United States Brent Oil Fund, LP ETV (NY: BNO )

31.36

+0.14

(+0.45%)

Streaming Delayed Price

Updated: 10:16 AM EST, Feb 20, 2025

Add to My Watchlist

All News about United States Brent Oil Fund, LP ETV

Elliott Wave Analysis: Dollar Testing Key Resisance Area

February 06, 2024

Via Talk Markets

Bonds, Bullion, Banks, & Bitcoin Battered As "Good News Is Bad News" Again After Powell

February 05, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

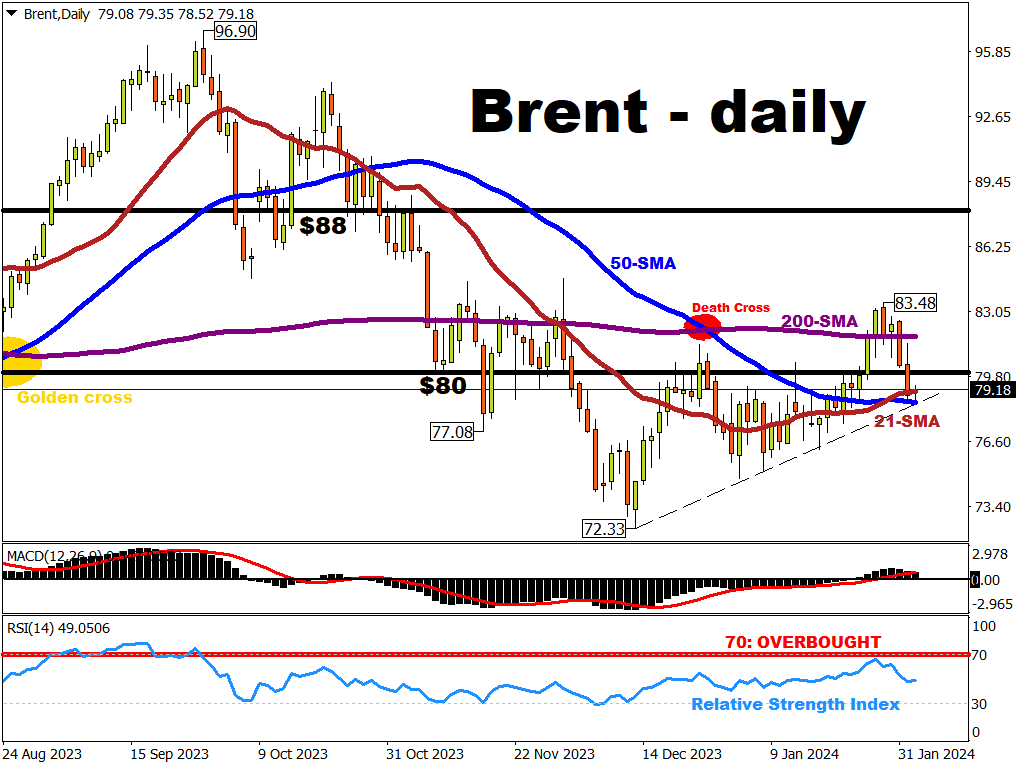

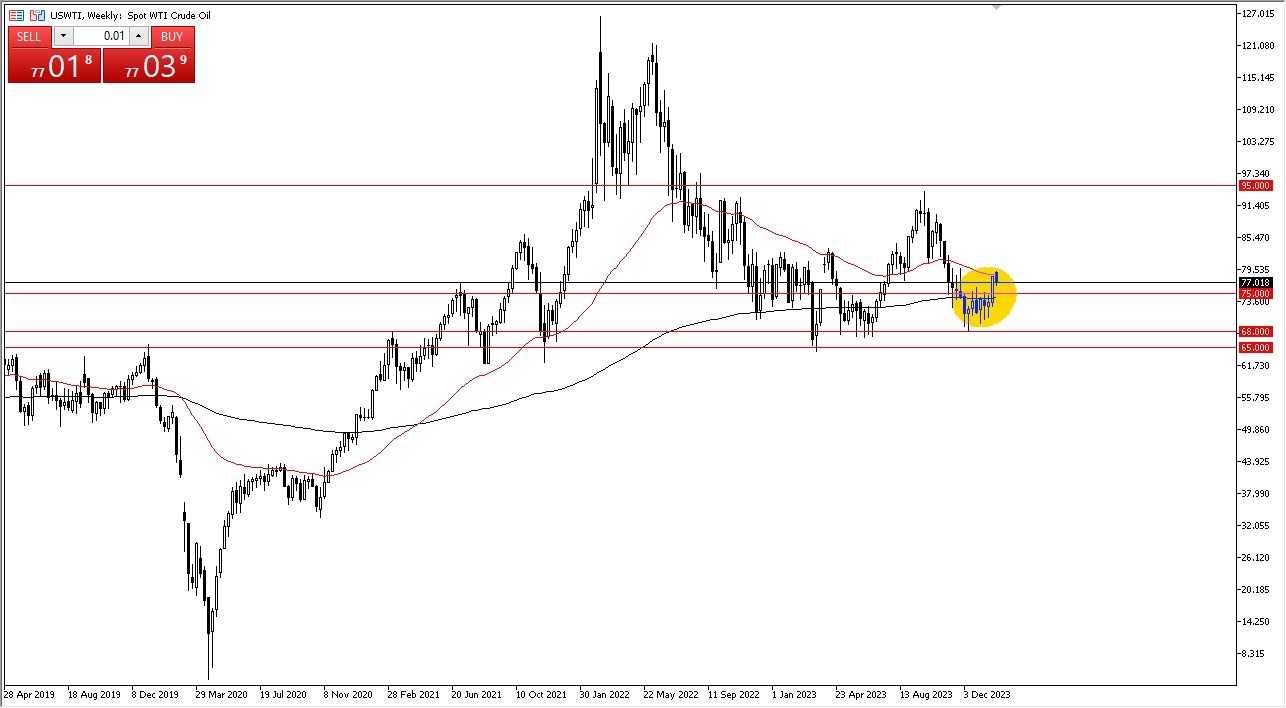

Here’s Why Brent Crude Oil Price Is Plunging Amid Geopolitical Risks

February 04, 2024

Via Talk Markets

Exposures

Fossil Fuels

S&P 500 Surges Spearheaded By A Big Tech Revival

February 01, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

The Commodities Feed: Fed Comments Weigh On The Complex

February 01, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

The Energy Report: Squeeze City

January 30, 2024

Via Talk Markets

Topics

Energy

Exposures

Fossil Fuels

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.