Artificial intelligence-related companies continue to grab headlines from the perspective of innovation and growth. With industry growth likely to remain robust, there are still plenty of attractive investment options.

BigBear.ai (BBAI), a provider of decision intelligence solutions, seems to be among the companies positioned to benefit. Investors can compare it to sector leader Palantir (PLTR), but unlike the big data behemoth, BBAI trades for significantly less. PLTR sports a price-sales (P/S) ratio of 158x, whereas BBAI's is 17x.

With a strong platform for growth driven by an acquisition coupled with a strong order book, BBAI stock has trended higher by 61% year-to-date (YTD). With Q3 developments being positive, the outlook remains bullish for BBAI stock.

About BBAI Stock

BigBear.ai is a provider of AI-powered decision intelligence solutions. The company’s solutions find application in a broad range of industries that include defense, homeland & border security, intelligence, manufacturing, and supply chain.

For Q3 2025, the company reported revenue of $33.1 million. For the same period, the non-GAAP adjusted EBITDA loss was $9.4 million.

With organic and acquisition-driven growth coupled with tailwinds for the AI sector, BBAI stock has surged by 79% in the last six months.

Acquisition of Ask Sage

Along with Q3 2025 results, BigBear.ai also announced an agreement to acquire Ask Sage for a consideration of $250 million. The latter is a generative AI platform that’s specifically built for defense, national security agencies, and other highly regulated sectors.

Ask Sage is on a high-growth trajectory, with ARR increasing by 6x from FY 2024 to FY 2025. The platform currently serves 16,000 government teams, and the company is expected to report ARR of $25 million in FY 2025.

The acquisition will support customer expansion, and with scope for cross-selling, there is headroom for growth acceleration.

It’s worth noting that BigBear.ai ended Q3 2025 with cash and investments of $715 million. This will support potential inorganic growth in the future.

Strong Order Backlog to Support Growth

For Q3 2025, BigBear.ai reported a 20% decline in revenue to $33.1 million. The decline in revenue was primarily due to lower volumes on “certain Army programs.” For FY 2025, the company expects revenue in the range of $125 to $140 million.

However, there are two key factors that are likely to support revenue acceleration in 2026 and beyond. First, the acquisition of Ask Sage with a healthy ARR. Further, a backlog of $376 million as of September 2025, which provides revenue visibility. It’s worth adding that contracts have been delayed due to the government shutdown. Once new contracts are awarded, it’s likely that the backlog will continue to swell.

On the flip side, BigBear.ai reported an operating loss of $133 million for the first nine months of 2025. However, this is unlikely to be a concern considering a strong cash buffer. Also, as growth accelerates in FY 2026 and beyond, margin expansion is likely.

What Analysts Say About BBAI Stock

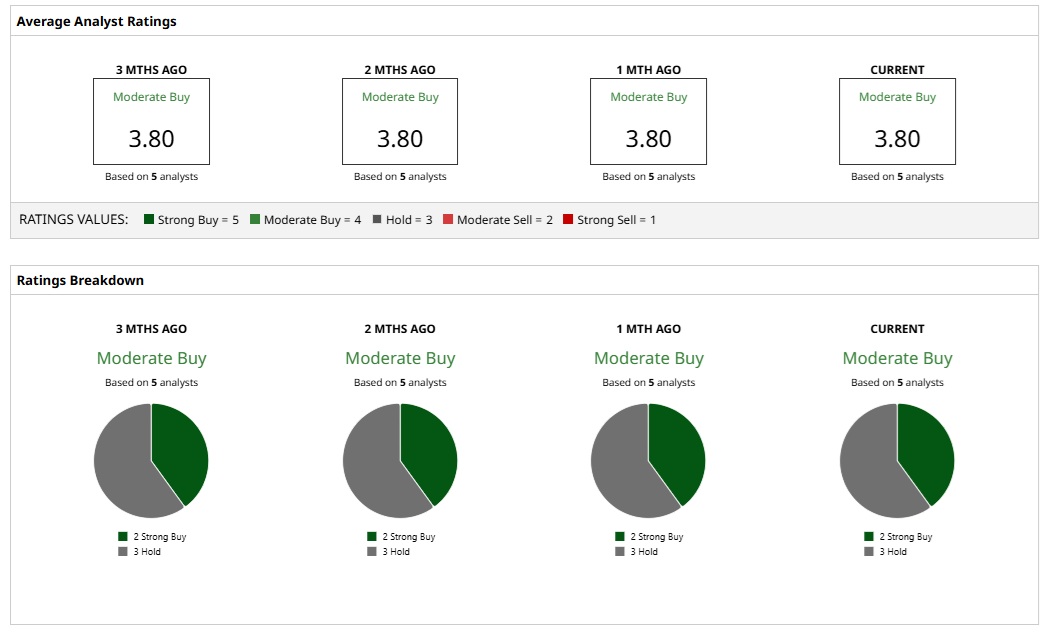

Based on the rating of five analysts, BBAI stock is a “Moderate Buy.”

While two analysts believe that the stock is a “Strong Buy,” three believe that BBAI stock is a “Hold.”

Further, a mean average price target of $6.67 implies a downside potential of 7%. On the other hand, the most bullish price target of $8 implies an upside potential of 12%.

H.C. Wainwright analyst Scott Buck has a “Buy” rating for the stock with a price target of $8 on the back of the Ask Sage deal. Scott expects the “transaction to be margin accretive” and believes that the company will continue to look for acquisitions with a strong cash buffer.

Amidst these positives, it’s important to note that BBAI stock has a 60-month beta of 3.42. With a rally of over 100% in the last six months, it’s time to be cautiously optimistic in the near term.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Find Stocks to Trade Before the Rest of the Market by Adding This Trend Indicator to Your Charts

- IBM Is Staring Down Quantum Advantage. Should You Buy IBM Stock First?

- Michael Burry Shutters Hedge Fund as Trump’s 50-Year Mortgage Threatens an $11 Trillion Housing Collapse – Is Big Short 2.0 Brewing in Housing, Not Tech?

- Nvidia Stock Is a High-Stakes Trade Ahead of November 19. How to Hedge the Risk of a Post-Earnings Plunge.