Finally they are catching up . Just 3 weeks after we moved our Member Portfolios to mostly CASH!!! positions, Investment Banks Morgan Stanley, Citigroup Inc. and Credit Suisse Group AG are cautioning investors about the U.S. equity outlook. Morgan Stanley slashed U.S. equities to underweight and global stocks to equal-weight on Tuesday , citing “outsized risk” to growth through October. Rising cases of the delta virus strain, and tension between elevated inflation expectations and low yields are at play during a time “ that has historically poor seasonality ,” strategists wrote in a note . Citigroup said any minor correction is at risk of being amplified given the extent of bullish positions. And on Wednesday, Credit Suisse said it maintains a small underweight on U.S. equities due to reasons such as extreme valuations and regulatory risk. Indeed the gap between US Equity Performance and Global Equity Performance has recently hit 5% – a very extreme level. Morgan Stanley says they prefer Japan to the US but Business Sentiment in Japan fell 28% last month , from 48.4 to 34.7 and 50 is the line for optimism over there. The sharpest deterioration in a year and a half sent the gauge back to its lowest point since January when Tokyo returned to a state of emergency. The surge in virus cases that sent sentiment careening also drove Prime Minister Yoshihide Suga to announce his resignation last week. The country’s next leader is likely to call for a new stimulus package to shore up the recovery, plunging the nation even deeper into their record-setting debt. And that's a country Morgan Stanley would rather invest in than America! Sentiment fell in all 10 major Japanese regions tracked by the survey. The mood among bar and restaurant operators, which have endured government calls for shortened hours and a stoppage to alcohol sales, fell the most among sectors. The report cited a real estate agency in the Osaka area as saying it was dealing with an endless stream of businesses, from big to small, that were canceling leases. …

![Buy! BUY! Sell! SELL! [pic]: investing](http://cdn.shopify.com/s/files/1/0060/6102/products/book_buy_sell_sell_new.jpg?1293888719) Finally they are catching up.

Finally they are catching up.

