What a brutal six months it’s been for Wabash. The stock has dropped 37.9% and now trades at $9.98, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Wabash, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Wabash Will Underperform?

Even though the stock has become cheaper, we're cautious about Wabash. Here are three reasons why you should be careful with WNC and a stock we'd rather own.

1. Backlog Declines as Orders Drop

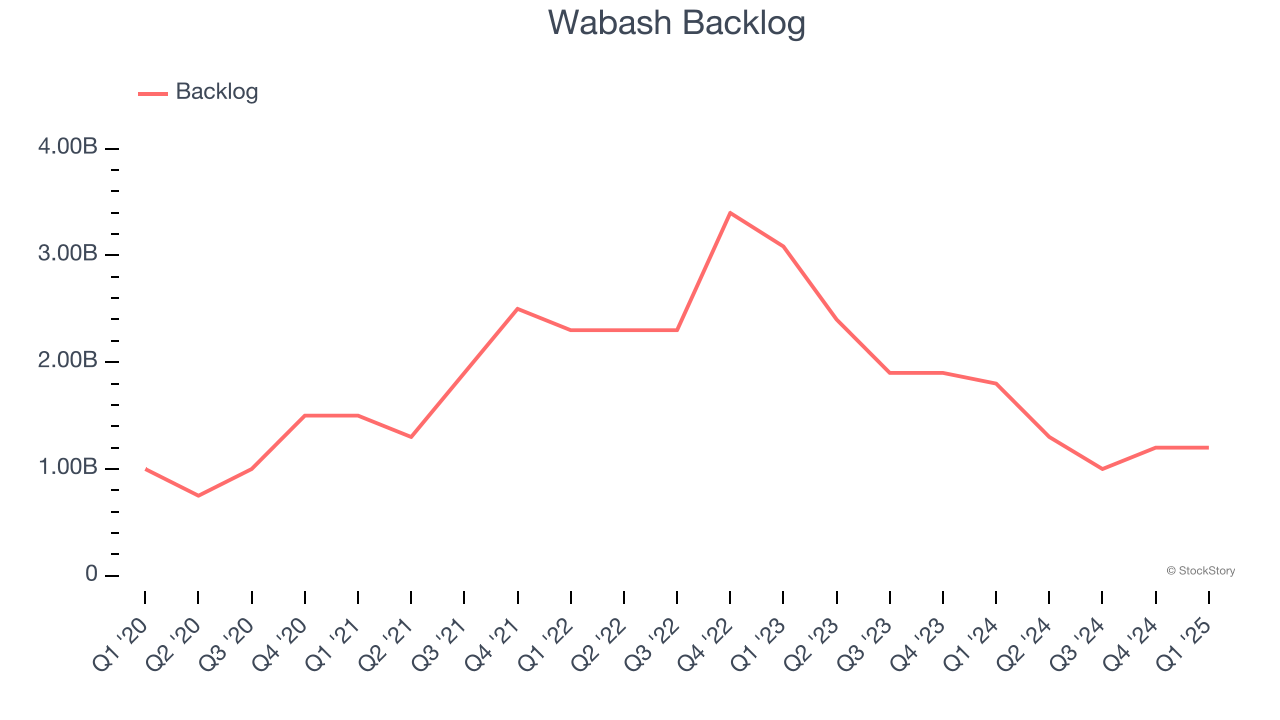

Investors interested in Heavy Transportation Equipment companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Wabash’s future revenue streams.

Wabash’s backlog came in at $1.2 billion in the latest quarter, and it averaged 32.8% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. Low Gross Margin Reveals Weak Structural Profitability

