iShares TIPS Bond ETF (NY:TIP)

Headline News about iShares TIPS Bond ETF

Via Talk Markets

Topics

ETFs

Via Talk Markets

Topics

Economy

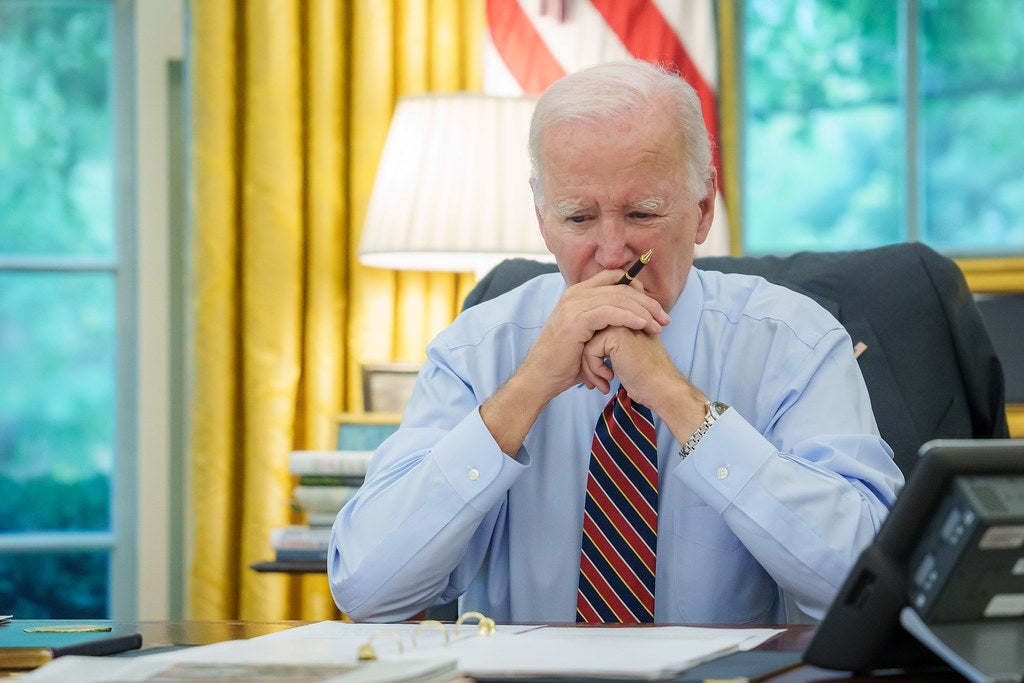

El-Erian Thinks Biden's Economic Woes Could Be Self-Inflicted As Trump Gains Ground In Voter Confidence

February 12, 2024

Via Benzinga

Topics

Government

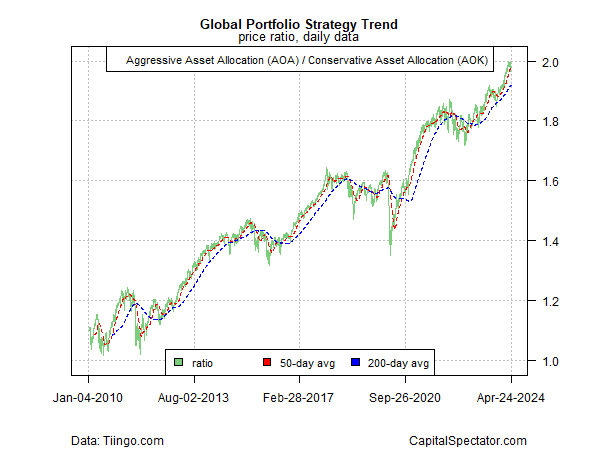

Oil Is Sending A Warning Message To The Stock Market

November 18, 2023

Via Talk Markets

Topics

Bonds

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.