Technology distribution company ScanSource (NASDAQ: SCSC) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 6.3% year on year to $704.8 million. The company’s full-year revenue guidance of $3 billion at the midpoint came in 3.5% below analysts’ estimates. Its non-GAAP profit of $0.86 per share was 11% above analysts’ consensus estimates.

Is now the time to buy ScanSource? Find out by accessing our full research report, it’s free.

ScanSource (SCSC) Q1 CY2025 Highlights:

- Revenue: $704.8 million vs analyst estimates of $777.9 million (6.3% year-on-year decline, 9.4% miss)

- Adjusted EPS: $0.86 vs analyst estimates of $0.78 (11% beat)

- Adjusted EBITDA: $33.55 million vs analyst estimates of $33.93 million (4.8% margin, 1.1% miss)

- The company dropped its revenue guidance for the full year to $3 billion at the midpoint from $3.3 billion, a 9.1% decrease

- EBITDA guidance for the full year is $142.5 million at the midpoint, above analyst estimates of $138.5 million

- Operating Margin: 3.2%, in line with the same quarter last year

- Free Cash Flow Margin: 9.2%, down from 21% in the same quarter last year

- Market Capitalization: $847.5 million

“Our business performed well this quarter with both segments achieving year-over-year gross profit growth and higher EBITDA margins,” said Mike Baur, Chair and CEO of ScanSource,

Company Overview

Operating as a crucial link in the technology supply chain since 1992, ScanSource (NASDAQ: SCSC) is a hybrid distributor that connects hardware, software, and cloud services from technology suppliers to resellers and business customers.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $2.97 billion in revenue over the past 12 months, ScanSource is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

