iShares MSCI Canada Index Fund (NY:EWC)

All News about iShares MSCI Canada Index Fund

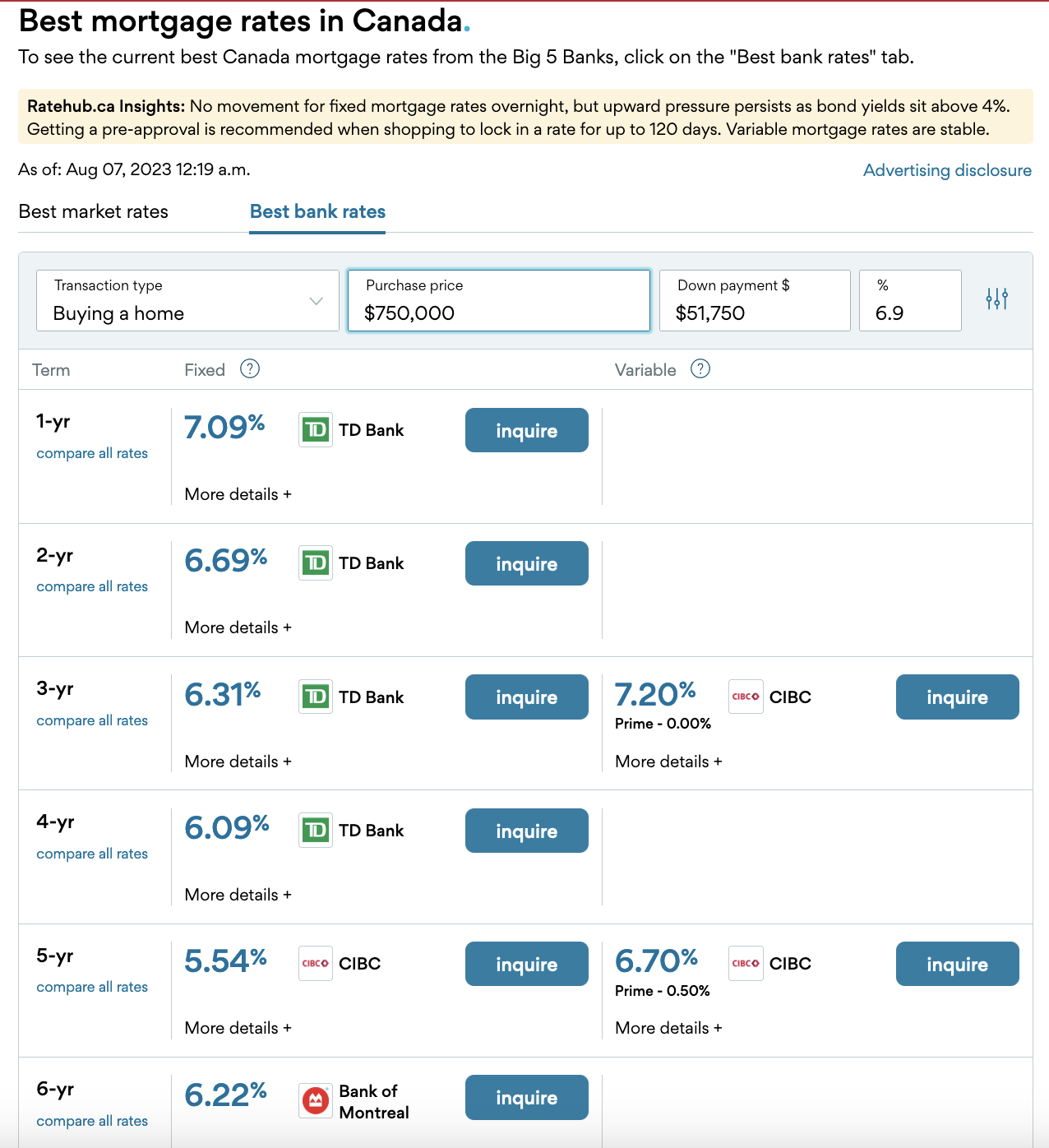

Unaffordable Prices Cure Unaffordable Prices

August 30, 2023

Via Talk Markets

