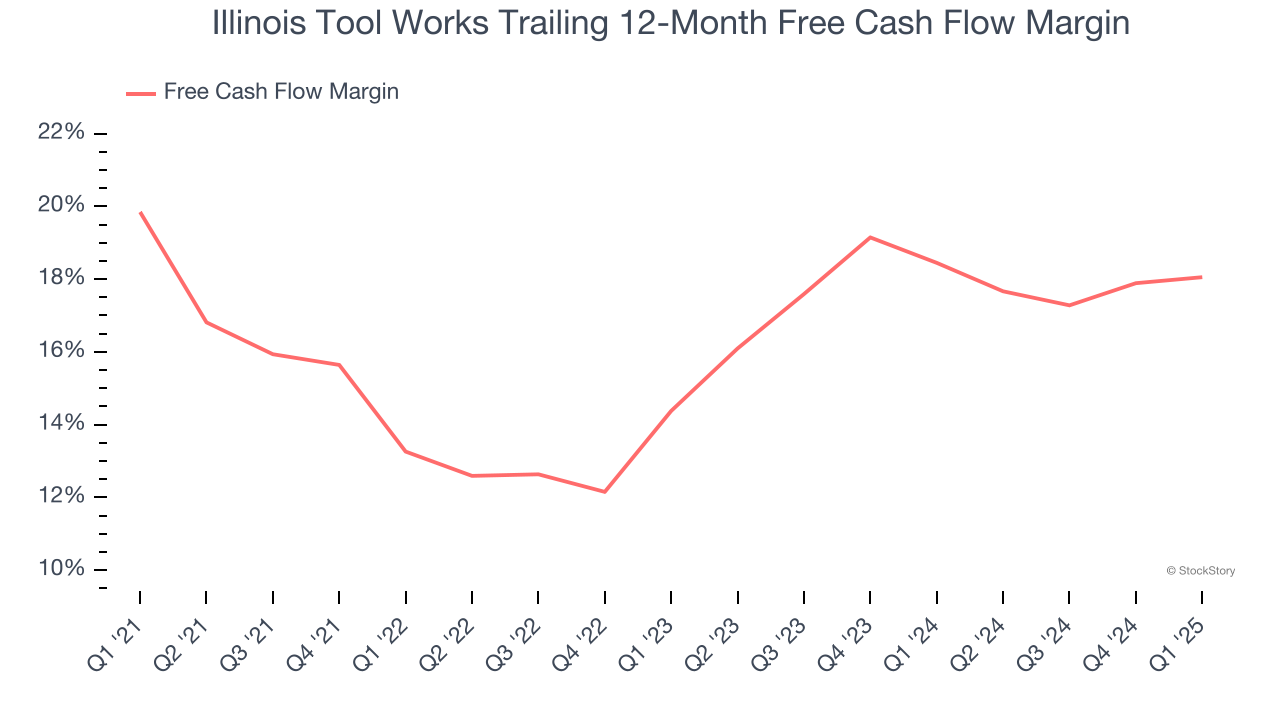

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Illinois Tool Works’s margin dropped by 1.8 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Illinois Tool Works’s free cash flow margin for the trailing 12 months was 18.1%.

Final Judgment

Illinois Tool Works isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 23.3× forward P/E (or $246.98 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Illinois Tool Works

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.