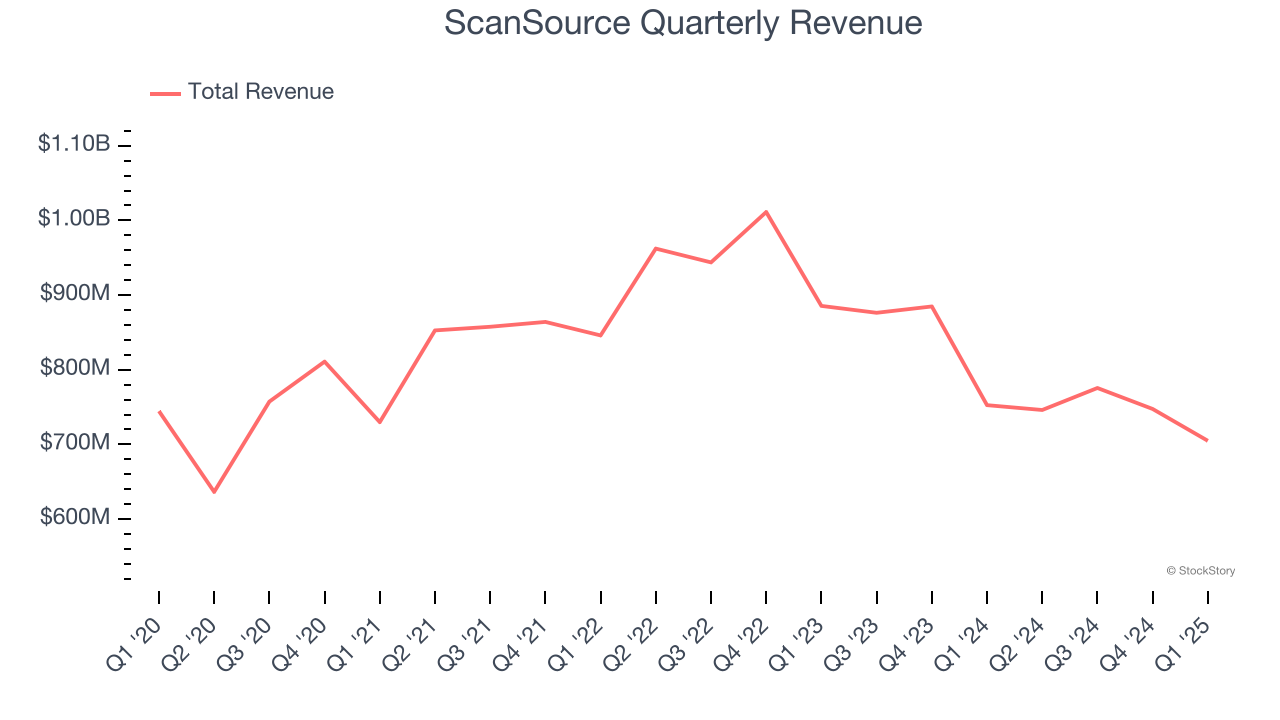

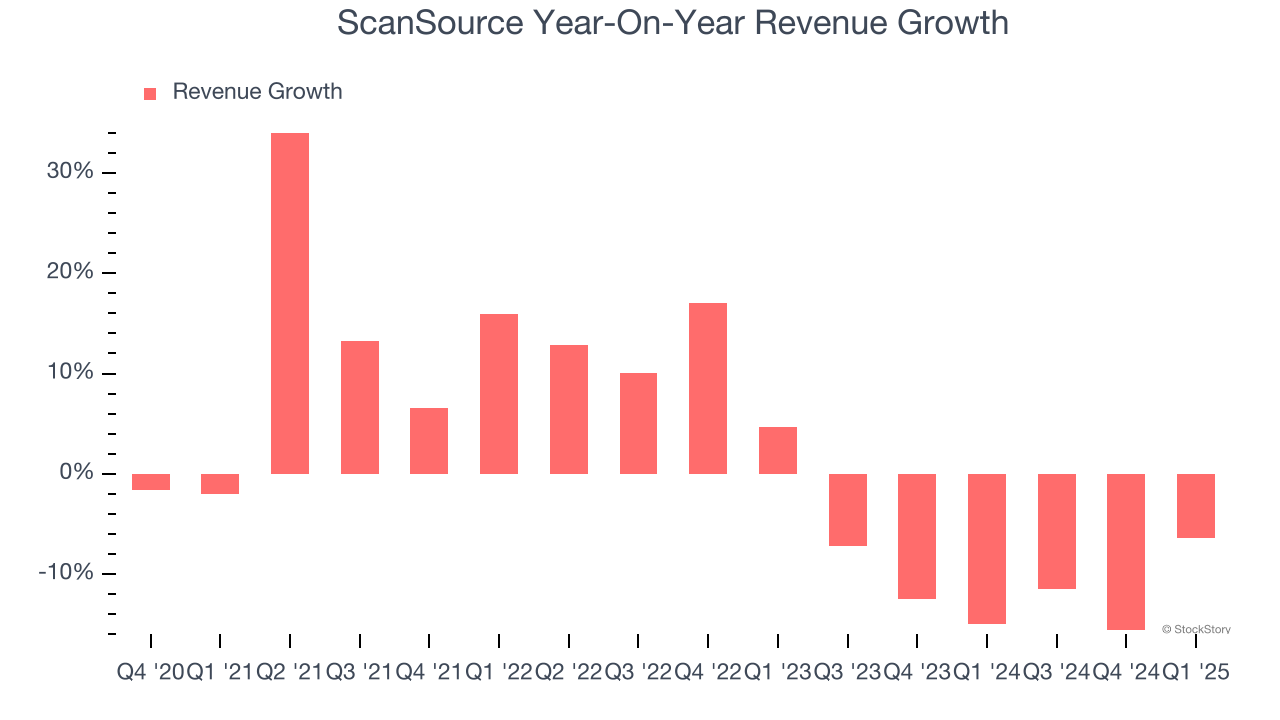

As you can see below, ScanSource’s demand was weak over the last five years. Its sales fell by 1.5% annually, a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. ScanSource’s recent performance shows its demand remained suppressed as its revenue has declined by 11.6% annually over the last two years.

This quarter, ScanSource missed Wall Street’s estimates and reported a rather uninspiring 6.3% year-on-year revenue decline, generating $704.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 9.9% over the next 12 months, an improvement versus the last two years. This projection is commendable and implies its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