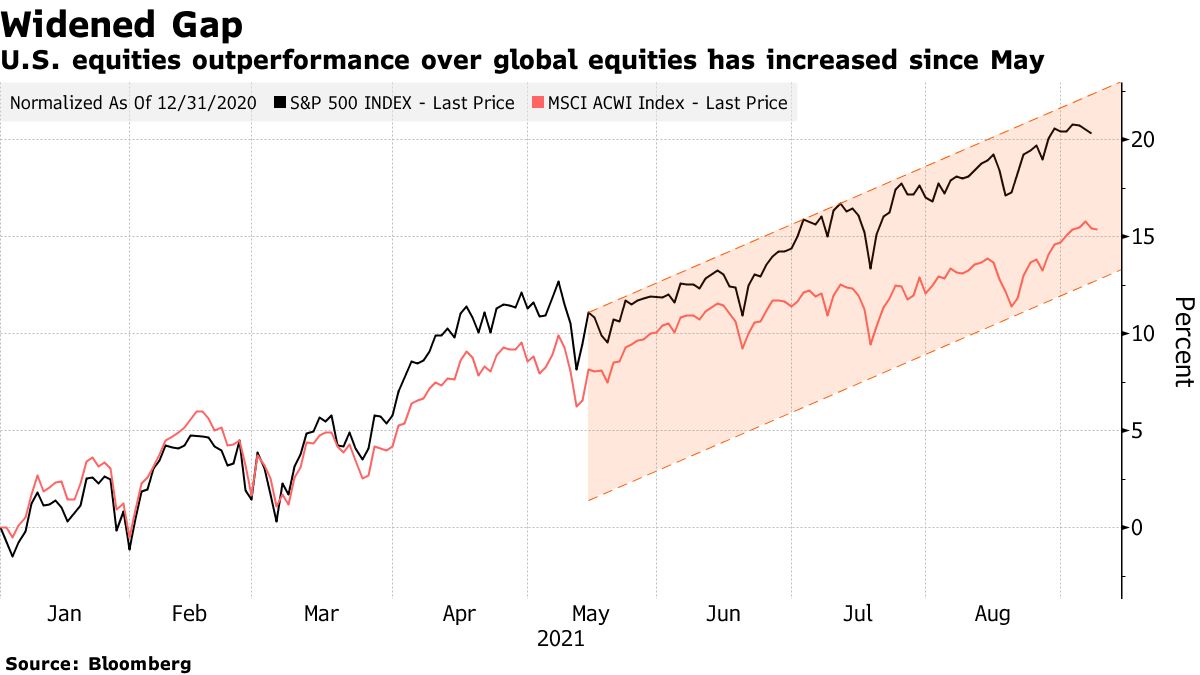

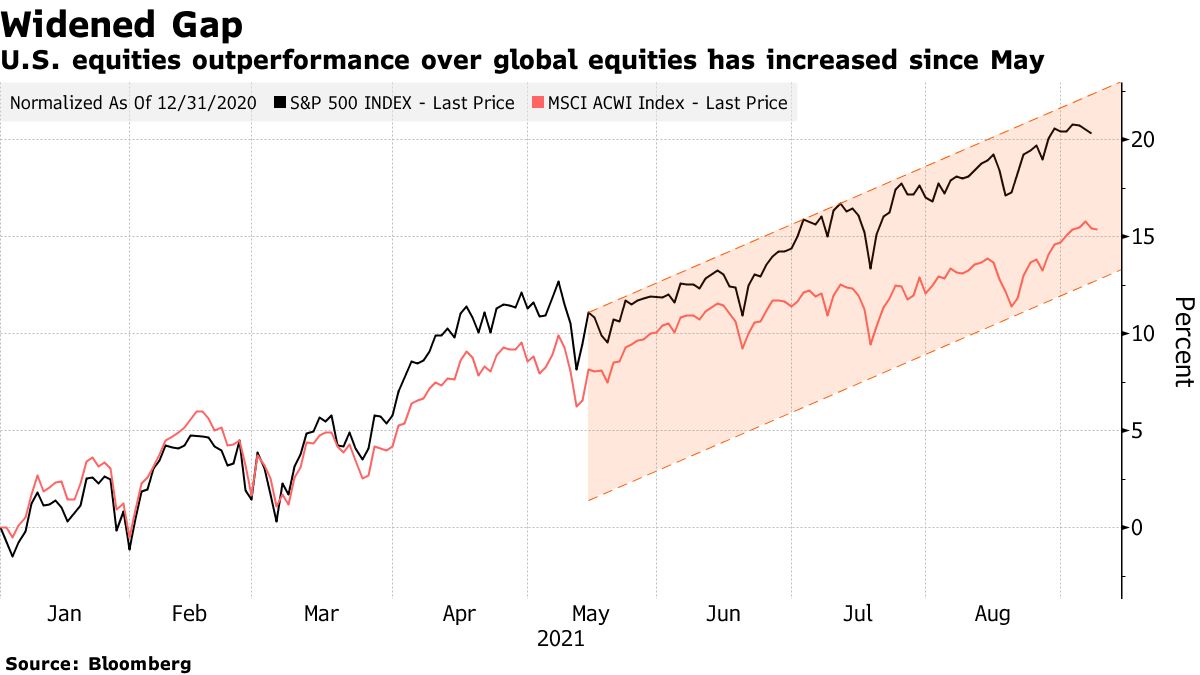

Just 3 weeks after we moved our Member Portfolios to mostly CASH!!! positions, Investment Banks Morgan Stanley, Citigroup Inc. and Credit Suisse Group AG are cautioning investors about the U.S. equity outlook. Morgan Stanley slashed U.S. equities to underweight and global stocks to equal-weight on Tuesday, citing “outsized risk” to growth through October. Rising cases of the delta virus strain, and tension between elevated inflation expectations and low yields are at play during a time “that has historically poor seasonality,” strategists wrote in a note.

Citigroup said any minor correction is at risk of being amplified given the extent of bullish positions. And on Wednesday, Credit Suisse said it maintains a small underweight on U.S. equities due to reasons such as extreme valuations and regulatory risk. Indeed the gap between US Equity Performance and Global Equity Performance has recently hit 5% – a very extreme level.

