Angi has been treading water for the past six months, recording a small return of 1.5% while holding steady at $16.74.

Is now the time to buy Angi, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Angi Not Exciting?

We don't have much confidence in Angi. Here are three reasons why we avoid ANGI and a stock we'd rather own.

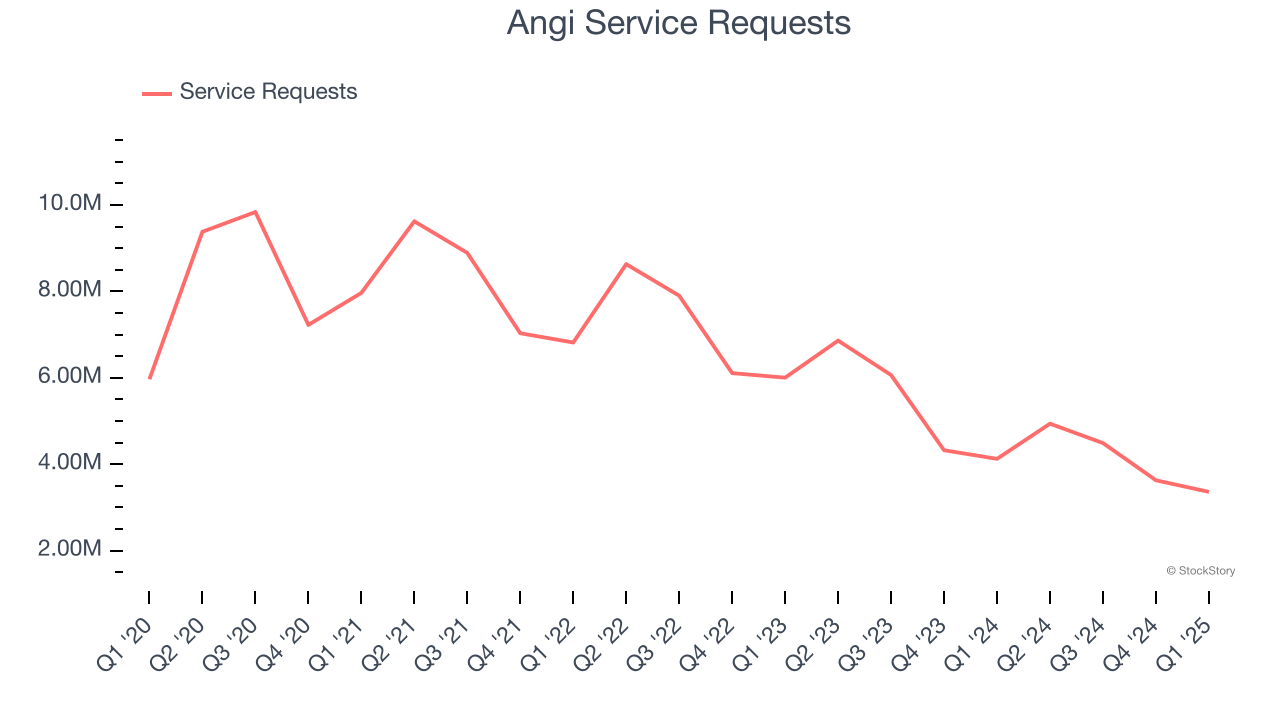

1. Declining Service Requests Reflect Product Weakness

As a gig economy marketplace, Angi generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Angi struggled with new customer acquisition over the last two years as its service requests have declined by 24.1% annually to 3.36 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Angi wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Angi’s revenue to drop by 9.7%. it’s hard to get excited about a company that is struggling with demand.

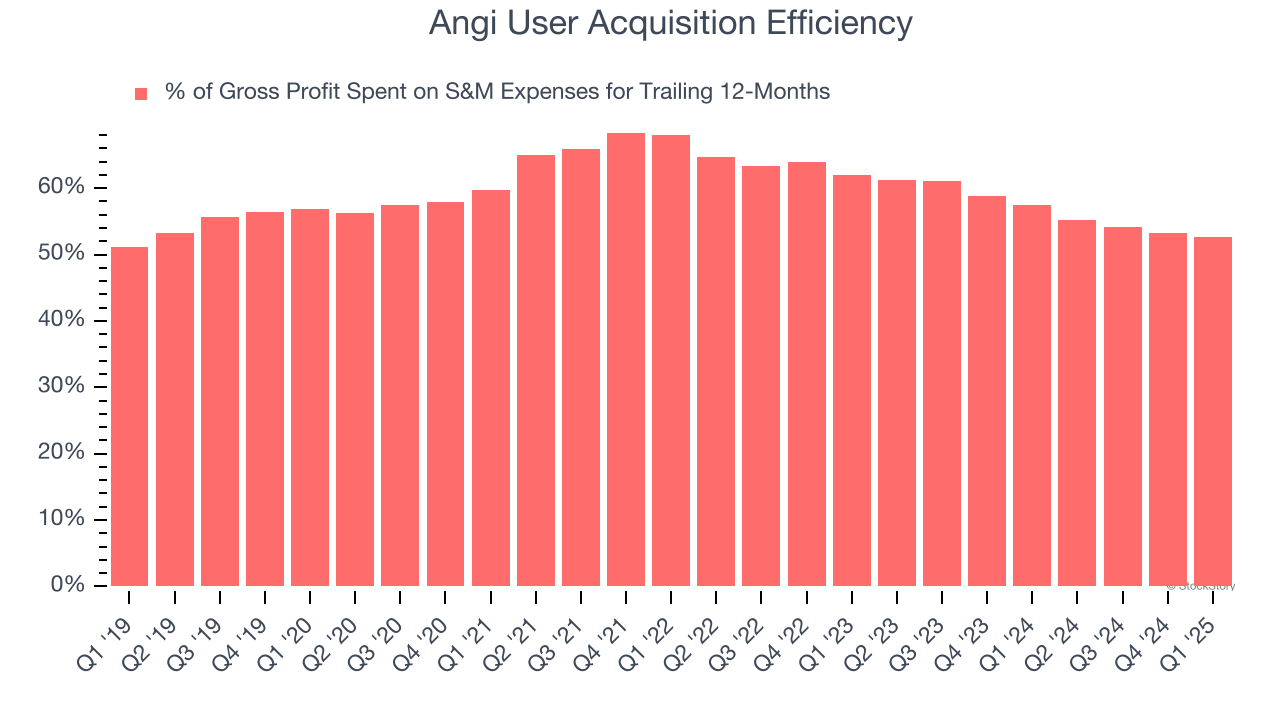

3. Poor Marketing Efficiency Drains Profits

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Angi grow from a combination of product virality, paid advertisement, and incentives.

It’s expensive for Angi to acquire new users as the company has spent 52.6% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that Angi’s product offering can be easily replicated and that it must continue investing to maintain an acceptable growth trajectory.

Final Judgment

Angi isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 5.6× forward EV/EBITDA (or $16.74 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. Let us point you toward one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.