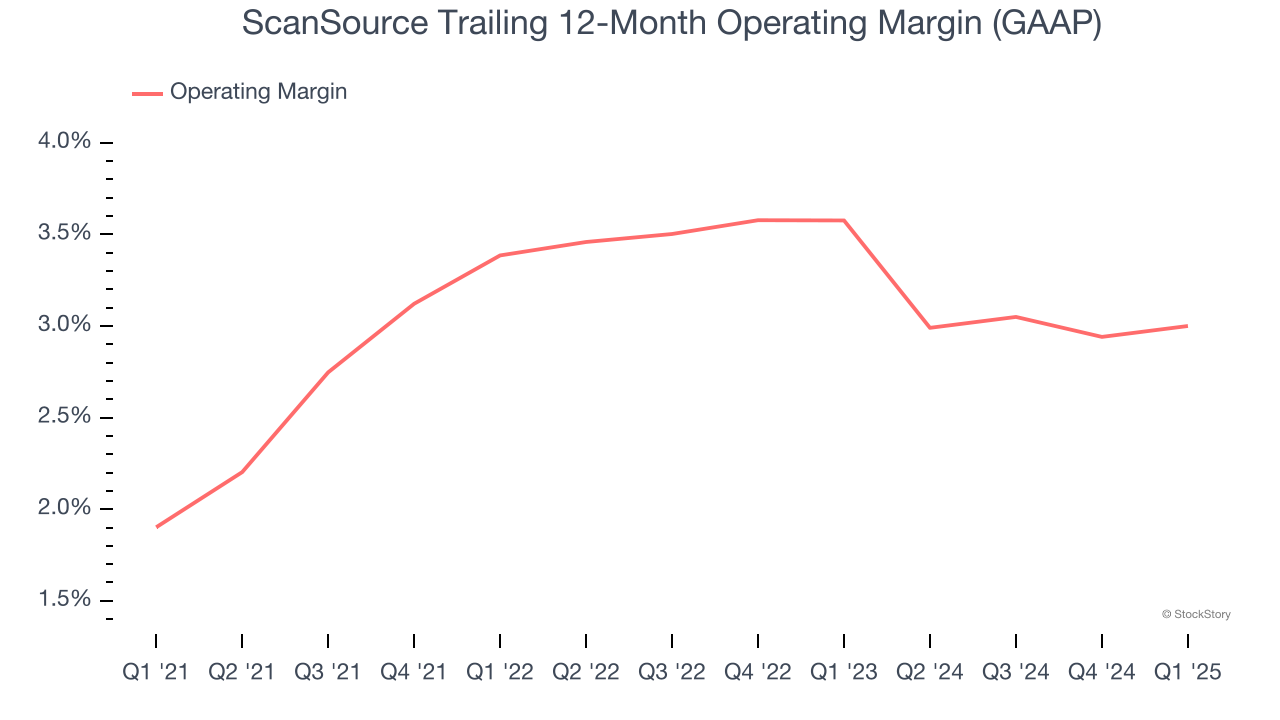

ScanSource was profitable over the last five years but held back by its large cost base. Its average operating margin of 3% was weak for a business services business.

On the plus side, ScanSource’s operating margin rose by 1.1 percentage points over the last five years.

This quarter, ScanSource generated an operating profit margin of 3.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