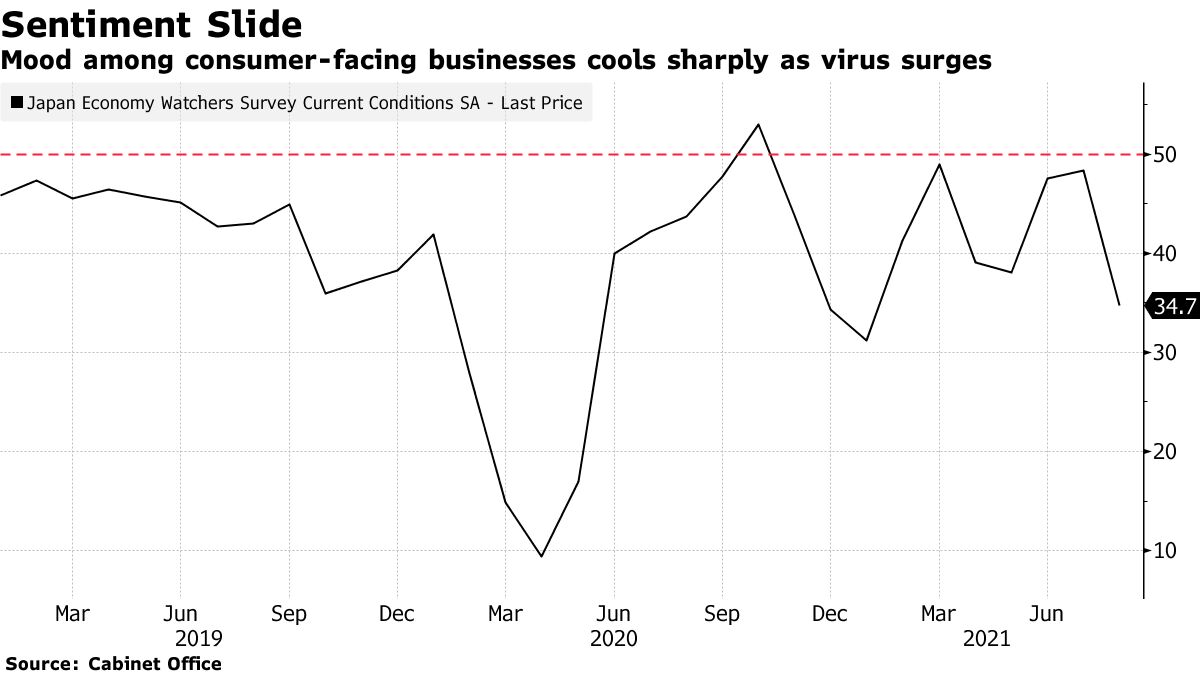

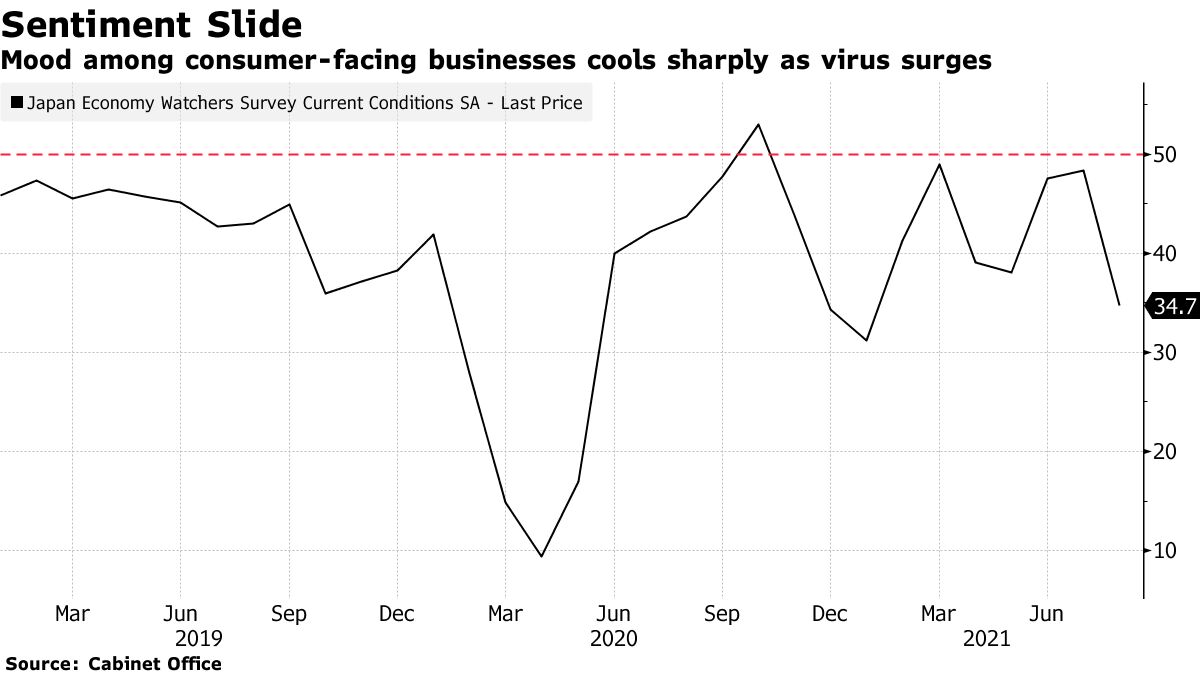

Morgan Stanley says they prefer Japan to the US but Business Sentiment in Japan fell 28% last month, from 48.4 to 34.7 and 50 is the line for optimism over there. The sharpest deterioration in a year and a half sent the gauge back to its lowest point since January when Tokyo returned to a state of emergency. The surge in virus cases that sent sentiment careening also drove Prime Minister Yoshihide Suga to announce his resignation last week. The country’s next leader is likely to call for a new stimulus package to shore up the recovery, plunging the nation even deeper into their record-setting debt.

And that's a country Morgan Stanley would rather invest in than America!

Sentiment fell in all 10 major Japanese regions tracked by the survey. The mood among bar and restaurant operators, which have endured government calls for shortened hours and a stoppage to alcohol sales, fell the most among sectors. The report cited a real estate agency in the Osaka area as saying it was dealing with an endless stream of businesses, from big to small, that were canceling leases.

…

![Buy! BUY! Sell! SELL! [pic]: investing](http://cdn.shopify.com/s/files/1/0060/6102/products/book_buy_sell_sell_new.jpg?1293888719) Finally they are catching up.

Finally they are catching up.