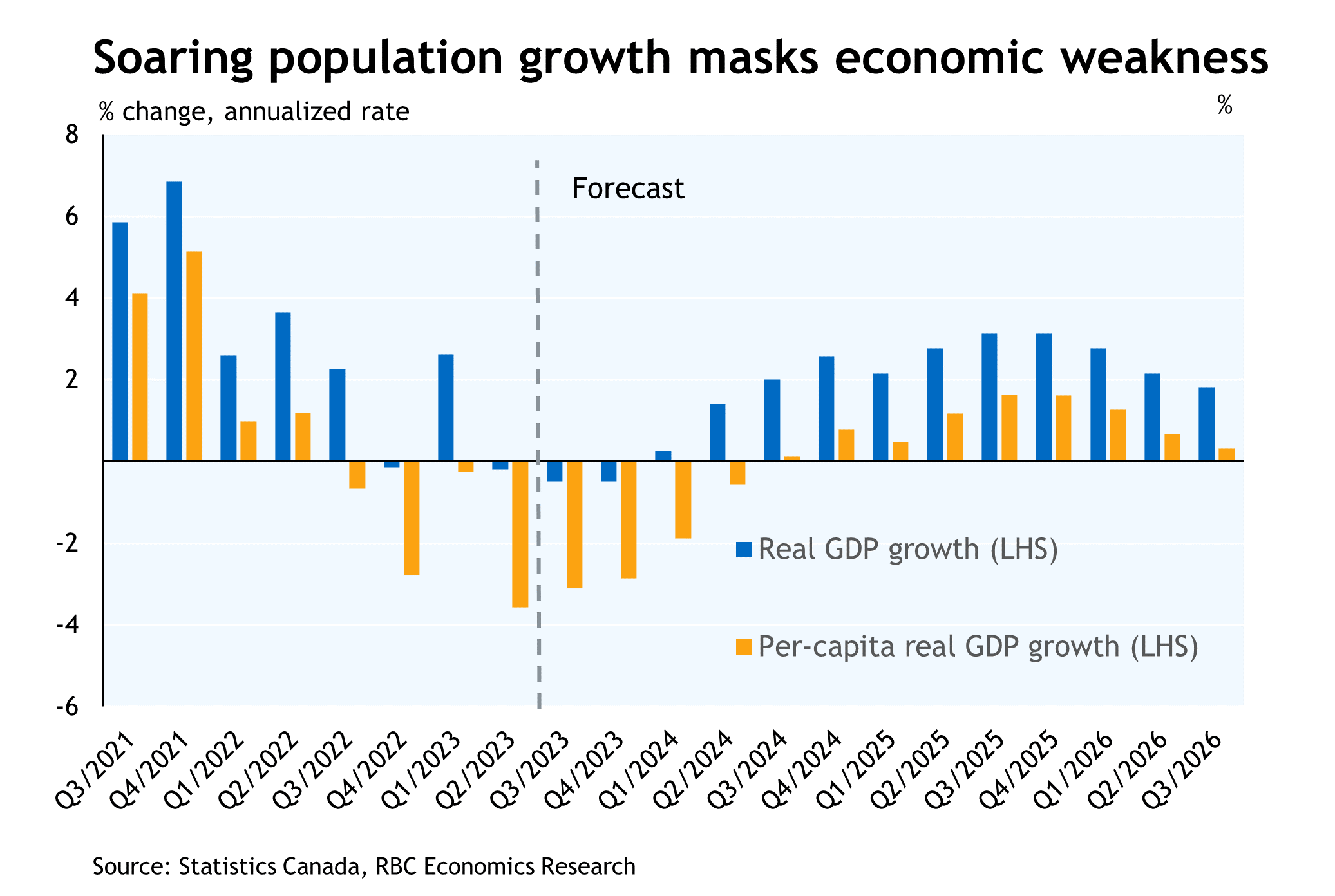

Waiting For The Anticipated Recession Is Very Tiresome

August 21, 2023

Via Talk Markets

Topics

Economy

Exposures

Economy

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.