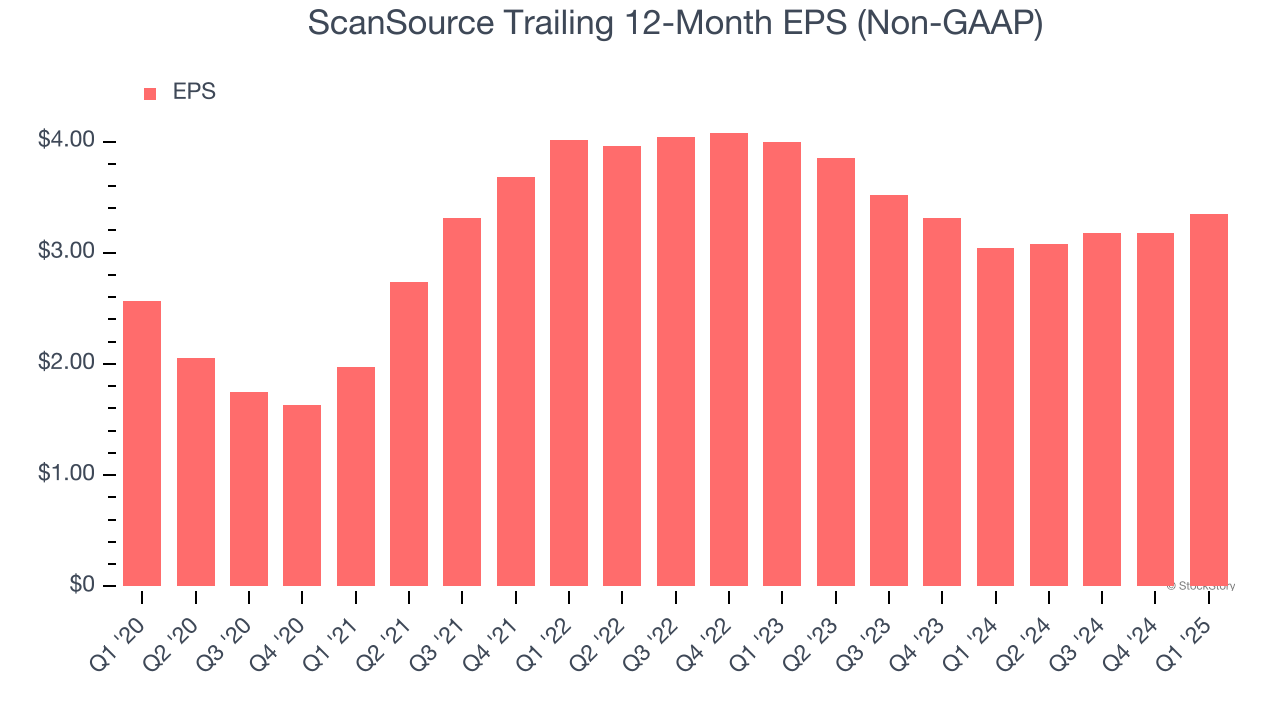

ScanSource’s EPS grew at an unimpressive 5.4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.5% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

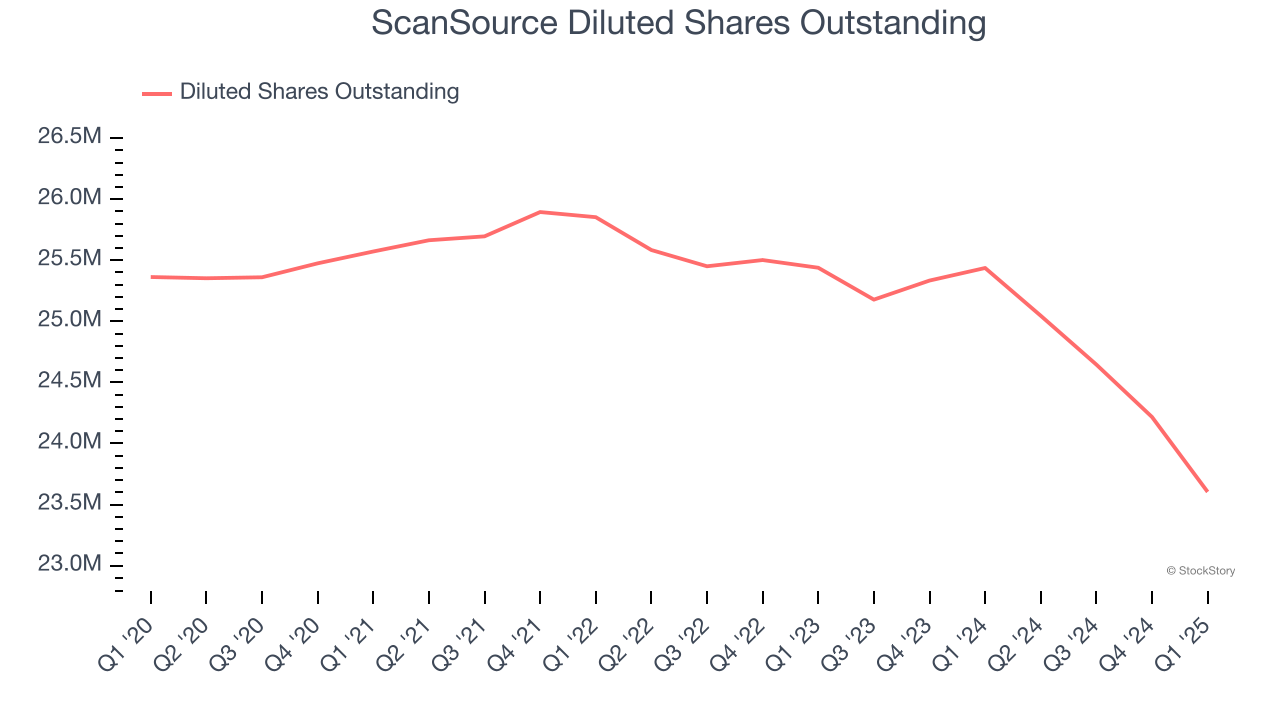

Diving into the nuances of ScanSource’s earnings can give us a better understanding of its performance. As we mentioned earlier, ScanSource’s operating margin was flat this quarter but expanded by 1.1 percentage points over the last five years. On top of that, its share count shrank by 6.9%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q1, ScanSource reported EPS at $0.86, up from $0.69 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ScanSource’s full-year EPS of $3.35 to grow 10.8%.

Key Takeaways from ScanSource’s Q1 Results

We enjoyed seeing ScanSource beat on EPS this quarter and provide full-year EBITDA guidance that topped analysts’ expectations. On the other hand, it lowered its full-year revenue guidance, and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter, but the stock traded up 2.4% to $36.91 immediately following the results.

Is ScanSource an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.