Chevron Corp (CVX) reported a 52% YoY gain in Q3 adjusted free cash flow (FCF), and a 14% adjusted FCF margin. That more than covered its dividend and buybacks. This implies that if Chevron raises its dividend by 5%, CVX stock may be worth $177.49 per share, based on its average yield.

That represents a potential 14% gain over today's price of $155.72. However, CVX is still well off its recent peak of $161.82 on Sept. 2, but up from a recent low of $148.90 on Oct. 10.

Chevron released its Q3 results before the market opened on Oct. 31. So, the market has already had a day to react to Chevron's results.

This presents a good opportunity for value investors to buy in at a value price, especially using out-of-the-money (OTM) short-put plays. This article will explain how to do this.

Strong FCF Results

Chevron's Q3 adj. FCF was $7 billion, up +42.9% from $4.9 billion in Q2 and +52% from $4.6 billion a year ago. Moreover, year-to-date its 9-month adj. FCF was $16 billion, up +23% from the 9-month results last year.

This was even though last year, oil prices were $10 higher during the same period, according to the company. Chevron's production increased due to its acquisition of Hess, which closed last quarter. It also benefited from higher productivity and output at its Permian and other oil and gas assets.

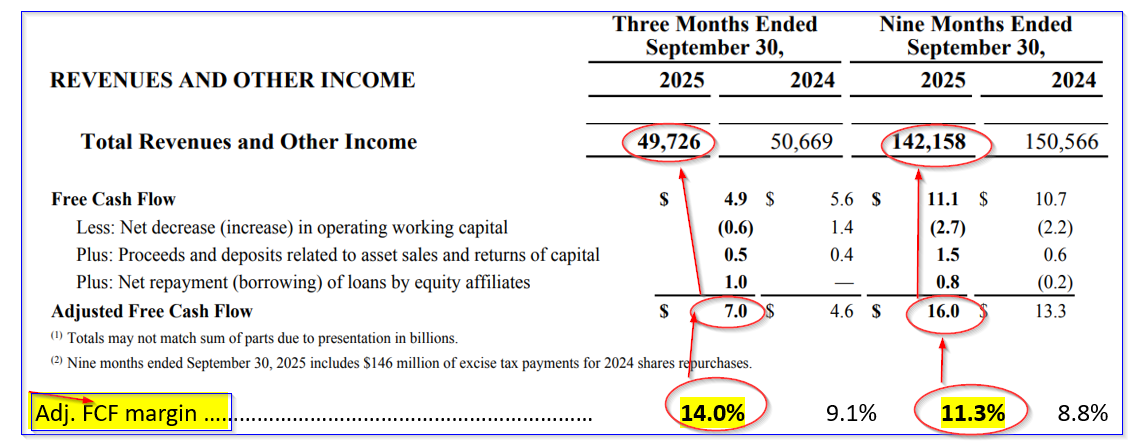

Its adj. FCF can be seen in the table on page 9 of its earnings release below:

This shows that the adj. FCF margin on revenue was 14% in Q3, vs. 9.1% a year ago, and 11.3% for the 9 months.

That FCF generation was even better than the 10.3% adj. FCF margin last quarter, as I described in my last article ("Chevron's Q2 Free Cash Flow Rises - CVX Stock Looks Cheap").

