Big reversal.

Big reversal.

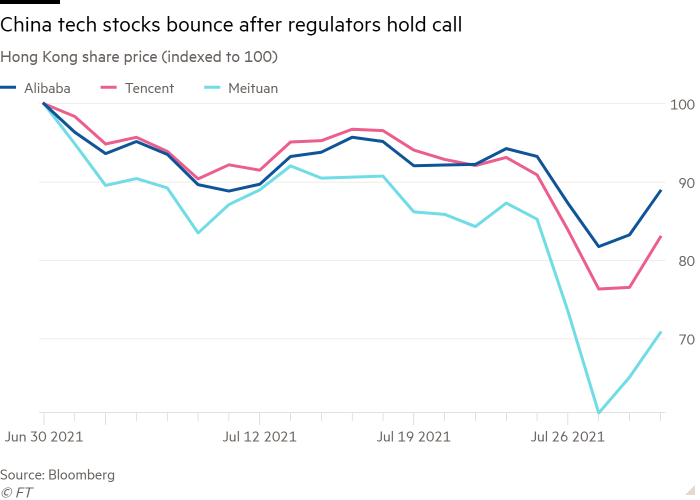

Regulators in Beijing held a call with executives from global investors, Wall Street banks and Chinese financial groups last night, according to the Financial Times. The call sought to reassure the groups after China issued an effective ban on the country’s $100Bn private tutoring industry at the weekend, which led to concerns of a broader regulatory crackdown on Chinese tech companies listed abroad.

During the call, CSRC vice-chair, Fang Xinghai, told the international groups China was committed to allowing companies to access capital markets and that the action on education technology businesses was an isolated situation. The ChiNext Index bounced 5% overnight with the CSI up 2%.

While it's very dangerous to take China at it's word, I'm liking DIDI, who have fallen below their IPO price of $14 to $8.87, which is a $10.5Bn market cap for a company with $30Bn in quickly growing sales (no profits so far but manageable losses). They are likely to be up 20% at the open, though. Amazon owns a piece of them and I think they are worth a toss down here so let's add them to our Future Is Now Portfolio as such (I'm estimating the opening prices):

- Sell 20 DIDI Feb $10 puts forr $2.50 ($5,000)

- Buy 50 DIDI Feb $10 calls for $3 ($15,000)

- Sell 50 DIDI Feb $15 calls for $2 ($10,000)

That's a net $0 cost on the $25,000 spread and our only obligation is owning 2,000 shares of DIDI for $10 so, as long as we REALLY want to invest in DIDI over the long-haul, the risk of assignment should not bother us. The upside potential is a clean $25,000 if they get back to $15 and, of course, we intend to roll the Feb $10 calls out to longer strikes when they are published.

There's an incorrect rumor in the Wall Street Journal that says "Didi Weighs Going Private to Placate China, Investors," that is not true and makes no stratgic sense and shame on the WSJ for publishing fake news. …