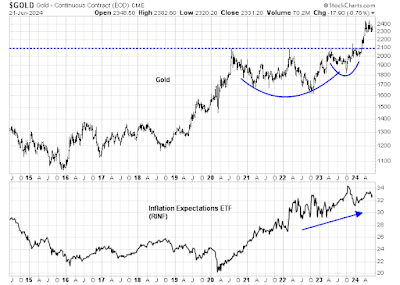

I am reiterating my bullish outlook on gold. The yellow metal staged an upside breakout from a cup and handle pattern in March. As well, the long-term inflation expectations of ETF (RINF) has been in a steady uptrend. The only question is how far and how fast can gold run?

The future may be bright as gold prices respond to unexpected inflation. The non-partisan Congressional Budget Office (CBO) recently updated its projection of the U.S. fiscal path by raising its FY 2024 estimate of the deficit from $1.5 trillion to $1.9 trillion, driven by emergency spending on foreign assistance to Israel, Ukraine and Taiwan, as well as student loan relief. The long-term picture also deteriorated, the deficit rises to $2.8 trillion by 2034 and debt is expected to grow to 122% of GDP by 2034.

For investors, much of its intermediate-term outlook depends on the outcome of the U.S. November elections and the trajectory of White House policies.The full post can be found here.