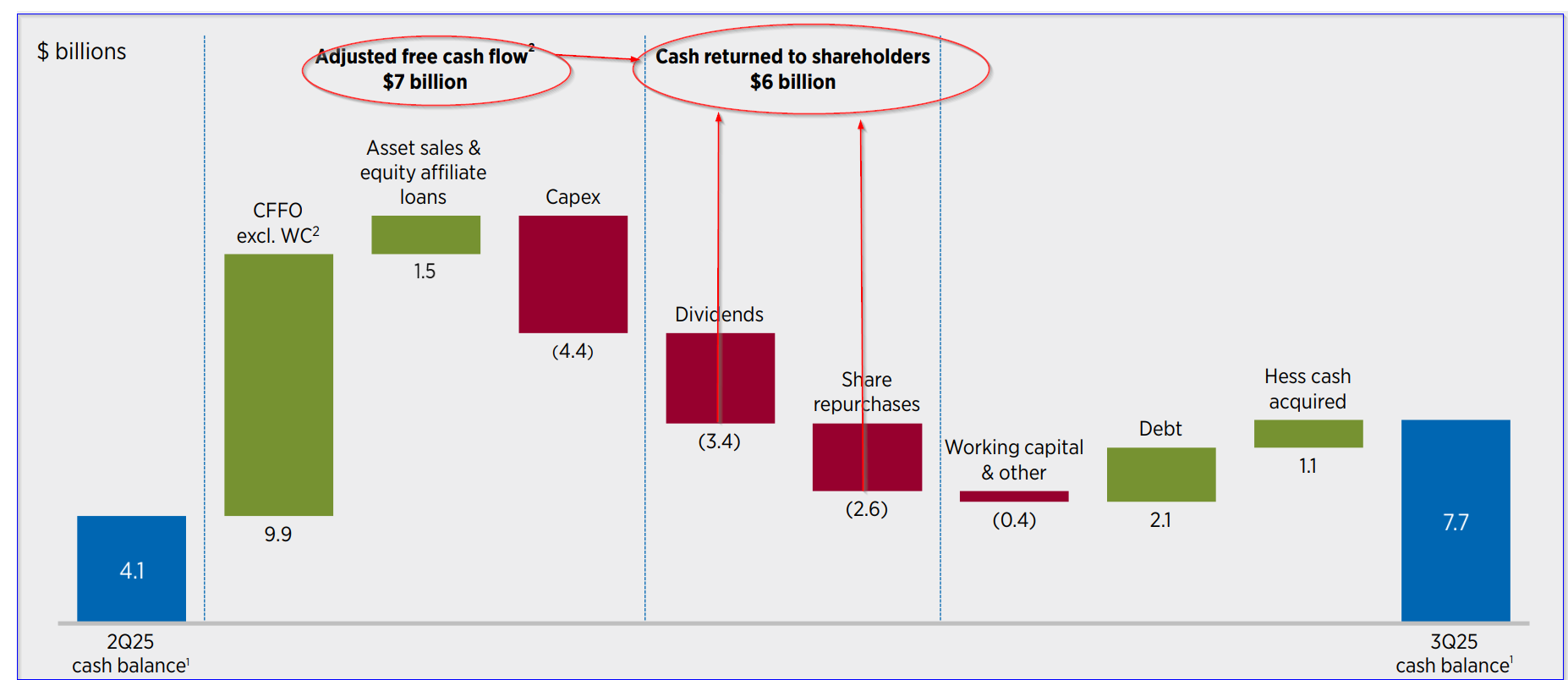

Moreover, Chevron's adj. FCF now more than covers its cash returned to shareholders (i.e., dividend and buyback purchases). This can be seen on page 7 of its Q3 deck:

It shows that the $7 billion in Q3 adj. FCF is greater than the $6 billion in dividends and buybacks during the quarter. However, YTD its dividends and buybacks have been $18.5 billion, lower than the $16.0 billion in YTD adj. FCF.

But based on our estimates, the company should be able to cover the shareholder payments going forward.

This augurs well for the company's valuation, especially if it can keep this high FCF margin.

FCF-Based Price Target

For example, analysts expect revenue next year to rise 2.6% to $191.52 billion from $186.67 billion this year. As a result, if Chevron can sustain an average 12.65% adj. FCF margin - i.e.,14% Q3 +11.3% YTD/2 - it could generate over $24 billion in adj. FCF:

0.1265 x $191.52 billion revenue 2026 = $24.2 billion adj. FCF in 2026

That would be 18.6% higher than the $20.4 billion it has generated in the last 12 months (i.e., $16 billion in adj. FCF YTD plus $4.4 billion in Q4 2024 FCF).

Moreover, this could lead to a higher stock market valuation based on its FCF yield metric.

For example, its trailing 12-month FCF of $20.4 billion represents a yield of 6.5% on its present market cap of $314 billion:

$20.4b / $314b = 0.065

As a result, using my forecast of $24.2 billion in 2026 FCF, the market could rise to $372 billion:

$24.2b / 0.065 = $372.3 billion market cap

This implies a rise of 18.57% over its present valuation. That means that CVX stock could be worth over $184 per share:

$155.72 x 1.1857 = $184.64 price target

Another way to value CVX stock is to use its average dividend yield.

Dividend Yield-Based Price Target

Right now, CVX has a dividend yield of 4.39%, based on its annual dividend per share (DPS) payments of $6.84 (i.e., $1.71 per quarter).

But Chevron has now made four quarterly payments at that rate. Given that it has a 37-year history of raising its dividends. That implies it could hike the dividend next quarter. This could push CVX stock higher, based on its average yield.

For example, Morningstar reports that the average dividend yield for CVX stock has been 4.9% over the last 5 years. In addition, Yahoo! Finance reports an average 5-year yield of 4.34%.

That implies an average yield of 4.215%.

