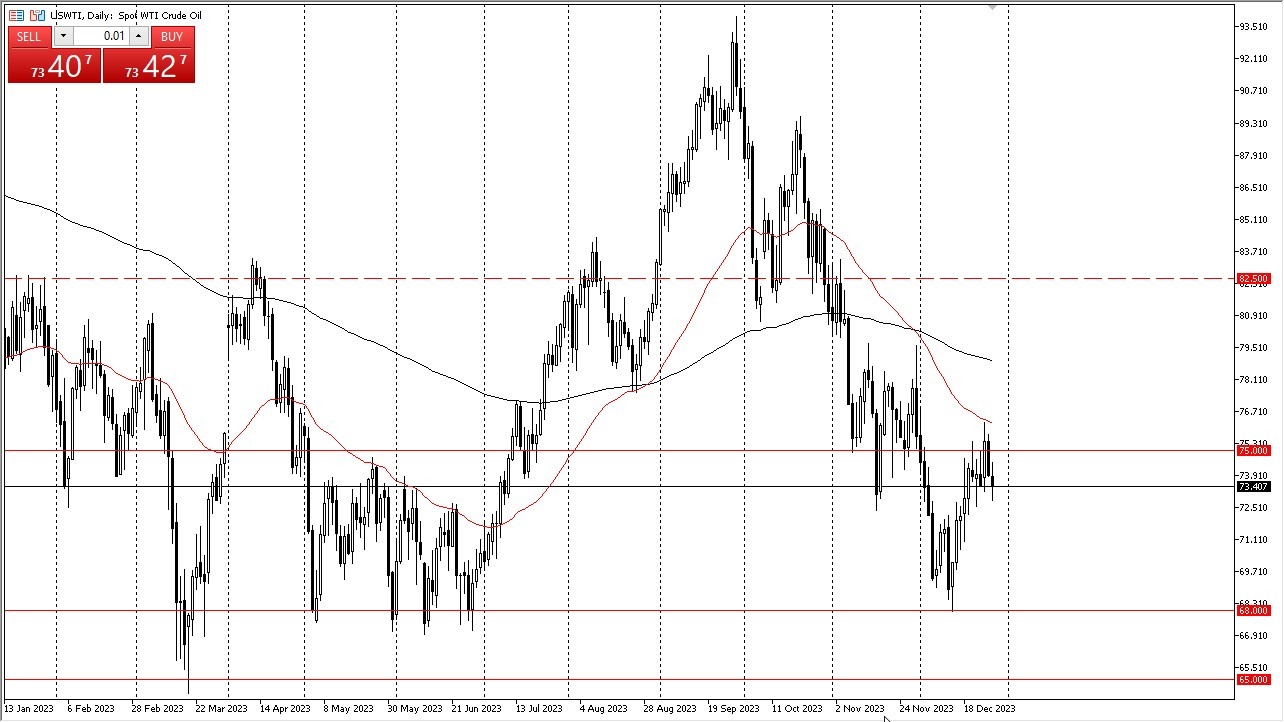

WT Offshore (NY:WTI)

All News about WT Offshore

The Energy Report: Oil New Year

December 29, 2023

Via Talk Markets

-638412576829226962.png)

Via Talk Markets

The Commodities Feed: US Natural Gas Prices Spike Higher

January 14, 2024

Via Talk Markets

Topics

Energy

Via Talk Markets

Via Talk Markets

WTI Rebounds Above $74.00, Focus On Red Sea Developments

December 28, 2023

Via Talk Markets

Topics

Economy

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.