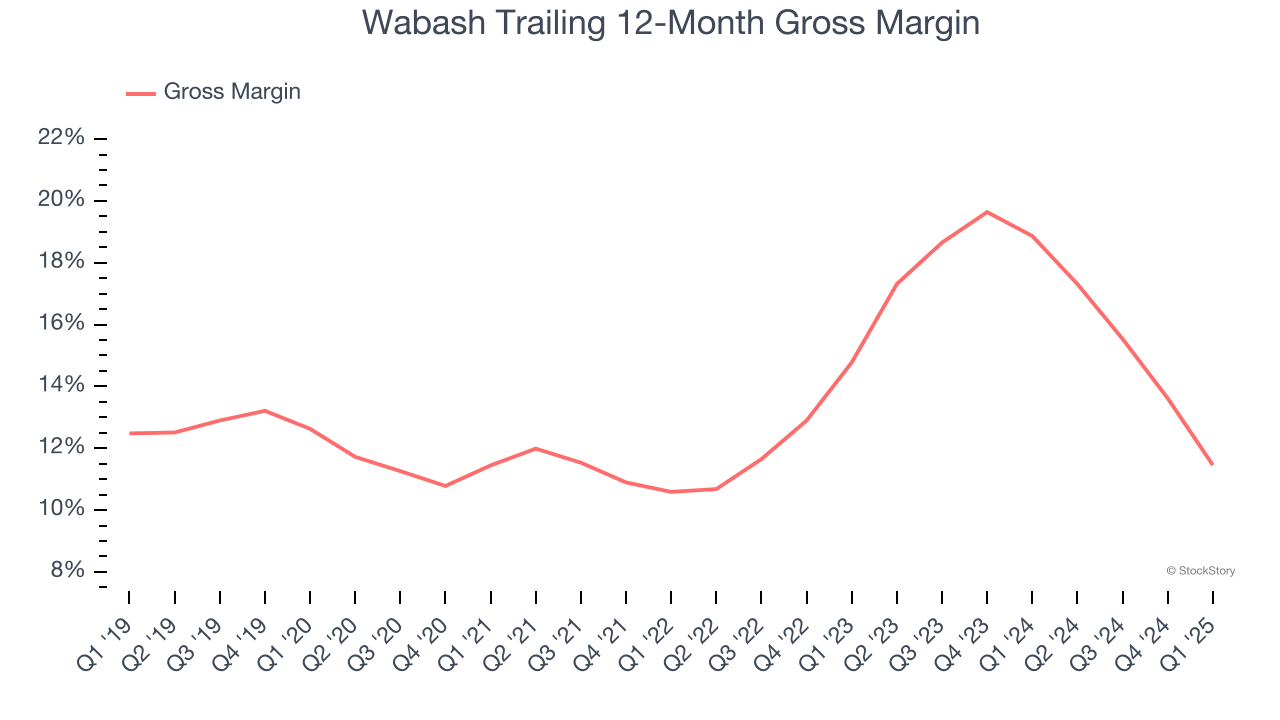

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Wabash has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.9% gross margin over the last five years. That means Wabash paid its suppliers a lot of money ($86.12 for every $100 in revenue) to run its business.

3. EPS Trending Down

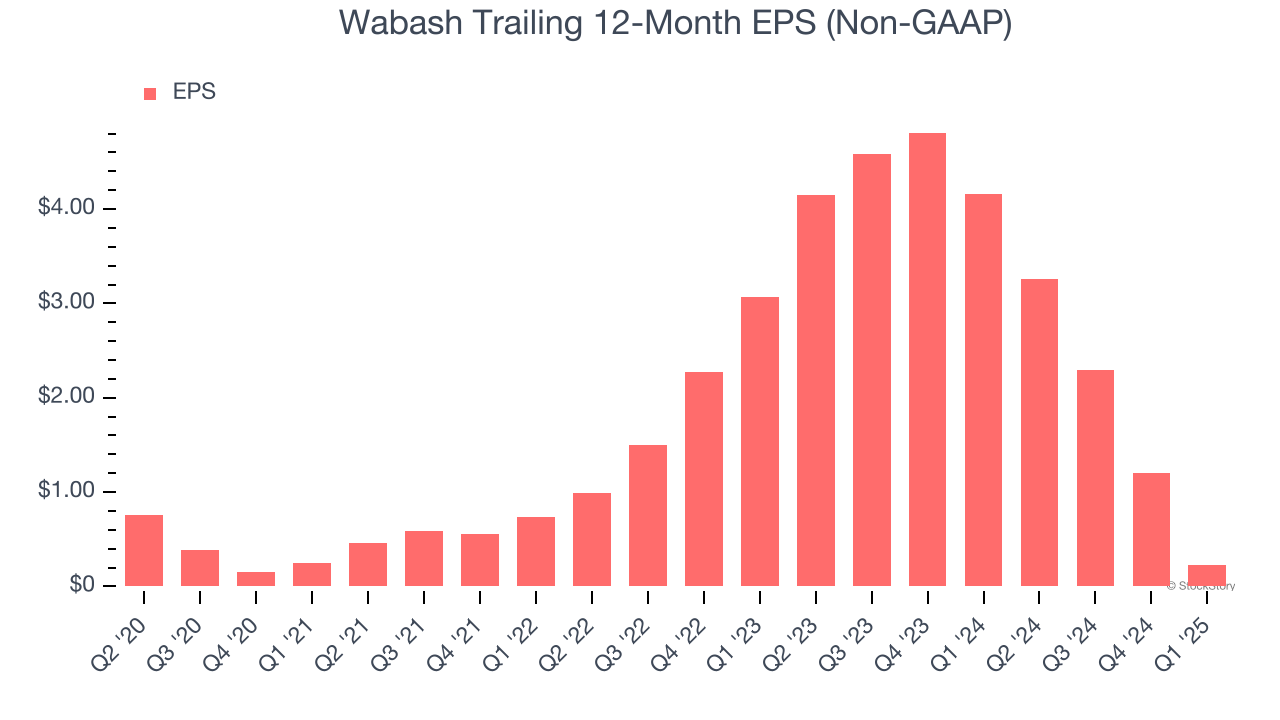

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Wabash, its EPS declined by 20.5% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Wabash falls short of our quality standards. After the recent drawdown, the stock trades at 10.5× forward P/E (or $9.98 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. Let us point you toward the most dominant software business in the world.

Stocks We Like More Than Wabash

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.