So, if Chevron raises its annual DPS payment to $7.18, or 4.97% higher, comparable to last year's 4.9% increase from $6.52 to $6.84, CVX stock could rise to over $170 per share:

$7.17 DPS / 0.04215 = $170.34 price target

That would be 9.38% higher than today's price.

Summary of Price Targets

As a result, based on the two price targets, CVX stock could be worth

FCF-Yield Based Target: $184.64

Div Yield Based Target: $170.34

Average Price Target ….. $177.49

That is 14% higher than today's price of $155.72 per share.

Moreover, analysts agree with this valuation. For example, Yahoo! Finance reports that its survey of 27 analysts shows they have an average price target of $172.04. Similarly, Barchart's survey shows a mean target of $170.31 per share.

In addition, AnaChart, which covers more recent analysts' recommendations, shows an average price target of $191.07 from 16 analysts.

This results in an average survey price target is $177.81. That is very close to my target price of $177.49. In other words, there is good reason to believe CVX stock has 14% upside over the next year.

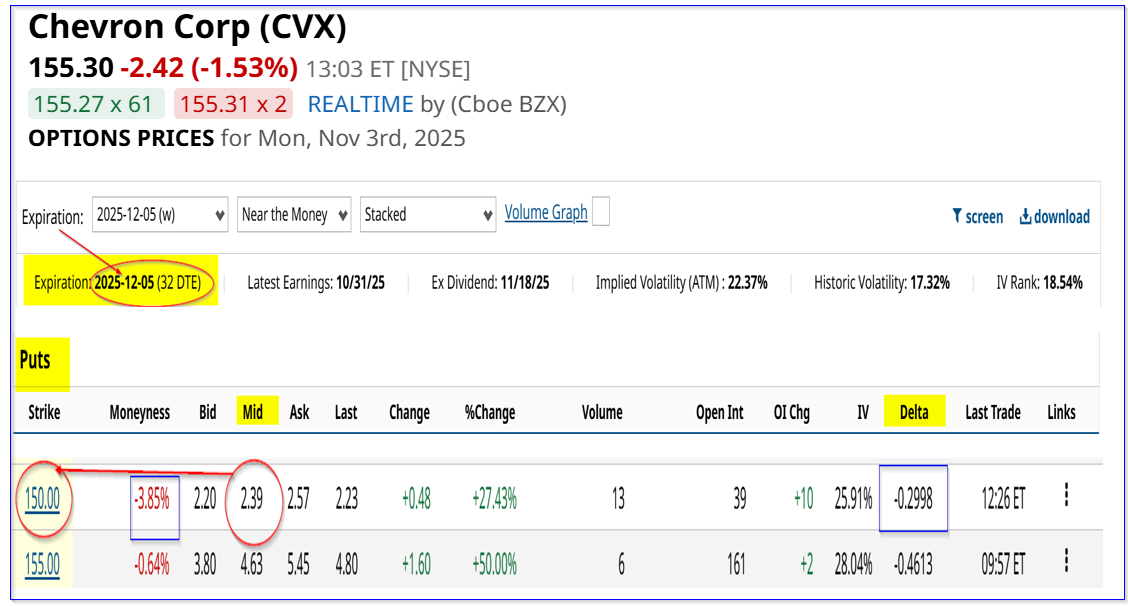

One way to play this is to set a potentially lower buy-in point by selling short cash-secured out-of-the-money put options.

Shorting OTM CVX Puts

For example, the Dec. 5, 2025, expiry period shows that the $150.00 strike price put has a midpoint premium of $2.39 per put contract.

That represents an immediate yield of 1.59% (i.e., $2.39/$150.00) for the investor who does a short-put play at this strike price, which is less than 4% below today's price.

This means that an investor who secures $15,000 with their brokerage firm can enter an order to “Sell to Open” 1 put contract at $150.00. The account will then receive $239.00.

As long as CVX stays over $150.00 on or before Dec. 5, the $15k collateral will not be assigned to buy 100 shares at $150.00

But even if that happens, the buy-in breakeven point is lower, since the investor keeps the income already received:

$150.00 - $2.39 = $147.61 breakeven

That is 5.2% below today's price, so it provides good downside protection and a lower buy-in.

Moreover, the upside, at $177.49, is higher than just owning shares of CVX:

$177.49 / $147.61 -1 = 0.202 = +20.2% upside

The bottom line is that this is a better way to set a lower buy-in. Even if the stock doesn't fall to $150.00, the investor can repeat this play each month and make more income, with another chance to buy in at a lower price each month.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart